Today’s Chart: This Real Estate Bust Is A Global Problem

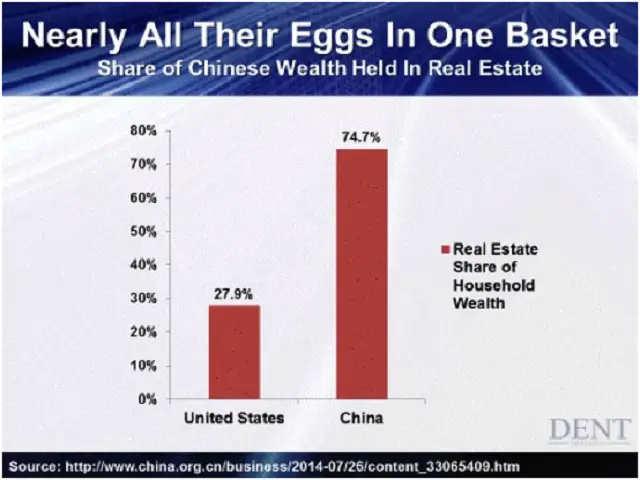

Pretend you’re a country that over the past decade has engineered the mother of all real estate booms, in the process encouraging your citizens to load up on houses, apartments, raw land, anything related to the property sector. Your households now have 74% of their wealth in real estate, versus only 28% for those house-mad Americans. You’re China of course.

Now assume that your real estate bubble is in danger of bursting, as a giant property developer implodes under the weight of its Ponziesque financing schemes, threatening to impoverish millions of people who one way or another are exposed to its failed projects.

But that just phases one of the problems. Because most other Chinese real estate developers also have opaque finances, investors are pulling their money out of those companies too, potentially crashing the entire industry – which, remember, accounts for ¾ of household assets. Put bluntly, the Chinese economic miracle is now in danger.

But that just phases two of the problem. China is the second-biggest economy in the world and has investments/trade deals/financing arrangements pretty much everywhere. So no place is safe from a Chinese financial crisis.

This means – you guessed it – a coordinated bailout of whoever needs it by the world’s central banks, coming soon.