Two Trades To Watch: FTSE 100, DAX Forecast

Photo by Anne Nygård on Unsplash

UK 100 hits fresh record highs lifted by oil stocks & Next

- Oil stocks rise on the prospect of Venezuelan projects

- Next jumps after upgrading profit guidance

- FTSE 100 pushed further above 10k

The FTSE is rising on Tuesday, extending gains from the previous session, and pushing decisively above 10,000 to a new record high, driven by strong performances in heavyweight energy stocks such as BP and Shell alongside miners, which are benefiting from a broad rally in metals.

Even though oil prices are heading lower following the US government's ousting of Venezuelan President Maduro over the weekend, the move gives America a larger say over Venezuela's vast oil reserves. President Trump has wasted no time in saying that major firms, including Chevron, ExxonMobil, and ConocoPhillips, could be central to reviving Venezuela's crippled oil sector. This optimism is translating into European oil firms BP and Shell.

These stocks are being buoyed by the prospect of politically backed projects in Venezuela, even if the potential payoff could be slow, risky, and far from guaranteed.

Interestingly, oil prices are falling. While Venezuela holds around 1/5 of the world's proven oil reserves, its current output accounts for less than 1% of global supply. Should U.S. companies invest more in repairing and modernising Venezuela's facilities, the country could see more crude oil brought to market, potentially increasing supply and lowering oil prices. However, this is a long-term move.

Elsewhere, Next jumped over 3% after upgrading its profit guidance, forecasting after-tax earnings of 738.8p per share, above market expectations. This comes after 10% sessions December's sales.

On the data front, the British Retail Consortium showed that food price inflation accelerated to 3.3% year on year in December, up from 3.3% in November, driven by adverse weather and poor harvests.

UK 100 forecast – technical analysis

The FTSE 100 has extended gains to fresh record highs above 10,000. The price rebounded from the multi-month rising trendline and 50 SMA mid-December, pushing above 9930, the previous record high, to 10,065. 10,100 is the next level to watch.

Support is evident at 9930 (the November high) and 9800 (the rising trendline support). A break below 9600 creates a lower low.

(Click on image to enlarge)

DAX rises to a record high with geopolitical developments in focus

- Defence stocks supported by a security-first stance

- German inflation data is due later

- DAX rises to a record high

The DAX is extending yesterday’s gains, reaching a fresh record high as investors continue to watch developments surrounding the US intervention in Venezuela and await key US economic data.

The move by Trump reinforces the message that globalisation first has been replaced by security first. The US is openly prioritising control of resources and trade routes, Russia and China are expanding their reach NATO is rearming. Overall, this means a lasting boost to defence and security spending, which has lifted defence stocks higher.

In short, rather than seeing a risk-off response to the US–Venezuela developments, which would involve selling riskier assets, investors are repositioning into defensive stocks.

German inflation data is due later today and is expected to ease to 2.2% YoY, down from 2.6%. The data is unlikely to affect the ECB's monetary policy outlook, with no rate moves expected anytime soon.

German services PMI was upwardly revised to 52.7 from 52.6. While the composite PMI was downwardly revised to 51.3 from 51.5.

Attention also turns to US economic data this week, with ADP payrolls and the ISM services PMI due on Wednesday. This comes after ISM manufacturing PMI contracted again yesterday.

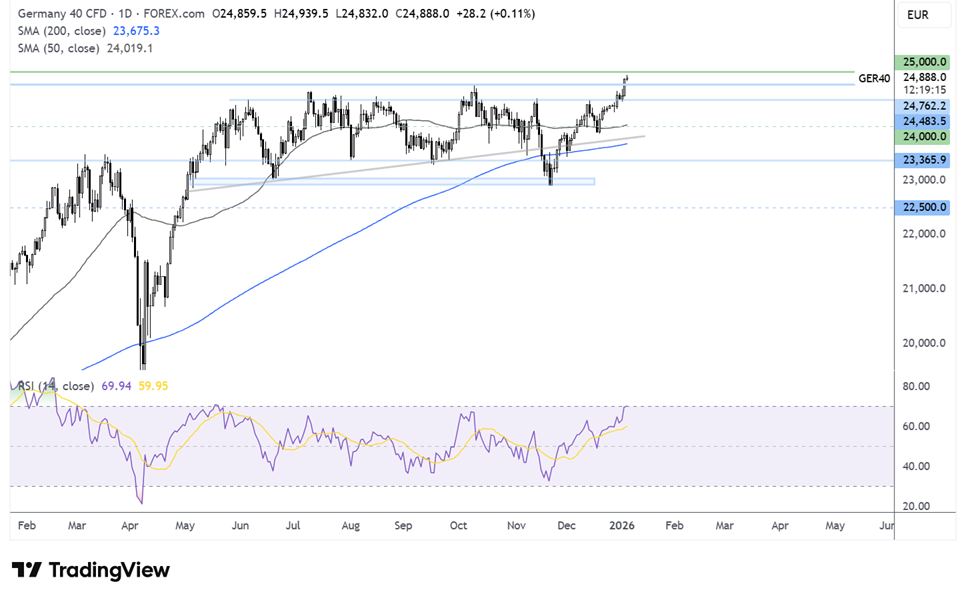

DAX forecast – technical analysis

The DAX extended its rally from the 22,900 November low, rising above the 50 SMA and 24,770, the previous record high, to 24,930, an all-time high. Buyers will look to extend gains towards 25,000.

Immediate support is at 24,770 and 24,500. Below here, 24,000 comes into play.

(Click on image to enlarge)

More By This Author:

GBP/USD 2026 Outlook: Cable Technical AnalysisTwo Trades To Watch: GBP/USD, Oil Forecast - Wednesday, Dec. 17

Two Trades To Watch: EUR/USD, Oil Forecast - Wednesday, Dec. 10

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more