Two Trades To Watch: Dax, Gold - Wednesday, May 4

DAX trades cautiously ahead of the Fed. Gold has fallen 1.6% so far this month on hawkish Fed bets is there more downside to come?

Image: Forex.com

DAX trades cautiously ahead of the Fed

The DAX, along with its European peers, is opening in a cautious mood after disappointing trade data and ahead of the Fed’s rate decision later today.

German exports fell by more than expected in March as the impact of the Russian war became apparent. Exports fell -by 3.3% MoM after rising 6.2% in February. Expectations had been from a -2% monthly decline. Exports to Russia have come to a standstill, and with COVID cases rising in China, supply chain disruptions.

German services PMI data is due later and is expected to confirm the preliminary reading of 57.9 in April, up from 56.1.

Looking ahead the Federal Reserve rate decision is expected to drive risk sentiment.

Where next for the DAX?

The DAX has been trending lower since the start of the year. It trades below the falling trendline, below the 50 & 100 sma. The price recently ran into support at 13550 and has rebounded higher, moving back over 14000.

The price appears to be consolidating between 13800 on the lower side and capped by the 50 sma at 14100. The RSI is neutral at 50.

Traders could look for a break-out trade. Buyers will look for a move over the 50 sma, which has capped the upside since the start of the year. This will expose the falling trendline resistance ahead of 14930, the March high.

On the downside, sellers will look for a move below 13800, opening the door at 13550. A move below here could spark a deeper selloff.

Gold awaits the Fed

Gold trades 1.6% lower in May after dropping 2.6% across April. The precious metal has come under pressure as expectations of a more hawkish Fed ramped up, boosting the USD to an almost 20-year high.

Today the Fed is expected to raise interest rates by 50 basis points and announce its plans for trimming its $9 trillion balance sheet.

Given that the hike is priced in and a $95 billion QT is priced in, the focus will be on the outlook and how fast the Fed plans to hike rates over the coming months.

With the labor market holding up well, the Fed has room to act aggressively. A more hawkish-sounding Fed could boost the USD and hurt demand for Gold further.

Where next for Gold prices?

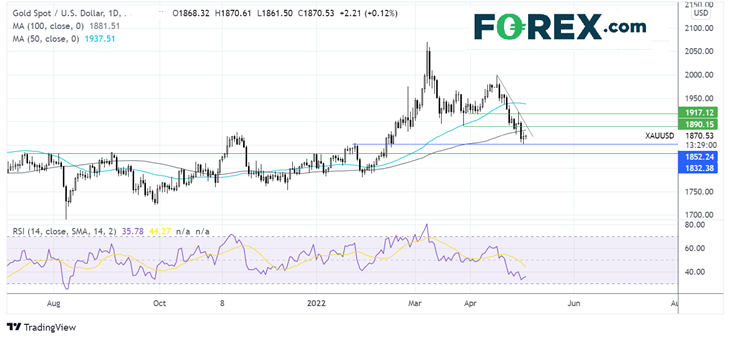

After rising to a high of $1998 in mid-April, the precious metal has been trending lower. The price fell through its 50 & 100 sma, which, combined with the bearish RSI, keeps sellers hopeful of further downside.

An immediate floor can be seen at 1850yesterday’s low; a break below here could open the door to $1831.

On the flip side, a move over 1880 the 100 sma, open the door to 1890 the March low. A move above 1917 is needed to create a higher.