Turkish Lira Plunges To All Time Low After Surprise Rate Cut By The Erdogan Central Bank

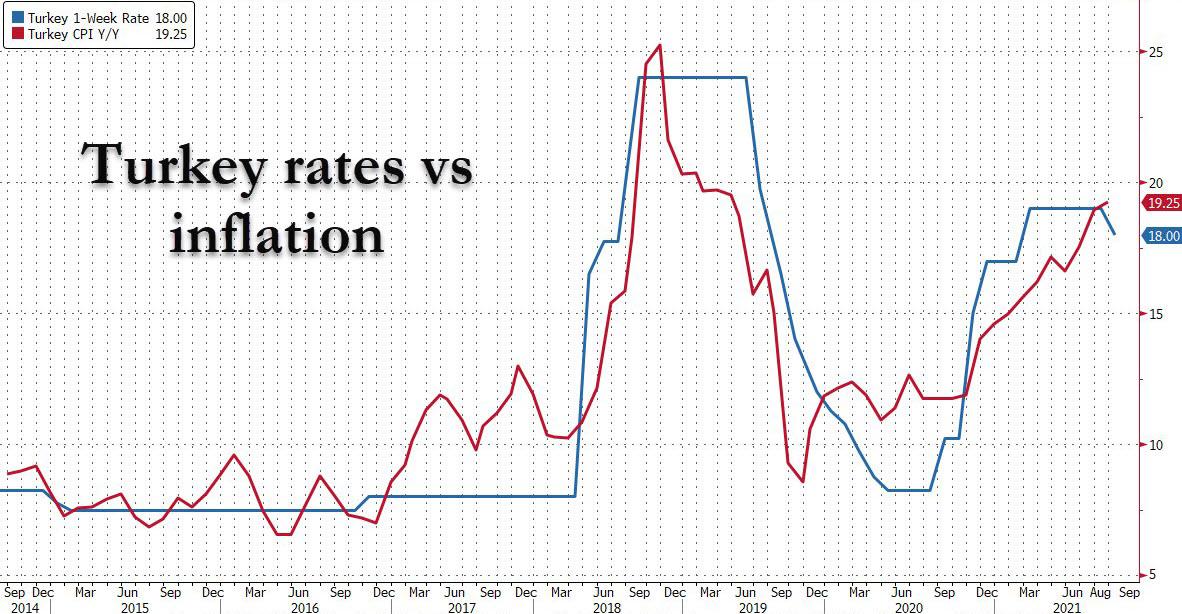

Turkey’s currency plunged to a new all-time low, with the USDTRY rising as high as 8.8017 after Erdogan's central bank unexpectedly cut its policy rate by 100 basis points to 18% on Thursday, delivering stimulus long sought by President Erdogan despite soaring inflation.

The central bank was widely expected to hold interest rates steady at 19%, where they had been since March, given inflation soared to 19.25% last month, the highest level since Turkey's FX crisis in 2018. Only two of 17 polled economists had predicted a cut.

In retrospect, the cut should have been more widely expected after Governor Sahap Kavcioglu - who is the latest central bank head installed by Erdogan to serve at his behest at the "independent" bank - sounded more dovish in recent weeks, paving the way for Turkey’s first monetary easing since May 2020 and ending a tightening cycle that began 12 months ago. Kavcioglu strategically shifted his emphasis to (lower) core inflation as a reference benchmark, which stood below 17% in August, instead of headline CPI, and had said policy was tight enough to cool price rises in the fourth quarter.

The Turkish Central Bank is notorious for having its governors - hand-picked by Erdogan in recent years - also get fired by Erdogan if they defy the core tenets of "Erdoganomics" and refuse to cut rates to tame soaring inflation.

Today, the bank’s policy committee said a rate cut was “needed” because of the lower core price measures - which strip out food and some other goods - as well as shocks to supply in the wake of pandemic measures.

The tightness in monetary stance has started to have a higher than envisaged contractionary effect on commercial loans. In addition, macroprudential policy framework has been strengthened to curb personal loan growth. The Committee evaluated the analyses to decompose the impact of demand factors that monetary policy can have an effect, core inflation developments and supply shocks

Echoing the Fed, the TCMB said the recent rises in inflation “are due to transitory factors" and added that “the tightness in monetary stance has started to have a higher than envisaged contradictory effect on commercial loans.”

“Ridiculous move by the CBRT - but not unexpected. Erdogan gets what Erdogan wants. But inflation is rising and yet they are cutting rates. The CBRT is taking a huge risk with the exchange rate” Blubeay's Tim Ash said of the rate cut.

The central bank’s dovish pivot this month had prompted analysts to warn of a “policy mistake” if cuts come too soon, though most predicted they would come before year-end. Foreign investors, having had enough of Erdogan's unpredictable authoritarianism, have dumped Turkish assets in recent years due in part to concerns over the political independence of the central bank, given Erdogan ousted its last three governors over a 20-month span due to policy disagreements. A self-described “enemy” of interest rates, Erdogan said in June he spoke to Kavcioglu about the need for a rate cut in August. Last month, he said, “we will start to see a fall in rates”.

Commenting on the Turkish decision, Capital Economics' Jason Tuvey said that “Erdogan gets his way with surprise rate cut ... We think that further aggressive easing is likely over the next year. A few factors seem to have swayed the central bank to commence an easing cycle today. The first is the further decline in core inflation last month, to 16.8% y/y – CBRT Governor Sahap Kavcioglu had recently emphasized the ‘importance of core inflation indicators’ when determining the monetary policy stance.”

“The second is that policymakers seem to be concerned about the impact of the tight policy stance on activity. The latest hard activity figures showed that the economy made a soft start to Q3. Finally, Mr. Kavcioglu will have been well aware of what happened to previous CBRT governor’s that defied President Erdogan’s desire for rate cuts and may have moved on policy to save his job

The lira tumbled as much as 1.5% and stood at 8.76 against the dollar after earlier touching an all-time low of 8.80. Depreciation brings further inflation in Turkey due to imports priced in hard currencies, but according to "Erdoganomics", lower rates lead to lower inflation in a revolutionary overhaul of conventional monetary thinking.

“People were set up to be short the currency, there were the comments you had from Erdogan and the whole story of the conflict with the central bank. Obviously, the currency has weakened and it will weaken further, but I don’t think you are going to see it blow up completely because there was some positioning for this” said Peter Kisler, emerging markets portfolio manager at Trium Capital. Investor jitters had led to a more than 4% currency devaluation this month.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more