Two Trades To Watch: FTSE, EUR/USD, Monday, Sept. 12

FTSE rises despite GDP growing less than expected. EUR/USD rises as USD corrects lower.

FTSE rises despite GDP growing less than expected

The FTSE rose 1% last week thanks to a rally in the latter part of the week. Optimism that peak inflation could be passing in the US helped the broad market mood ahead of US CPI data on Tuesday.

Today the UK index is heading higher, helped in part by news that Ukraine has recaptured key territory as Russian defenses collapse. While it has been months since the war in Ukraine has driven the markets, these latest developments are giving investors space to consider the range of outcomes, including a potential earlier end to the conflict.

While the FTSE is rising, it is under performing European peers, weaker than forecast UK GDP data.

UK GDP rose 0.2% MoM in July, a slower than expected recovery from the Jubilee bank holiday hit to the UK economy in June. Construction and industrial production contracted, while consumer-facing services drove growth in July, albeit anaemic growth. There is a glimmer of hope that Liz Truss’ energy relief package could help the UK economy avoid a recession this year.

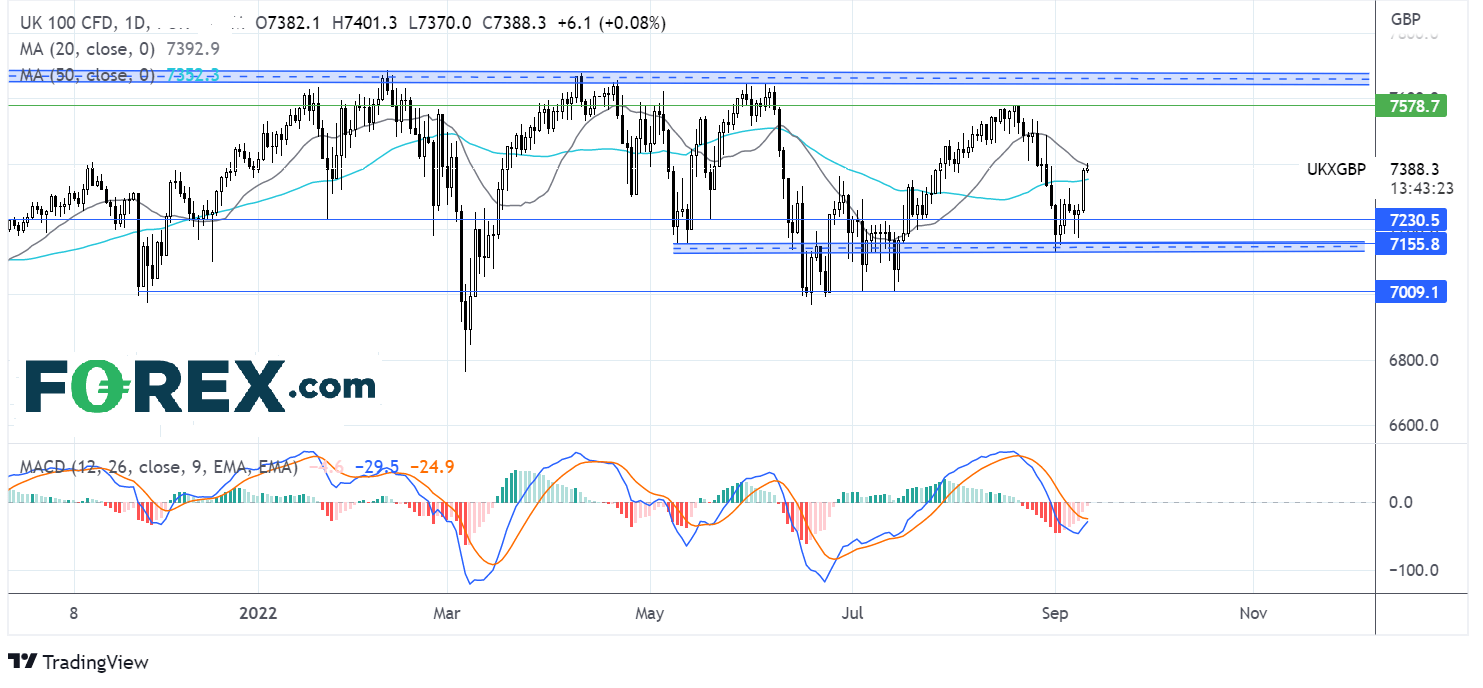

Where next for FTSE?

The FTSE is extending its rebound from 7130, the September low, retaking the 50 sma, which, combined with the bullish crossover on the MACD, is keeping buyers hopeful of further gains.

Buyers need to re-take 7400 the 20sma in order to bring 7580, the August high, into focus ahead of 7600/40 the year-to-date high.

Immediate support can be seen at 7450 the 50 sma, with a break below here opening the door to 7230, a level that has offered support on several occasions across the year.

EUR/USD rises as USD corrects lower

EUR/USD is extending gains from last week after the ECB hiked interest rates by 75 basis points and as ECB policymakers point to further hawkish action. Bundesbank President Joachim Nagel said that more action would need to be taken if consumer prices don’t cool

Furthermore, the upbeat market mood is helping the common currency higher, and the USD correction is also gathering steam. Expectations are growing that the Federal Reserve will slow the pace of rate hikes following the September FOMC meeting.]

There is no high-impacting eurozone data due for release today. Medium tier Italian industrial production and Spanish consumer confidence figures are due to be released.

Fed speakers are now in the blackout period ahead of the September FOMC.

Where next for EUR/USD?

EUR/USD rebounded off the 2022 low of 0.9764, recapturing the 50 sma, which along with the bullish RSI keeps buyers hopeful of more upside.

Buyers will look to retake 1.02 round number ahead of 1.0280. This opens the door to the 100 sma at 1.0350, also the August high. A move above here could change the bias to bullish.

Immediate support can be seen at 1.0120 the 50 sma ahead of 1.0080 the August 29 high.

More By This Author:

Two Trades To Watch: DAX, USD/CADTwo Trades To Watch: FTSE, Oil - Wednesday, Sept. 7

ECB Interest Rate Rise: Supersize Or Jumbo?

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more