Time To Buy These 3 Internet-Commerce Stocks?

Image: Bigstock

Among the Zacks Rank #1 (Strong Buy) and Zacks Rank #2 (Buy) list, several internet-commerce stocks are standing out with earnings estimate revisions on the rise. With the Internet-Commerce Industry in the top 11% of over 250 Zacks Industries, here is a look at some of the top-rated stocks in the space to consider buying amid the strong start to 2023.

Alibaba (BABA - Free Report)

Starting the list is Alibaba, which has been among the Zacks Rank #1 Strong Buys since Jan. 18, with its stock climbing considerably during this time. Following the reopening of China’s economy, Alibaba has been one of the pack leaders among Chinese stocks that have soared over the last few months.

Alibaba’s fiscal 2023 earnings are expected at $7.20 per share, which would be a -13% drop from a year ago, but FY24 earnings are forecasted to rebound and climb 15% to $8.28 a share.

Image Source: Zacks Investment Research

Earnings estimates continuing to rise for Alibaba is a good sign, as the stock has been up +52% over the last three months to easily outpace the S&P 500’s +11%.

Plus, having recently been seen trading at around $106 a share, the stock still trades attractively relative to its past at 18.5X forward earnings. This is 72% below its historical high of 66.6X and a 50% discount to the median of 36.9X, which is another indication that there could be more upside from current levels.

JD.com (JD - Free Report)

JD.com is another Chinese internet-commerce stock that may also have more upside, with its stock skyrocketing in the past few months as well. Over the last three months, JD stock has been up +30% to beat the benchmark and has been on par with the Electronic Commerce Markets' +31%, despite trailing Alibaba’s +52%.

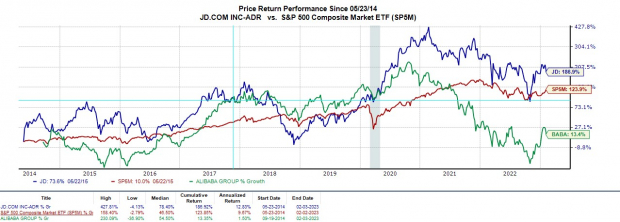

More impressively, since going public in 2014, JD stock is now up +187%, which has topped Alibaba’s +13% during this period and the S&P 500’s +124%. This shows the company is very much a viable option in regards to E-commerce growth in China.

Image Source: Zacks Investment Research

With the enormous size of China’s population, there is certainly enough room for both Alibaba and JD.com to perform as elite players in regard to direct-to-consumer product sales through their online platforms. To that note, JD.com’s earnings estimates have gone up for its current fiscal 2022 and FY23.

Fiscal 2022 earnings are now projected to climb 44% to $2.44 per share compared to EPS of $1.69 in FY21. Fiscal 2023 earnings are forecasted to rise another 14%. Having recently been seen trading at $57 a share and 27X forward earnings, the stock trades well below its absurd historical high of 2,100.5X and at a 60% discount to the median of 68.9X.

Match Group (MTCH - Free Report)

Rounding out this list is North American-based dating platform operator Match Group, which was recently seen on the Strong Buy list along with JD.com.

With earnings estimates trending higher, Match Group's stock is starting to stick out as MTCH is still 67% off its 52-week highs. While there is no guarantee Match Group will eclipse the very impressive high of $118.95 per share seen last February, fiscal 2023 earnings are projected to climb an impressive 72% to $2.15 per share compared to EPS of $1.25 in FY22.

Image Source: Zacks Investment Research

Plus, FY24 earnings are projected to jump another 14%, with MTCH stock recently trading at $48 per share and 24.4X forward earnings. This is 90% below its historical high of 249X and a 43% discount to the median of 43.2X, with Match stock up 15% over the last month to top the recent rallies in the broader indexes.

Bottom Line

With these internet-commerce stocks recently seen trading attractively relative to their past, the rising earnings estimate revisions are a great sign that there could still be more upside left after their recent rallies. The annual bottom line growth is also impressive, and it creates long-term value in addition to near-term upside, with their average Zacks Price Targets well above current levels.

More By This Author:

Apple Earnings Miss, But The Stock Rallies AnywayThese 3 Stocks Have Found Plenty Of Buyers In 2023

PayPal Reports Next Week: Wall Street Expects Earnings Growth

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more