UK Jobs Market Remains Resilient Despite Incoming Recession

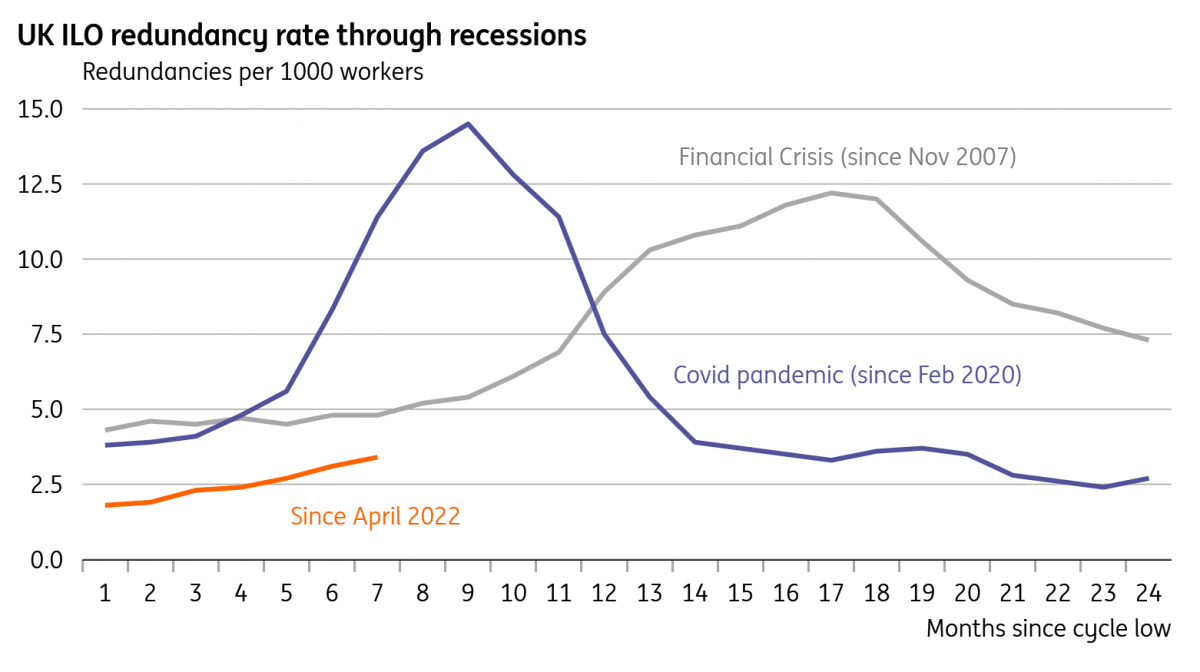

While the jobs market is a lagging indicator of economic strength, the resilience of both vacancy and redundancy numbers suggests the impact of the forthcoming recession on the jobs market will be more modest than in some past recessions.

Despite all the challenges facing the UK economy, the jobs market is still holding up fairly well. The unemployment rate is still flirting with all-time lows, while so far there are only moderate signs of deterioration in the more timely indicators. Unfilled vacancies are trending lower – and you’d expect that to continue based on another measure of online adverts – though neither measure is below pre-Covid norms. The official redundancy rate is edging higher but again is now essentially in line with past averages.

The redundancy rate is edging higher, but so far is only back to pre-Covid norms

Image Source: Macrobond

As with all jobs data, we need to remember they are lagging indicators, and indeed the redundancy rate took more than a year to go from trough to peak during the financial crisis. Nevertheless, the UK jobs market is entering the forthcoming recession from an unusually tight starting point. While Bank of England survey data shows the proportion of firms finding it ‘much harder’ to hire has begun to tumble, the root causes of worker shortages look like they will prove long-lasting.

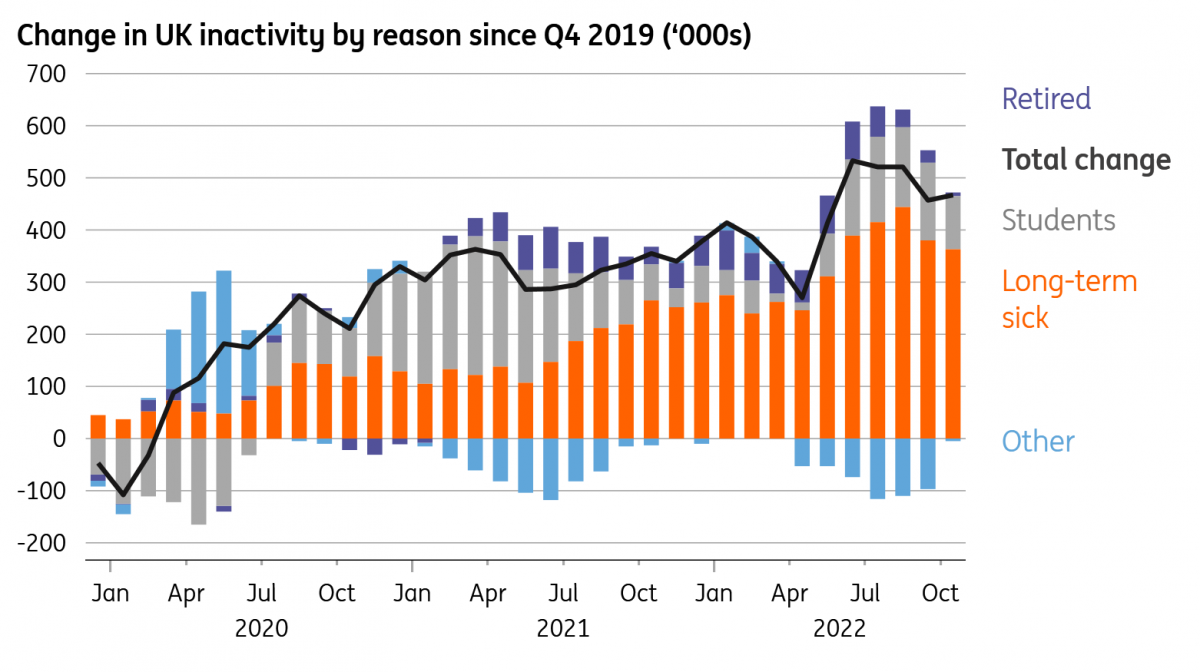

The number of people economically inactive – that are neither employed nor actively seeking a role – is no longer increasing, and the worrying upward trend in long-term sickness levels appears to have tentatively reversed. But to the extent that this vast increase in illness has been amplified by long waiting lists for treatments and delays in urgent care, the situation is, if anything, getting worse. Lower levels of inward migration from the EU also appear to have added to hiring struggles.

Inactivity levels have stabilized over the past few readings

Image Source: Macrobond, ING calculations

We, therefore, suspect firms will be more inclined than usual to ‘hoard’ labor, and avoid layoffs where possible to insure against potential rehiring problems when conditions improve. While we suspect the unemployment rate will rise, we think it will be more modest than during some past recessions. The clear risk here is that, with 70% of SME debt on floating interest rates and the effective rate on this lending already dramatically higher, firms are forced to make material cutbacks to their workforce regardless. A lot could hinge on whether energy prices begin to rise again later this year.

For the time being though, the jobs market is the biggest argument in favor of another 50 basis-point rate hike by the Bank of England. Indeed, wage growth came in a touch higher than expected in the latest figures, and the bank's own survey data continues to point to more acute pay pressures come through. In reality, though, the February meeting rests on a knife edge, and there's a clear chance the Bank decides to mirror the Fed and slow the pace of rate hikes further now Bank Rate is well into restrictive territory. Tomorrow’s inflation data could be key.

More By This Author:

Rates Spark: Bond Bull TrapsConcrete Prices Won’t Fall Before Spring Despite Lower Energy Prices

China Reopening Boosts Copper Outlook

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more