Think Ahead: The Week The Transatlantic Tables, Chairs And Everything Else Turned

Image Source: Pexels

Historic spending announcements and weak US data have prompted an astonishing reversal in economic narratives on both sides of the Atlantic. But there are some major caveats, and James Smith explains they will have a major bearing on where financial markets go next. Surely, next week can't be as historic as the last? Don't bet on it…

The week the Transatlantic tables turned

For financial markets, this was the week where everything turned on its head. US economic exceptionalism – for weeks a key market driver – is under serious question. And Europe may just have found a way out of its seemingly endless doom-loop. The result? The Euro is more than four percent stronger against the dollar versus a week ago. German bund yields are almost 40bp higher too.

Yet history tells us that things rarely play out the way we expect. You only need listen to ECB chief Lagarde this week and her seventeen separate uses of the word “uncertainty” in the post-meeting presser, where in January it was only four.

So let’s break it down. What are investors assuming right now, and are they right?

Firstly, they're betting that all that extra German spending combined with the proposed changes to the European Commission's deficit rules, will curtail the ECB's easing cycle and keep rates higher long into the future. Our resident ECB watcher Carsten largely agrees. He now thinks it’ll pause its rate-cutting cycle in April and lower the deposit rate just once more before the summer.

As for what it'll do to growth is more up for debate. The assumption within markets is that the extra cash will rejuvinate both the short and long-term growth outlook. More than that, it signifies a seismic shift towards greater fiscal activism and acceptance of higher deficits as the necessary cost of security.

Certainly, infrastructure spending should come with a high multiplier effect. And Carsten has been arguing since forever that Germany needs this investment if it stands any chance of reinventing its ailing business model.

But capital investment takes time to deploy; shovel-ready projects aren’t always readily available. And there’s still the small matter of getting these policies through the outgoing German parliament over the coming days.

As for military spending, nobody is in much doubt that the bulk of extra equipment is going to get imported, at least until the European defence sector scales up. What we don’t know is whether that extra spending will be accompanied by cuts elsewhere in government. That’s what we’ve seen here in Britain, where greater defence spending is at the expense of foreign aid.

Changes to the European Commission’s deficit rules should in theory negate that, as my colleagues discuss here. However, that extra fiscal space only exists on paper; it doesn’t mean financial markets won’t be reactive to the greater issuance that comes with it. Higher yields are ultimately a drag on growth.

Our team concludes that higher defence spending is only likely to drive annual eurozone growth rates up by a couple of tenths of a percentage points over the next couple of years.

But what if the real macro boost comes not from the defence spending itself, but the metaphorical ammunition it provides Europe with to negotiate a deal with the US administration? Surely that’s what really has the potential to restore activity in Europe right now, assuming all that extra government spending takes time to kick in.

Whether that thinking underscores any of this week’s spike in European rates isn't clear. We’d certainly be sceptical. Remember that the EU, which negotiates trade policy for the bloc, can’t compel national governments to buy more defence kit, even if that’s probably what they’ll do. Ultimately, the US Administration’s grievances regarding European trade surpluses appear deeply rooted. The US Treasury desperately needs the tax revenues, too.

The on-and-off nature of Canadian/Mexican tariffs shows that predicting trade policy is fast becoming a fool’s game. But our view, discussed in Inga Fecher’s Trade Outlook, is that tariffs are heading for Europe this April one way or another. And if we’re right, it’s this and not government spending that’s likely to be the dominating force for the European economy this summer. The uncertainty alone is a major headwind.

That same is just as true in the US itself. The weaker tinge to recent US data – epitomised by the remarkable import-driven plunge in the Atlanta Fed’s nowcast of first-quarter GDP – is causing markets to rapidly reassess just how much longer the US macro success story can continue. Policy uncertainty doesn’t help, and markets are now pricing in three rate cuts from the Fed this year.

So what are the chances investors are overdoing the gloom? I put the question to James K over in New York, and in a very narrow sense, he reckons Q1 growth probably won’t be quite so bad. Higher imports are a symptom of tariff front-loading which should eventually show up in either consumer spending or inventories, which are both GDP-positive. Another 'hot' inflation report next week might also put the brakes on that Fed repricing.

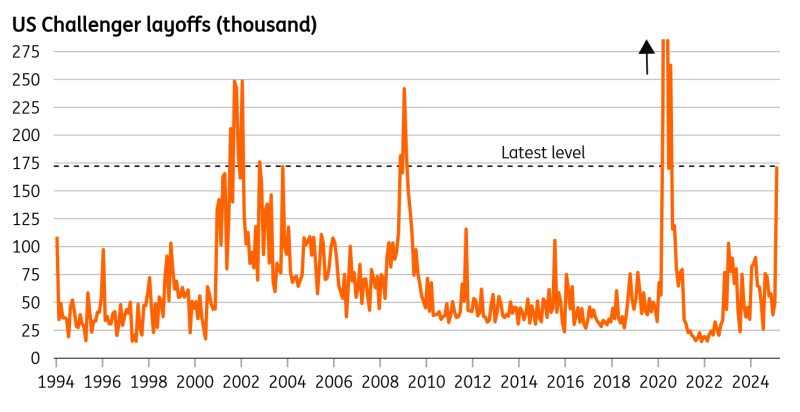

Take a step back, though, and James argues investors are right to question the US exceptionalism story. President Trump’s early focus on cost-cutting and tariffs – both negative for growth – so far haven’t been met with the offsetting stimulus of tax cuts, nor a clear-cut dividend from deregulation. This week’s spike in layoffs, to levels not far off the dot-com bubble/financial crisis peaks, isn’t a great omen.

The bottom line? This week's tectonic shifts in the Transatlantic divide come with significant caveats and major unknowns. And it's these question marks that really matter for what happens next in financial markets.

Speaking of which, let me leave you with our team’s comprehensive assessment of what happens next across FX, bonds and credit.

Chart of the week: US layoffs unexpectedly spike

Source: Macrobond

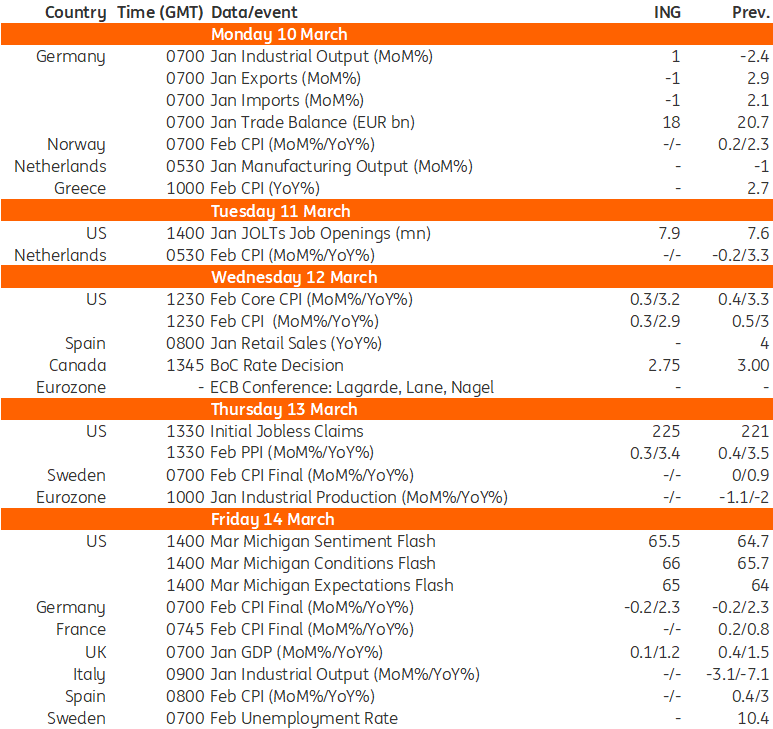

THINK Ahead in developed markets

United States (James Knightley)

- CPI (Wed): US consumer price inflation will be the big focus in the coming week. It has been too hot of late and another 0.3% MoM print is expected with evidence from business surveys suggesting that some companies are pre-empting tariffs by lifting prices. Food prices also remain under upward pressure while energy prices are also likely to contribute to more inflation despite sharp falls in gasoline in recent days. Nonetheless, the market appears more focused on worries about growth right now in an environment of government austerity and the threat of a squeeze on spending power if prices do respond to tariffs. As such, we have seen the market swing over the past three weeks from pricing just one 25bp rate cut this year to pricing three. A 0.3% MoM inflation print is unlikely to change that situation.

Canada (James Knightley)

- Interest rates (Wed): The Bank of Canada has cut rates 200bp already in the wake of weak growth and subdued inflation, but with the US implementing tariffs on imports from Canada, there are additional concerns about recession. In a recent speech Governor Macklem stated that “the economic consequences of a protracted trade conflict would be severe" with their models suggesting that the economy contracts initially before steadying and then returning to growth “but on a path that is about 2½% lower” than they assumed in January. After all 76% of Canadian exports go to the US, which is equivalent to 20% of Canadian GDP. Given the risks in an environment of 6.6% unemployment and 1.9% inflation the BoC has room to cut rates another 25bp on Wednesday.

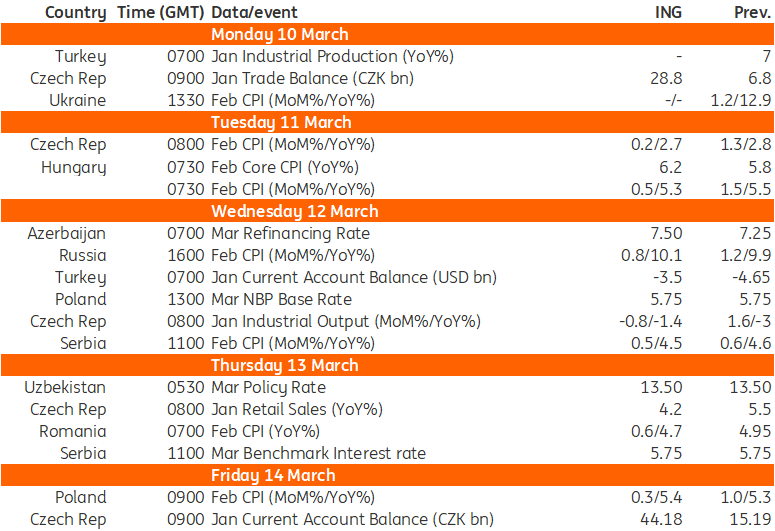

THINK ahead for Central and Eastern Europe

Poland (Adam Antoniak)

- NBP rate (Mon): The March meeting is unlikely to bring any major shift in the NBP's policy stance. Official rates should remain unchanged and policymakers are likely to continue stressing the upside risks to inflation in 4Q25 from electricity prices, wage pressures and a loose fiscal policy. The new set of staff macroeconomic projections will still be based on the current legal stance, that the cap on household electricity prices (PLN500/MWh) is lifted from October to the current level of electricity tariff (PLN623/MWh). Any rate cuts seem to be off the cards in the first half of the year and the July projection is the first one that could be based on updated inputs, including any new tariffs.

- CPI (Fri): Expect a further slight increase in February's headline inflation amid higher food prices. At the same time, the StatOffice will update the CPI basket weights and may revise its January CPI estimate. We forecast headline inflation to peak in March and core inflation to remain close to 4%YoY in the coming months.

Hungary (Peter Virovacz)

- Inflation (Tue): We expect a mixed bag for February inflation in Hungary. Fuel prices have come down significantly and we see some favourable repricing of some food items as the government has warned the food industry and retailers that it is ready to intervene with tough measures to fight inflation and profitability in these sectors. Seasonality will also help, as will the recent strengthening of the Hungarian forint. The bottom line is that we expect headline inflation to slow on both a monthly and annual basis, while core inflation will break through 6% YoY due to the stickiness of services inflation and base effects.

Czech Republic (David Havrlant)

- Trade (Mon): Both the trade balance and current account are expected to have improved at the beginning of the year, as imports softened after the strong pre-Christmas stocking. It also seems the external demand has reached the bottom recently, which may have removed the lid on exports.

- CPI (Tue): The Statistical Office will likely confirm the CPI reading from the preliminary estimates, providing a detailed breakdown. We see core inflation somewhat milder in February as the strong price growth in the service sector becomes gradually saturated. Meanwhile, potent food prices kept the headline price dynamics above the target.

- Industrial output (Wed): Industrial output declined further in annual terms at the beginning of the year, yet by less than in the previous reading. The soft indicators suggest that the Czech industry has put the worst behind, and we expect the output to gradually gain traction over the coming quarters.

- Retail sales (Thu): Real retail sales maintained a solid annual dynamic at year-start yet progressed at a less buoyant pace than the preceding year-end sales boosted by the Christmas shopping spree. Still, there remains a gap toward pre-pandemic levels that is about to be filled.

Azerbaijan & Uzbekistan (Dmitry Dolgin)

- Interest rates (Wed): We anticipate that the Central Bank of Azerbaijan (CBRA) will consider a modest increase in the key rate from the current 7.25%. This expectation is driven by the rise in inflation from 4.9% YoY in December 2024 to 5.4% YoY in January 2025, approaching the upper bound of the 4% ±2 target range. The higher CPI is primarily due to an increase in domestic tariffs and global food prices. Additional factors supporting a rate hike include fiscal easing of 2024 and the recent redollarization of the bank’s corporate funding base amid continued rapid growth in retail lending. However, we do not rule out the possibility that the CBRA may choose to maintain a wait-and-see approach for now.

- Interest rates (Thu): The Central Bank of Uzbekistan (CBRU) is under less pressure to hike rates, and we consider an unchanged policy rate of 13.50% as the base case. Inflation ticked up modestly from 9.9% year-on-year (YoY) in January to 10.1% YoY in February due to higher food prices. However, the overall Consumer Price Index (CPI) has been on a downward trend since last May, following household tariff liberalisation. Upward risks to inflation and the key rate in the medium term include the apparent fiscal easing of 2024, elevated inflationary expectations, and the upcoming second round of tariff increases in April, which is expected to cause a temporary 1-2 percentage point spike in the CPI rate.

Key events in developed markets next week

Source: Refinitiv, ING

Key events in EMEA next week

Source: Refinitiv, ING

More By This Author:

Resilience Of US Job Creation Set To Be Tested

FX Daily: A Payrolls Miss Will Do More Damage To The Dollar

China’s Trade Data Points To Weak Start To 2025

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more