Turkish Lira Currency Crisis Deepens As USD/TRY, EUR/TRY Eye New Highs

LIRA CRISIS CONTINUES

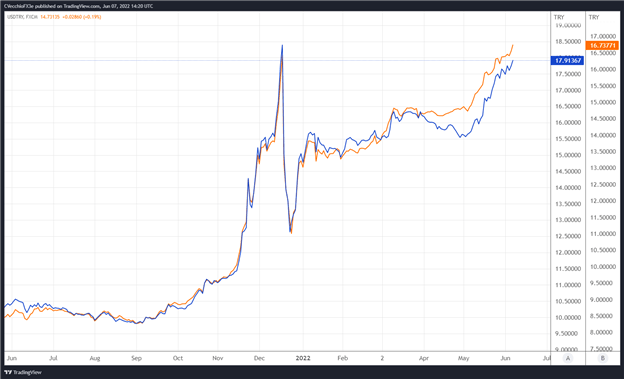

We’ve been intermittently reviewing the Turkish Lira since the end of September, as the emerging market currency remains embroiled in a textbook currency crisis. Misguided intervention efforts failed to stop the bleeding, and the Turkish Lira is in the midst of an outright freefall in 2022.

The rise in food and energy prices as a knock-on effect of the Russian invasion of Ukraine is hitting Turkey harder than most countries: it is the third-largest wheat exporter globally, and it imports 93% of the oil it consumes, and 99% of the gas it consumes. In TRY-terms, food prices are up by more than +93% y/y, while energy prices are up an astounding +92% year-to-date (Brent oil). Overall, this has led to a +73.5% y/y increase in Turkish inflation through May.

While the Turkish government continues its policy of reimbursing domestic savers on Lira declines in an attempt to stave off demand for foreign currencies like the Euro and the US Dollar, the Central Bank of the Republic of Turkey’s (CBRT) net reserves have plunged to -$55 billion when accounting for FX swap deals with Turkey’s domestic banks, according to Reuters.

As noted in December 2021, “in order to compensate for losses, the CBRT will have to print more currency – which can exacerbate the ongoing inflation issue, one that can’t be solved with Turkish President Recep Tayyip Erdoğan’s misguided obsession with low interest rates.” As things stand now, the Turkish Lira’s beatings will continue until morale improves – or rather, until the CBRT embraces sound monetary policy.

EUR/TRY [BLUE] & USD/TRY [ORANGE] TECHNICAL ANALYSIS: DAILY PRICE CHART (JUNE 2021 TO JUNE 2022) (CHART 1)

The longer-term outlook remains: the factors are in place for the currency crisis to get worse, per the Emerging Markets Crisis Monitor: record inflation (and record low real yields), a negative current account, rising implied FX volatility, widening bond risk premiums, and a rising external debt burden are hallmarks of an emerging market currency in crisis.