Two Trades To Watch: Oil, EUR/USD - Wednesday, Nov. 24

Oil (OIL) rises despite US reserves release, EIA data due. EUR/USD resumes decline ahead of German IFO business sentiment data & US data deluge.

Oil rises despite US reserves release

Oil prices are rising building on yesterday’s gains which came despite the US announcing that they will release 50 million barrels of oil from their strategic reserves.

Whilst oil prices had been steadily falling in the weeks prior to the announcement this appears to be a case of sell the rumor buy the fact.

The size of the release was probably also a little disappointing. The total release could add 70 to 80 million barrels, less than the 100 million initially priced in.

Furthermore, OPEC could decide to slow their production increase to offset any move by the US. We know that OPEC are concerned about a supply glut next year.

API data showed stockpiles rose by 2.3 million barrels higher than the 500,000 decline expected. EIA inventory data is due shortly.

Where next for WTI oil?

WTI oil’s rebound from the 100 EMA at 74.90 has retaken the 50 EMA at 78.15. This along with the receding bearish bias on the MACD are keeping buyer’s hopeful of further upside.

Resistance could be seen at 79.00 the daily high and 80.00 round number ahead of 80.85 last week’s high. A move above here could see buyers gain traction

Failure to hold above the 50 sma could bring 74.90 back into focus.

EUR/USD ahead of German IFO business sentiment & US data deluge

EUR/USD managed to close in the black yesterday just 0.1% higher after two straight losing sessions following better than expected PMIs.

However, EUR/USD is resuming its down trend today ahead of German IFO business sentiment data and a US data dump.

German business sentiment is expected to head lower fofxer a fifth straight month amid supply chain issues to 96.6 from 97.7 in October.

Meanwhile the US dollar will be looking towards a string of data ahead of the Thanksgiving holiday. The most important release will be the Core PCE index, the Fed’s preferred gauge of inflation, which is expected at 4.1% in October and could prompt bets of a sooner hike by the Fed.

Also on tap will be durable goods, jobless claims and Q3 GDP, the second reading. On top of all this will be the release of the minutes from the latest Fed meeting. However, the Fed meeting was prior to CPI jumping to 6.2% which means that the minutes are a little dated.

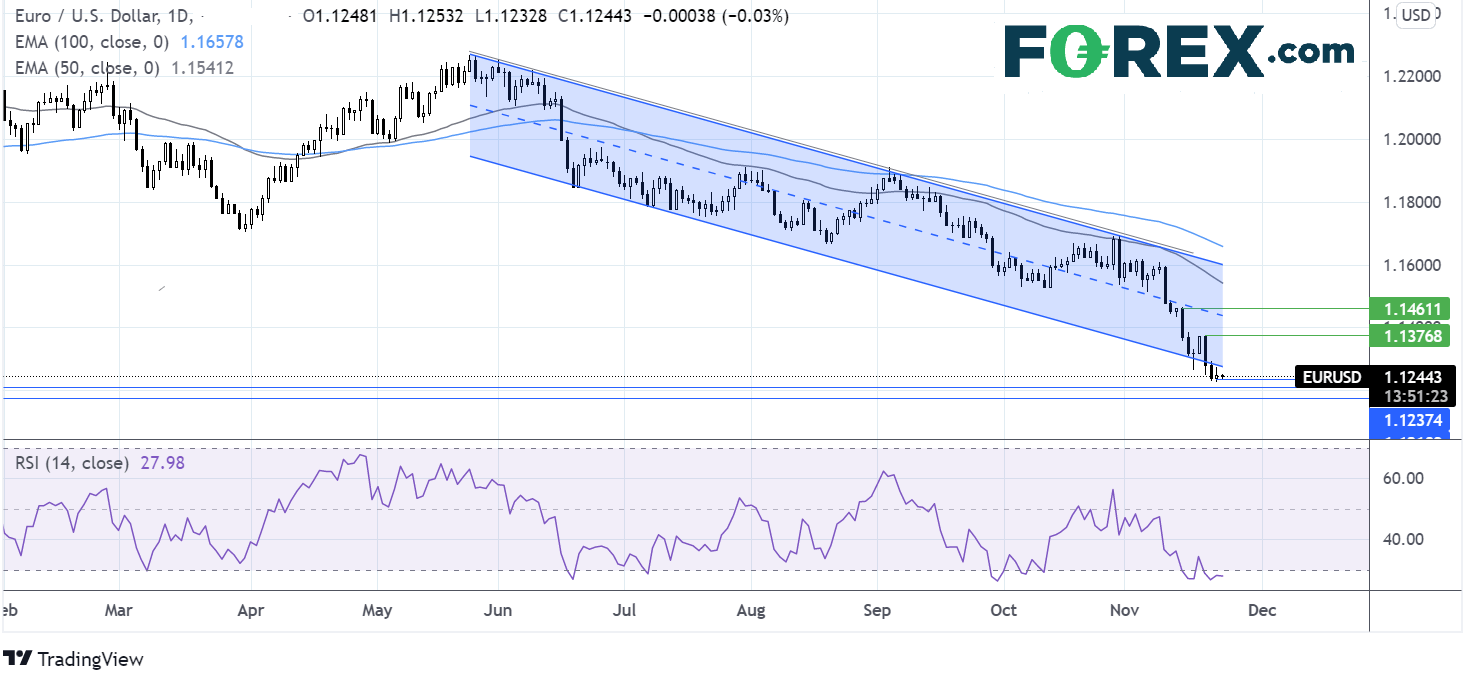

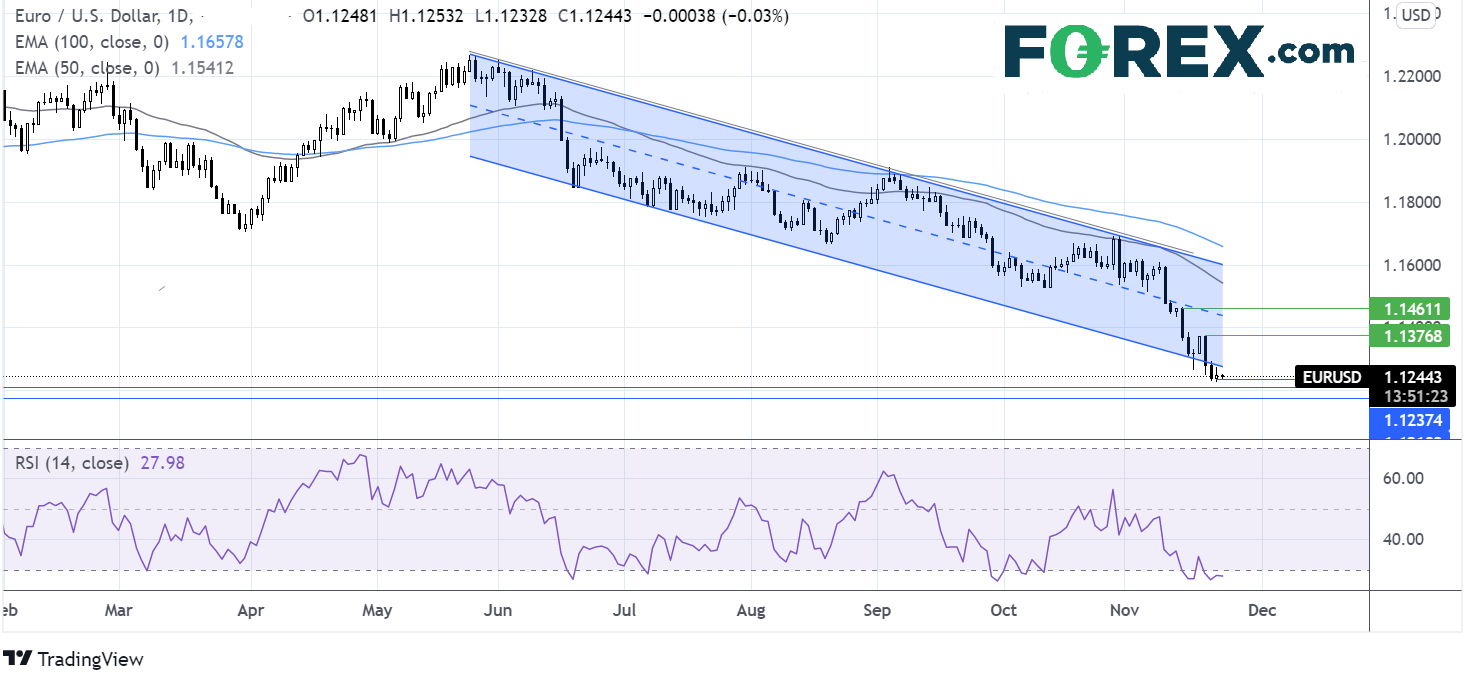

Where next for EUR/USD?

EUR/USD (FXE) fell out of the lower band of the falling channel at the start of the week. Yesterday the price faced rejection at 1.1275 the falling trendline resistance sending the pair lower.

The RSI is firmly in oversold territory so some consolidation or even a move higher could be on the cards.

Sellers will be looking for a move below 1.1226 yesterday’s low to target 1.12 round number and 1.1175 the June 20, 2020 low.

On the flip side buyers will be looking for a move over 1.1275 yesterday’s high ahead of 1.13 the round number. It would take a move over 1.1375 for the near term bias to turn bullish.