Turkey Posts Expected Current Account Surplus In September

In September, the current account surplus, which was in line with the consensus, narrowed in comparison to the previous year. The capital account, on the other hand, experienced outflows, leading to a decline in official reserves.

Photo by Omid Armin on Unsplash

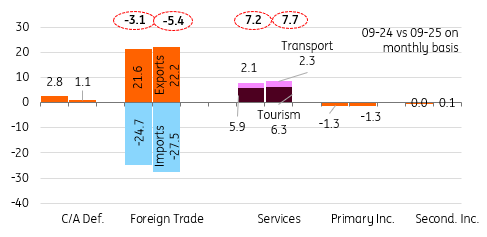

The current account posted a surplus of US$1.1bn, broadly in line with the market forecast. A closer look at the monthly figures shows that the surplus narrowed compared to the same month last year, primarily due to a higher trade gap, which deteriorated from $-3.1bn to $-5.4bn.

The deterioration was largely driven by a smaller core trade surplus and a worsening net gold trade balance. However, a further increase in services income, driven by growing transportation and tourism revenues, limited the decline in current account surplus.

As a result, the 12-month rolling current account deficit, which has been rising since November 2024, continued its uptrend and reached $20.1bn (around 1.5% of GDP) from $18.4bn in the previous month.

Breakdown of the current account (monthly, US$bn)

Source: CBT, ING

On the capital account, outflows totalled $6.0bn in September, following political developments. With net outflows from errors and omissions of $3.8bn, and considering the current account surplus, official reserves contracted by $8.7bn.

Further analysis reveals that resident activities generated an outflow of $10bn, mainly due to an increase in deposits held by domestic banks abroad, the extension of loans to foreign entities and the acquisition of financial assets abroad. On the flip side, non-resident activity led to inflows totalling $4.0bn, primarily from debt-related channels. Key components of non-resident inflows include: a $1.7bn debt issuance by the Treasury and a $1.3bn net eurobond issuance by domestic banks.

Net borrowing, on the other hand, was slightly negative at $0.6bn, driven mainly by banks' short-term debt repayments. Conversely, long-term borrowing by the banking sector has remained positive. That has resulted in long-term debt rollover ratios standing at 146% for corporations and 181% for banks, compared to 147% and 170%, respectively, on a 12-month rolling basis.

During the first nine months of 2025, resident outflows fell from $31.3bn in 2024 to $25.8bn. Foreign inflows, on the other hand, recorded an increase of $41.7bn, compared to $37.7bn during the same period in 2024. As a result, the capital account has remained in positive territory at $15.7bn, compared to $6.3bn in the previous year.

In addition, outflows via net errors and omissions remained elevated, totalling $-12.3bn vs $-5.3bn in 2024. Taken together with the widening current account deficit, which grew from $-5.2bn to $-14.9bn, official reserves were depleted by $11.5bn – a deeper decline than the $4.1bn drop recorded a year earlier.

Breakdown of financing (monthly, US$bn)

Source: CBT, ING

Overall, the current account surplus in September aligned with expectations, while the capital account once again played a crucial role due to significant outflows. Preliminary customs data from the Ministry of Trade suggest further deterioration in the September current account, as the foreign trade deficit appears to have widened in comparison to last year.

Looking forward, a combination of external risks – including developments in global trade and geopolitical tensions – as well as ongoing weakness in domestic demand, is expected to shape the path of the current account balance in the coming months.

More By This Author:

Italian Industrial Production Rebounds Strongly In September

FX Daily: Carry Trade Is Proving Persistent

The Commodities Feed: Refined Products Drive Oil Prices Higher

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more