Two Trades To Watch: Gold, DAX - Wednesday, July 27

Gold rises ahead of Fed rate decision. DAX rises despite consumer confidence dropping to a record low.

Gold rises ahead of Fed rate decision

Gold (GLD) is edging higher in cautious trade after two days of losses, although investors refrain from committing to large positions ahead of the Federal Reserve monetary policy announcement.

The Fed is expected to hike rates by 75 basis points, as expectations for a 100 bps hike have been tempered as the central bank battles to bring 4-decade high inflation under control.

Attention will be on what the Fed is guiding for in September, a 50 bps hike or 75 bps? Economic data has started to show some signs of weakness and recession fears are growing in the market. Should the Fed point to a slowdown in hiking or peak inflation passing, the USD could ease which and give gold a much-needed boost.

Where next for Gold?

After falling to a low of 1680, the price of gold has rebounded retaking the 50 sma on the 4 hour chart but failed to rise above the 100 sma.

The price is currently caught between the 50 and 100 sma and the RSIA is neutral so a breakout trade could be on the cards.

Buyers would look for a move over the 100 sma opening the door to 1740 last week’s high. A move over here would create a higher high and bring 1750 psychological level into play.

Sellers would look for a move below the 20 sma at 1714 towards 1700 round number and the 16 month low of 1680.

DAX rises despite consumer confidence dropping to a record low

The DAX (DAX) is heading higher after losses in the previous session. Concerns over gas flow following an announcement from Gazprom that supply along the Nord Stream pipeline will be cut to 20% of its capacity. This raises the likelihood of gas rationing heading towards winter, potentially tipping Germany into recession sooner.

Today the index, along with its European peers is heading higher despite weaker than forecast German consumer confidence and ahead of the Fed’s rate decision.

Consumer confidence plunged to its lowest level on record to -30.6 in August, down from -27.7 in July and below -29 forecast. The drop in confidence comes as food and energy prices continue to rise, pushing inflation to record levels.

Deutsche Bank posted a better-than-expected 51% rise in Q2 profits as investment banking revenues rose.

Where next for the DAX?

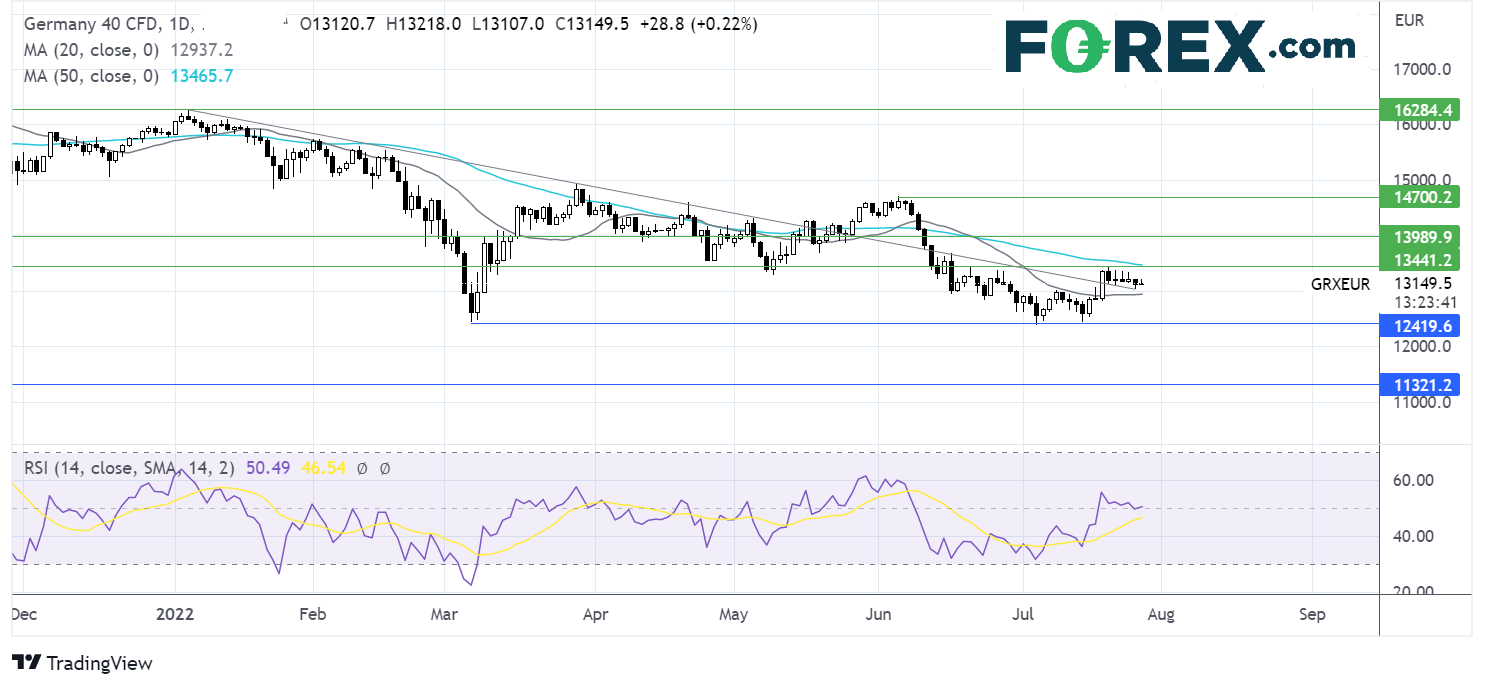

The DAX is attempting to extend the rebound from 12430 the 2022 low but ran into resistance just below the 50 sma at 13490.

The index trades caught between the 20 & 50 sma and the RSI is neutral so again a breakout trade could be on the cards.

Buyers will look for a move over 13490 to bring 14000 round number into focus and target 14700 the June high.

Sellers could look for a move below the 20 sma at 12950 to open the door to 12420, with a break below here needed to extend the bearish trend.

More By This Author:

Two Trades To Watch: USD/JPY, FTSETwo Trades To Watch: DAX, Oil - Monday, July 25

Two Trades To Watch: FTSE, Gold