Two Trades To Watch: DAX, USD/CAD - Tuesday, Sept. 20

Dax rises despite record PPI

The DAX, along with its European peers, is heading for a positive open despite soaring PPI keeping inflation worries present.

German PPI, which measures inflation at factory gate level, unexpectedly surged to 45.8% YoY in August, up from 37.2% in July. On a monthly basis, PPI soared 7.9%, well above forecasts of 1.6%, driven by soaring energy prices.

PPI is often considered a lead indicator for CPI, suggesting that consumer prices are set to continue rising.

PPI aside, the market mood is cautious ahead of a big week for central banks.

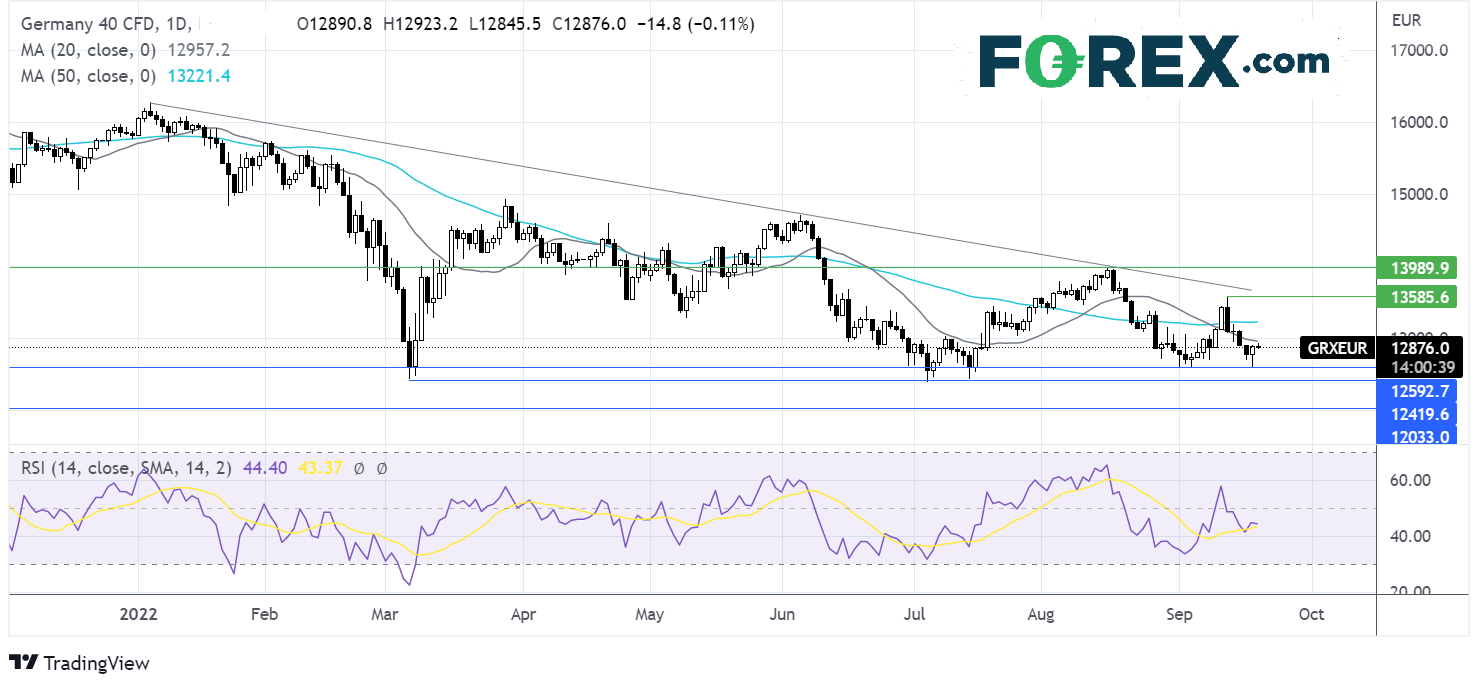

Where next for the DAX?

The DAX trades below its 20 & 50 sma and below its multi-month falling trendline. The price recently ran into resistance at 13585 and rebounded lower, finding a floor yesterday at 12600, the September low.

The RSI continues to trade below 50. Sellers need to break below 12600 to extend the downward trend towards 12385, the 2022 low.

Meanwhile, buyers will look to rise above the 20 sma at 13000 and the 50 sma at 13200, opening the door to 13585. A rise above here creates a higher high, exposing the falling trendline resistance at 13700.

USD/CAD edges higher ahead of Canadian inflation

USD/CAD ended yesterday’s session mildly lower yesterday after briefly pushing over 1.3340 to a two-

year high. Canadian PPI cooled for a third straight month, falling 1.2% MoM in August after falling 2.1% in July.

Today Canada’s CPPI inflation is in focus and is expected to cool to 7.3% YoY in August, down from 7.6%, marking the second straight month of cooling inflation. Another downtick in Canada’s CPI could prop up USD/CAD.

Meanwhile, the 2-day FOMC meeting begins, keeping the market mood cautious. The Fed is expected to hike rates by 75 basis points, although some traders are positioning for a full 100 basis point hike.

US housing market data is due to be released and is expected to confirm the cooling in the housing market as interest rates rise at the fastest pace for years.

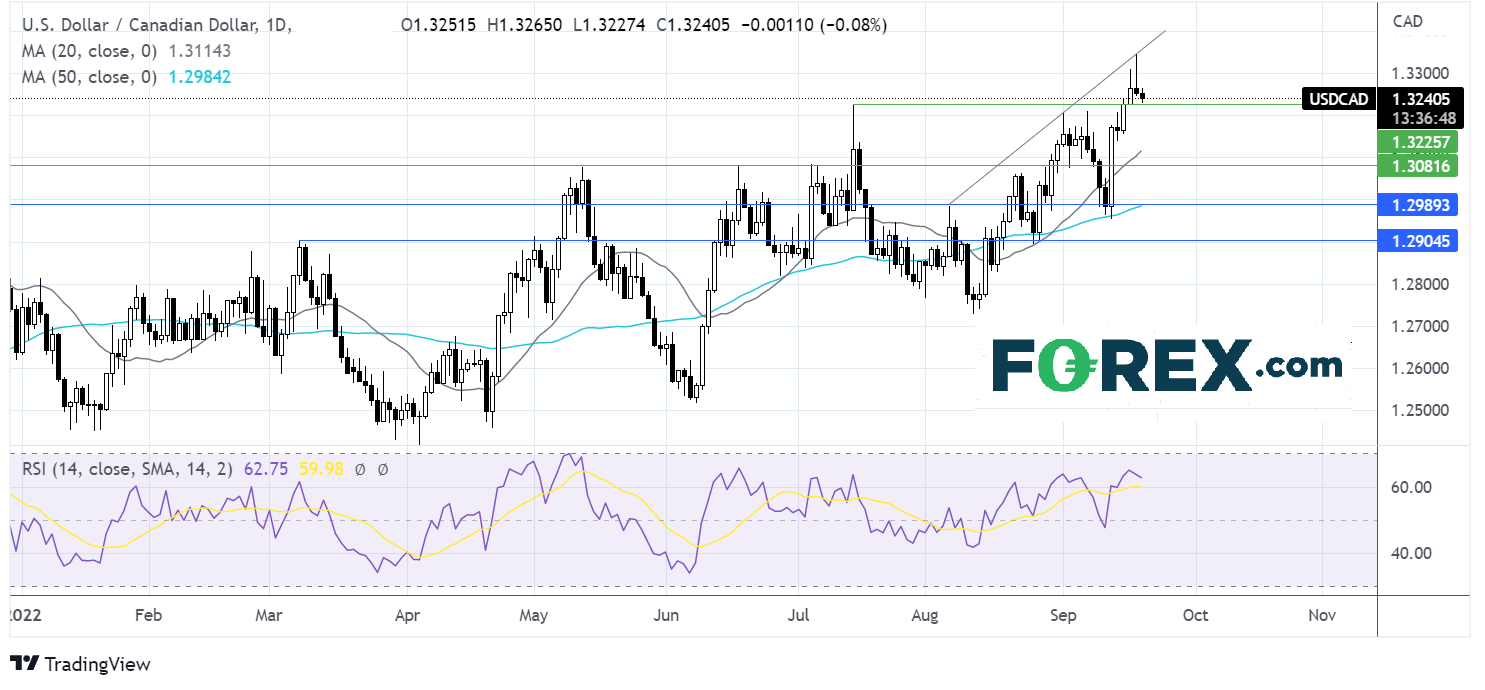

Where next for USD/CAD?

After rebounding off the 50 sma, USD/CAD has retaken the 20 sma and the July 14 high at 1.3225, hitting a fresh 2-year high at 1.3345, which along with the RSI over 50, keeps buyers hopeful of further upside. However, the long upper wick on yesterday’s candle suggests that there was little acceptance at the higher price.

Should bulls successfully defend 1.3225, buyers could look to rise back towards 1.33 and 1.3345 to create

a higher high.

However, failure to defend 1.3225 could see sellers head back towards 1.3080 the May and June high, negating the near-term uptrend.

More By This Author:

Two Trades To Watch: EUR/GBP, DAXTwo Trades To Watch: FTSE, EUR/USD, Monday, Sept. 12

Two Trades To Watch: DAX, USD/CAD