UK Services Inflation Nudges Higher On Surging Social Rents

The surprise pick-up in UK services inflation was driven by factors that are unlikely to meet the Bank of England's definition of 'persistent'. We expect a September rate hike, but November is still more of a question mark.

Rents rose by 1.7% between June and July, the highest month-on-month change in this category since 2005.

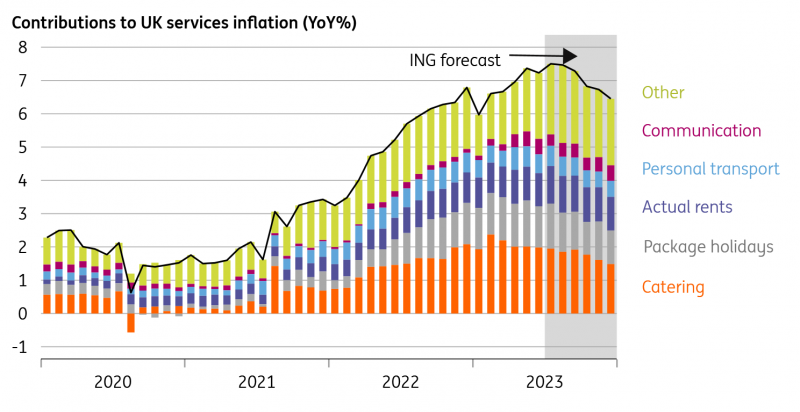

UK services inflation, the part of the CPI data the Bank of England is most concerned about, has picked up again from 7.2% to 7.4%. That’s higher than the Bank had forecast (7.3%), but importantly it was down to two factors that are unlikely to meet the BoE’s definition of “persistent” trends.

The most eye-catching change was rents, which rose by 1.7% between June and July, which we make out to be comfortably the highest month-on-month change in this category since 2005. The ONS puts this down to social rentals, and the jump seems unlikely to be repeated. We also saw a larger increase in airfares at the start of the summer holidays than we did last year, which also helped to drive services inflation higher. This is a highly volatile category, which the BoE itself typically removes from the index when it looks at "core services".

The bottom line is that the figures don’t carry huge implications for the Bank of England, and certainly, the unexpected pick-up in services inflation isn’t as broad-based as it has been in previous months when we’ve had unpleasant surprises. Indeed if we look at catering, which has been a key driver over recent months, the annual rate is gradually coming down. We think this is a trend that will continue, with ONS business surveys suggesting that firms in hospitality (and elsewhere in the service sector) are raising prices less aggressively, partly on account of the sharp fall in gas prices. For this reason, we still expect some moderate improvement in the services inflation numbers over the coming months.

UK services inflation picked up again in July

Macrobond, ING calculations

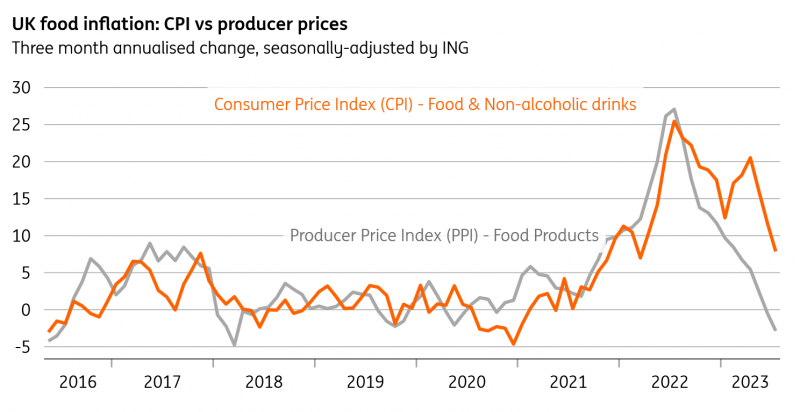

Elsewhere, headline CPI came down to 6.8%, having fallen by more than a percentage point on account of the near-20% fall in household electricity/gas bills in July. We’ll get another such fall in October. Meanwhile, the news on food inflation continues to improve, and it's now clearly following the path laid out by producer prices, which are now falling in level terms. Consumer food prices rose just 0.1% in July from June, compared to 2.2% a year ago.

Bundle those factors together, and we think inflation will end the year at roughly 5% (and should get there, or near enough, by October).

Food inflation finally following producer prices

Macrobond, ING calculations

For the Bank of England, today’s figures will help cement a September rate hike, especially after yesterday’s stubbornly-high wage growth figures. It’s worth saying we get another set of both price and wage data before the September meeting, and another round of numbers before November’s meeting. While we don’t rule out another rate hike in November, the committee appears to be slowly laying the ground for a pause. Barring unpleasant data surprises before November, our base case is that September’s hike will be the last.

More By This Author:

FX Daily: More Volunteers To Support The US DollarThe Commodities Feed: China Macro Concerns Grow

Surprise UK Wage Growth Pick-Up Helps Cement September Hike

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more