Thursday, May 12, 2022 11:52 AM EST

While the UK economy grew by a little under 1% through the first quarter, much of this was frontloaded in January and activity has begun to stagnate as the cost of living squeeze builds. A widely expected fall in health output is likely to deliver a negative second-quarter growth reading.

The UK’s relatively short-lived economic impact from Omicron meant that the economy ended up growing by 0.8% through the first quarter. But perhaps more interestingly, almost all of the growth came in January and since then, things have stagnated. Output slipped by 0.1% during March, which was overwhelmingly driven by that disappointing retail sales figure from a couple of weeks ago.

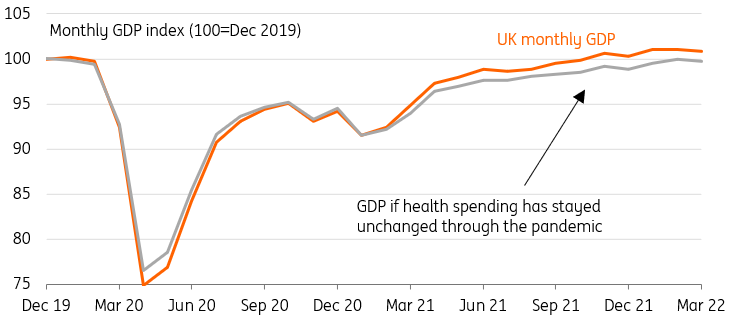

We should expect a second consecutive decline in April, which will coincide with the ending of free Covid-19 testing. Surprisingly, health output actually increased in March despite the ongoing wind-down of Covid-related activities, but clearly, that’s unlikely to last. Health spending has been a key driver of GDP through the pandemic, and in fact, the overall size of the economy would be around 1% smaller had output in this sector stayed flat since early-2020.

UK GDP would be lower if health output hadn't increased due to Covid testing/vaccines

Source: Macrobond, ING

Throw in the distortion of the extra bank holiday scheduled for June, as well as the ongoing impact of the consumer spending squeeze, and we’re likely to see a modestly negative GDP figure for the second quarter as a whole. An artificial bounce in activity when the bank holiday effect reverses might mean the economy narrowly avoids a technical recession – two quarters of successive negative growth. But as the Bank of England’s forecasts hinted last week, the growth outlook for this year looks far from encouraging.

With four rate hikes under its belt, the BoE has become more cautious in recent weeks and it’s pretty clear that it doesn’t expect to fulfil market rate hike expectations. Investors expect another five hikes by next spring. More likely we think, the Bank will hike a couple more times before pressing the pause button.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.