Traders Bet ECB Will Raise Rates Above 0% By Year-End For The First Time Since 2012

With the market now pricing in 3 distinct 50bps rate hikes in the next three FOMC meetings, all eyes have turned to the ECB whose stubborn refusal to move away from NIRP despite galloping inflation has raised more than one eyebrow. But that may be changing.

Following a barrage of hawkish rhetoric from policymakers spurred speculation the bank is priming the market for faster-than-expected monetary tightening, traders are now betting that the European Central Bank will raise rates above zero this year for the first time since 2012.

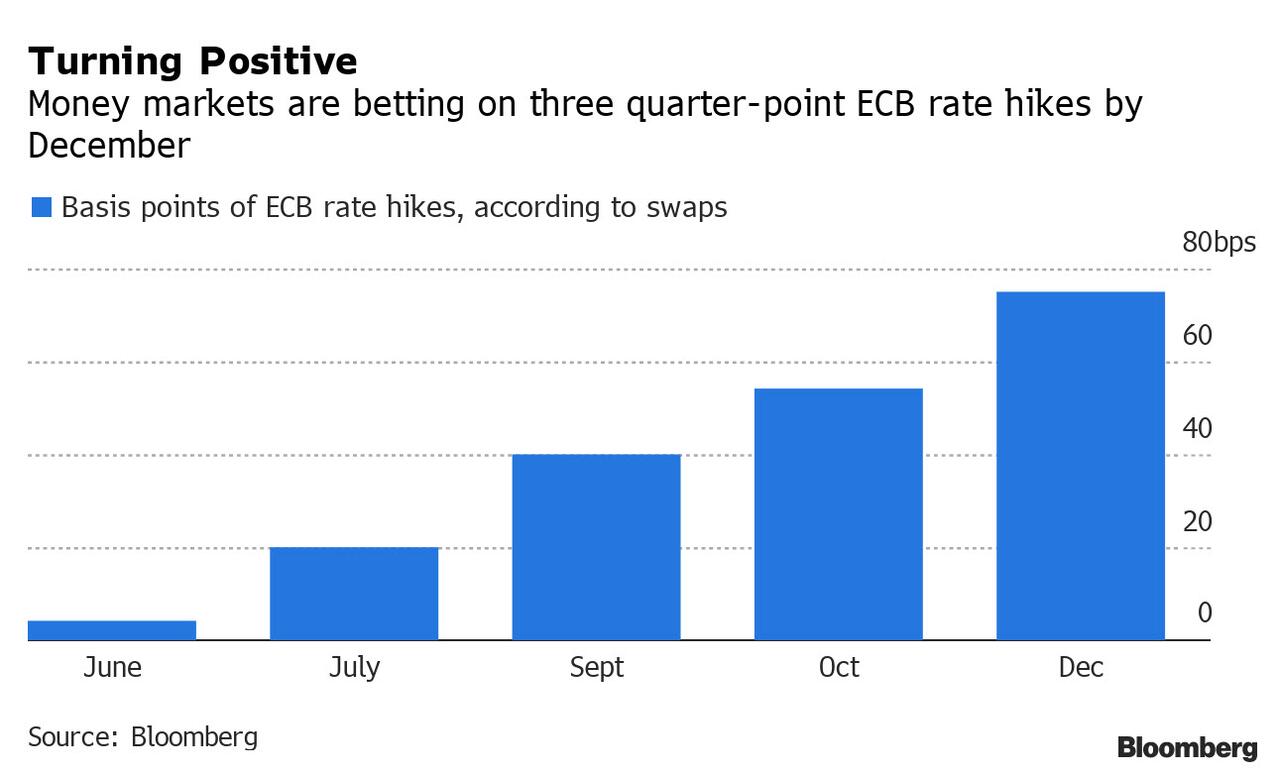

As shown below, money markets are pricing in roughly 75 basis points of interest-rate hikes by the ECB’s December decision, and also see an 80% chance of a quarter-point move in July. That’s up from less than one quarter-point increase expected at the start of the year. With the ECB’s deposit rate currently at a record low of minus 0.5%, that would push the bank's rate well into the green.

The repricing came after ECB Governing Council member Pierre Wunsch said policy rates could be raised above zero before year-end, with the bank perhaps even deploying “restrictive” policy to get surging prices under control; he added that while the war in Ukraine presents a significant risk to the economy, it probably won’t keep the ECB from raising borrowing costs to react to a series of unexpectedly strong inflation readings.

“Without any really bad news coming from that front, hiking by the end of this year to zero or slightly positive territory for me would be a no brainer,” Wunsch said.

Adding to the hawkish panic, fellow members Luis de Guindos and Martins Kazaks said this week a rate hike in July was possible, echoing calls from the ECB’s Joachim Nagel, who said interest rates may be lifted early in the third quarter.

“Everything is possible now,” said Christoph Rieger, head of fixed-rate strategy at Commerzbank AG. “The reference to a July rate hike seems almost like a concerted effort by a group of hawks.”

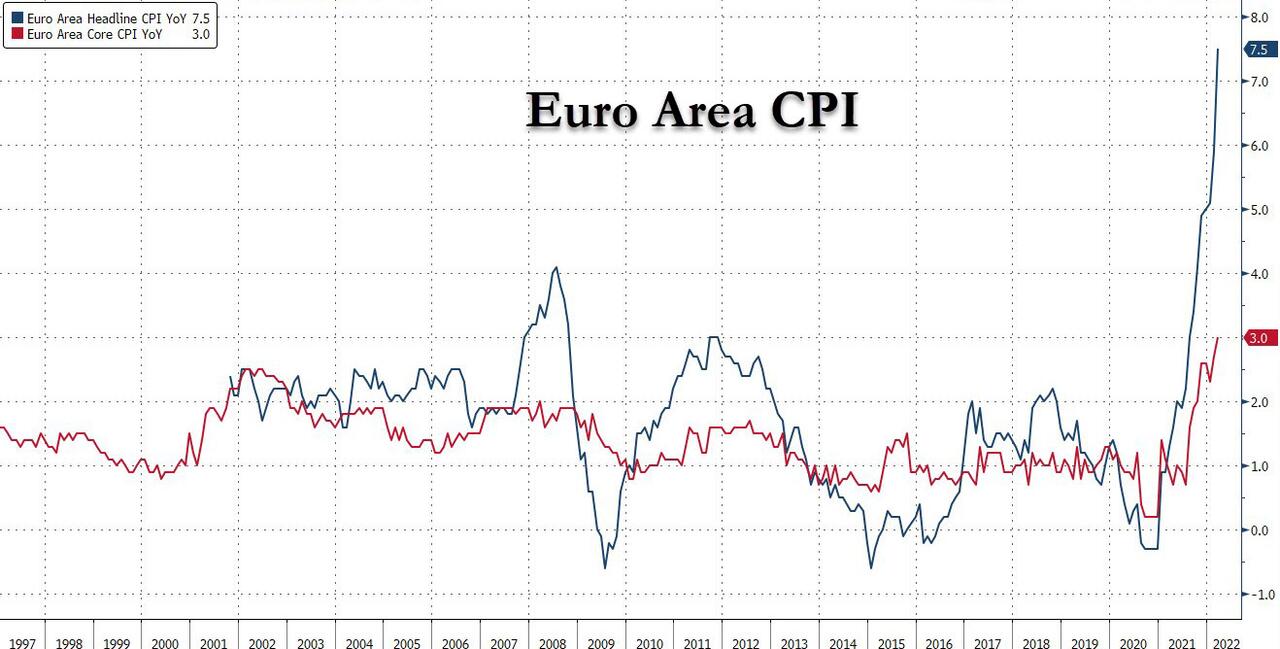

While it is too early to conclude the ECB will hike into a recession - like it did back in 2011 - sparking yet another bond market crisis, it is running out of options: the latest Euro-zone inflation smashed estimates by surging a record 7.5% in March from a year ago, as Russia’s invasion of Ukraine fanned energy costs and added to price pressures as the economy rebounded from the pandemic. That’s forcing policymakers to quickly put an end to an era of ultra-accommodative policy, which was supercharged over the past two years help foster a recovery.

Last week, ECB's hapless president Lagarde signaled that the central bank hedge fund's next meeting in June will start the clock ticking toward interest-rate hikes and investors will be listening closely for more clues when she speaks at an IMF panel with Fed Chair Jerome Powell later Thursday.

Latvia’s Martins Kazaks told Bloomberg a rate increase in July is “possible,” and that there are “no reasons” to disagree with what markets are pricing for the rest of the year.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more