UK Retail Sales Bounce On January Discounting

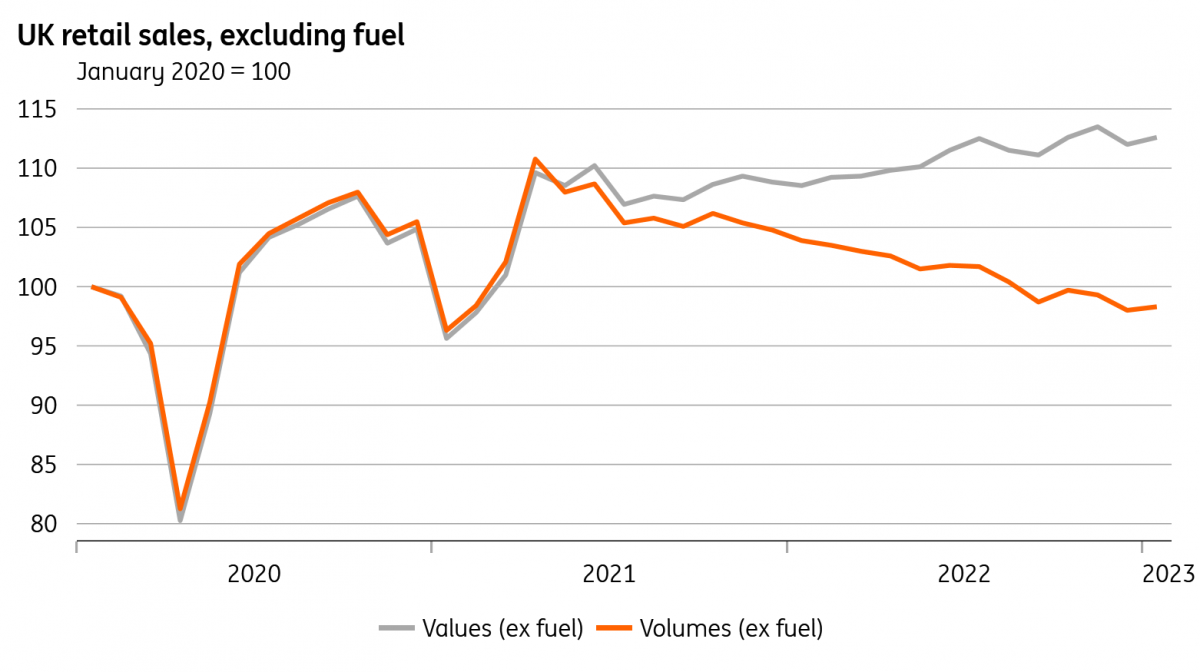

January's increase in retail sales wasn't enough to reverse a steep fall around Christmas, and the big picture is that sales have been on a downward trend. Signs of discounting in January will be welcome news for the Bank of England.

UK retail sales were better than expected in January, rising by 0.4% on an ex-fuel basis. However these are volatile numbers, and that increase only partly offsets the steep 1.4% decline we saw in December. More importantly, sales have been on a gradual downtrend since October 2021 and are down 7% since then, and indeed now lie below pre-Covid levels.

What’s interesting is that the ONS has said the brighter spots in January’s numbers – online and non-food sales – were bolstered by discounting. This is only anecdotal evidence admittedly, but it does support the trend we’re seeing in core goods inflation, which has been easing rapidly on lower consumer demand, improved supply chains, and rising retail inventories. Goods prices aren’t the main area of focus for the Bank of England, but it does help the overall inflation story.

UK shoppers have been spending more and getting much less

(Click on image to enlarge)

Source: Macrobond

What next for retail and consumer spending more generally? We suspect we’ll see the downward path of retail sales continue for at least a couple more months, but the outlook should begin to turn brighter. Our rough calculations suggest the average household energy bill will no longer rise to £3,000 as planned in April, and in fact should have fallen to £2,100-2,200 by the summer, from £2,500 currently. That’s still high by historical standards, but the lack of a further increase should help limit the fallout in consumer activity.

There are two main areas of uncertainty. On the positive side, there’s potential for consumers to dip into savings. Interestingly consumers have, in general, continued to build cash savings at a higher rate than pre-pandemic over recent months, and there is roughly 8% of GDP worth of these ‘excess savings’. The counterpoint is that this is highly skewed to higher earners, but it could yet provide some support to spending if consumer confidence improves.

Consumers have continued to build savings more quickly than pre-Covid

(Click on image to enlarge)

Source: Macrobond, ING calculations

Household deposits based on M4 data, which is a broad money aggregate and a measure of UK money supply

The housing market is probably the main negative risk, and a price correction is clearly underway. The vast majority of UK mortgages are on fixed interest rates which means the passthrough of higher rates is pretty gradual. And in general, the UK housing market looks less vulnerable than in some other countries. But buying activity is clearly very weak, and more aggressive price declines (if they come) would undoubtedly have a knock-on effect on spending.

Overall, we’re expecting a very mild recession through the first half of this year.

More By This Author:

FX Daily: Hawks In The Ascendancy

RBNZ Preview: 50bp Hike, But The Peak Is Close

Rates Spark: Crucial Levels Ahead

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more