UK Retail Sales Data Disappoints, Leading To More Investor Caution

Image Source: Pexels

FTSE 100 in the UK printed another modest decline on Wednesday. In the year leading up to June, retail sales volumes declined more rapidly than anticipated and are projected to decrease even further next month, although at a slower rate, according to industry data. The CBI distributive trades survey revealed a 24% drop in sales volumes this month, in contrast to May's 8% growth. The survey also indicated that sales volumes were significantly below the seasonal average, and orders placed with suppliers decreased by 14%, a similar pace to the previous month. Online sales experienced a significant decline during the month, surpassing initial expectations, and are anticipated to decrease further in July.

Deliveroo, a UK-based company, saw its shares rise by 5.7% to 134.70p following a report that U.S. meal delivery group Doordash had expressed interest in acquiring the company. According to sources familiar with the matter, Doordash approached Deliveroo last month, but discussions ended due to disagreement on valuation. Currently, there are no ongoing talks between the two companies. Deliveroo's stock is down 1.5% year-to-date as of the last close.

Liontrust Asset Management, a UK fund manager, saw its shares drop by 2.8% to 730p after reporting a 23% decrease in annual profit. The company experienced net outflows of 6.08 billion pounds ($7.70 billion) for the year, resulting in a drop in adjusted pretax profit to 67.4 million pounds from 87.1 million pounds compared to the previous year. Despite this, Liontrust Asset Management has noted a shift in investor sentiment and anticipates further changes as more central banks reduce interest rates. Year-to-date, the stock has seen an increase of approximately 14%.

Aston Martin's stock is on the rise by 2.1% to 158 pence as the company prepares to start delivering its limited edition sports car Valiant in the fourth quarter. According to a source close to the company, the retail price of Valiant is approximately 2 million pounds ($2.53 million) in the UK, excluding tax. Aston Martin plans to produce only 38 units of the Valiant. As of the last close, Aston Martin's stock is down 31.4% year-to-date.

Future Plc, a British publishing firm, has seen a 7.3% increase in its shares, reaching 1,076p and becoming the top performer on the FTSE midcap index. Jefferies, a brokerage firm, has raised the price target for Future Plc to 1,280p from 635p and upgraded its rating to 'buy'. The brokerage is confident in the company's strong return to revenue growth, supported by macro inflection, positive audience trends, and improvements in content quality. They also anticipate further upside from a shift towards higher yielding US direct Ad sales. Future Plc has risen approximately 36% year to date.

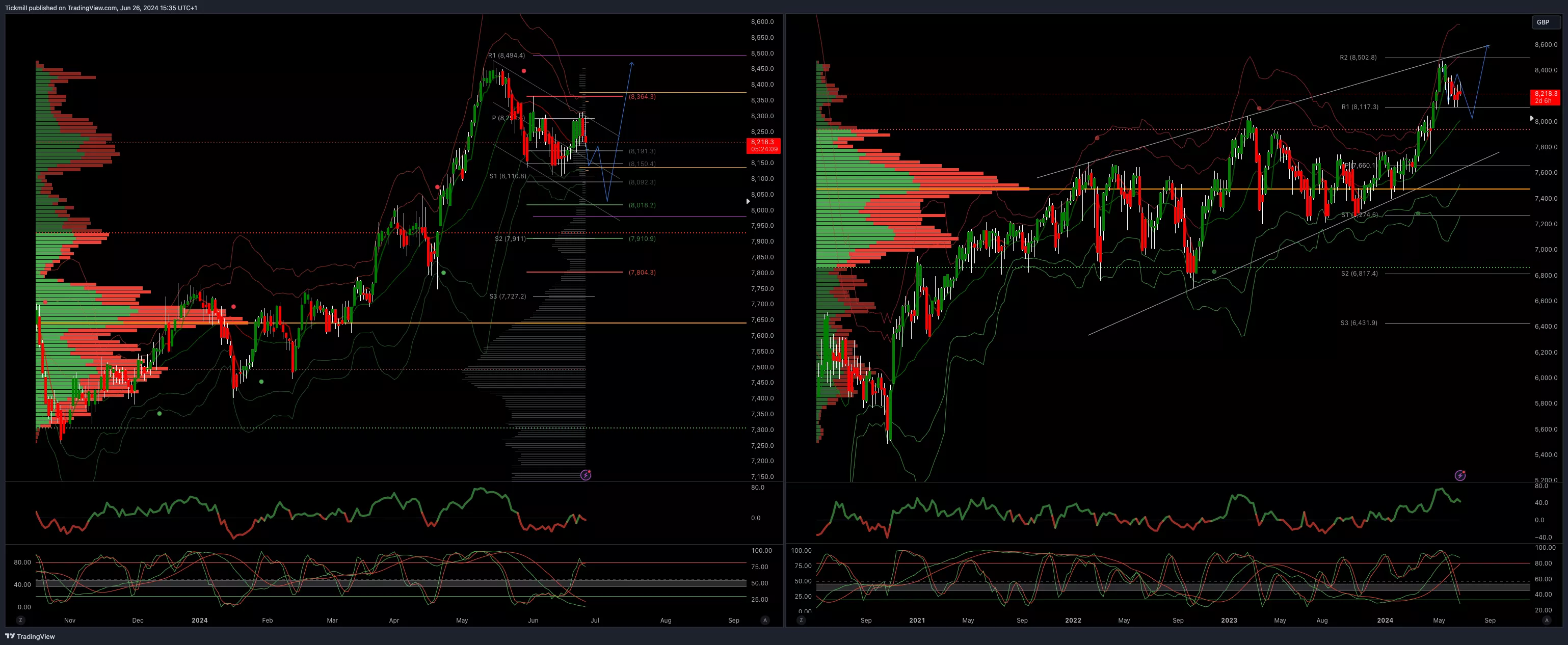

FTSE Bias: Bullish Above Bearish below 8300

- Above 8363 opens 8500

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bullish

- 20 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, June 26

FTSE Investors Turn Cautious Ahead Of Key UK & US Data

Daily Market Outlook - Tuesday, June 25