Think Ahead: Great Minds Think Alike

Enough of what us lot think. We asked actual real people - the audience of our live event earlier this week - what they thought on everything from the Fed to the US dollar. Are they thinking what we’re thinking? Read on as we dive into next week’s hectic financial and economic world.

The latest US jobs numbers are hot of the press as I write this, and if you were hoping for clarity on how large the Fed’s September rate cut is likely to be, well, think again.

The unemployment rate might have dipped back by a tenth of a percentage point, and payrolls' growth wasn’t as bad as it could have been. But do we really trust the numbers? The last two months were revised down and we already know that further – potentially substantial – revisions are on their way.

James Knightley has all the gory details here, but the upshot is he thinks it's all to play for on whether or not we get a bumper fifty basis-point rate cut in two weeks. Keep an eye on next week’s inflation figures, though James isn’t expecting any nasty surprises. And he told our Economics Live session earlier this week that even if the Fed doesn’t cut rates by 50bp this month, it may well have to do so before the year is out. Recession isn’t inevitable, but the momentum is certainly fading.

Our audience seemed to agree. Though by no means scientific...

our poll question revealed that more than half thought the Fed Funds Rate would end up below 3.5%.

That’s maybe not surprising, given financial markets have rates priced in a year’s time down close to 3%.

It's also undoubtedly contingent on what happens in November’s Presidential vote (watch our snazzy video). And next week’s head-to-head debate between Kamala Harris and Donald Trump could be pivotal, even if US voters have traditionally made up their minds by this point in the race. James reckons the result could have very different implications for the Fed, though he questions whether it will change much over the next 6-10 months or so.

Across the Atlantic, the European Central Bank is facing up to its own set of uncertainties. Wage growth is still showing some underlying strength, even if headline numbers are stabilising. The major question for next week’s meeting, according to Carsten, is whether the ECB ends up increasing its inflation forecast above 2% at the end of 2025.

If it does, then that would undoubtedly embolden the ECB hawks and presumably rule out a follow-up cut at October’s meeting.

58% of our webinar audience saw just one rate cut beyond September and before year-end.

That’s our view too, although the ECB’s other challenge is that growth isn’t looking too rosy either. Carsten’s point is that where the ECB may have been ahead of the curve when it cut rates in June, its renewed caution could quickly see it fall behind. We reckon rate cuts will speed up through the winter.

I think it’s going to be a similar story here in the UK, though our audience wasn’t wholly convinced.

41% thought the Bank of England would end up cutting rates less aggressively than the Fed, compared to 17% who thought they’d go harder.

Markets are leaning that way, too. Services inflation is, after all, still stuck above the US and eurozone. But let’s not get carried away. Just as the Bank mirrored the Fed as rates rose, I suspect the same will largely be true on the way down.

So where does that all leave markets? Opinion, at least judging by our poll results, has subtly shifted over the summer.

25% of respondents felt EUR/USD would end the year over 1.13, while 46% felt it would remain roughly stable in a 1.10-1.13 range.

Back in June, there was more of a bias in the direction of a move towards 1.07 or below among our audience.

That’s maybe not surprising, given the move in the dollar this summer. But it’s the way we’re leaning too. We’ve got a slight downside dollar bias ahead of the US elections – keep an eye out for some FX scenarios early next week

Beyond the election, well just like that September Fed meeting, for the US dollar, it’s still all to play for.

Chart of the week: How our views compare to yours

Sample sizes of roughly 150 people, so results are not intended to be scientific or representative. Results taken during polls in our Economics Live webinar earlier this week

Source: ING

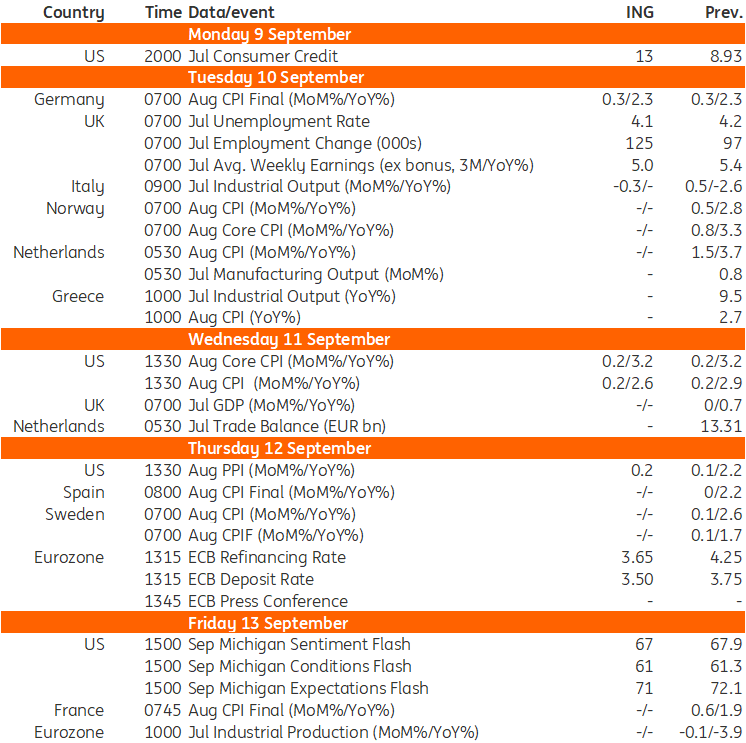

THINK Ahead in developed markets

United States (James Knightley)

- Friday’s jobs report did little to resolve the debate over whether the Fed will cut rates by 25bp or 50bp on 18 September. We have a 50bp in our forecast, but it is a low conviction call made on the basis that inflation fears have receded and the Fed will want to get ahead of labour market weakness, which we think will become increasingly apparent in the months ahead. Next week’s focus will be the inflation numbers. A 0.2%MoM core CPI print will give the Fed free range to do whatever they want, so this Fed decision will be a nail-biter. The Fed’s quiet period starts on Sunday (where they stop speaking) so watch out for a piece in the Wall Street journal planted by Fed officials if they really want to move the market. To be honest going into a Fed meeting not knowing what they will do could be quite healthy.

Eurozone (Carsten BrzeskI)

- European Central Bank (Thu): With the latest inflation data out of the eurozone, a rate cut at next week’s European Central Bank meeting has almost become a done deal. As current headline inflation is closing in on 2% and longer-term inflation forecasts remain stable at around 2%, the ECB has enough reasons to further reduce the level of monetary policy restrictiveness. Read our full preview here.

United Kingdom (James Smith)

- Jobs report (Tue): Last month, we saw an abrupt and frankly bizarre drop in UK unemployment from 1.5 to 1.2 million in the course of one month. Given the unemployment rate is a form of moving average, we’re likely to see a further drop, perhaps as far as 4.0% from a recent high of 4.4%. That’s even if the level of unemployment rebounds in the latest single-month numbers. Nobody is likely to pay too much attention, given the well-known issues with the data right now. Of greater consequence is the likely drop in wage growth, though that’s partly a base effect story. None of this is likely to move the needle for September’s Bank of England meeting, where we expect no change in rates.

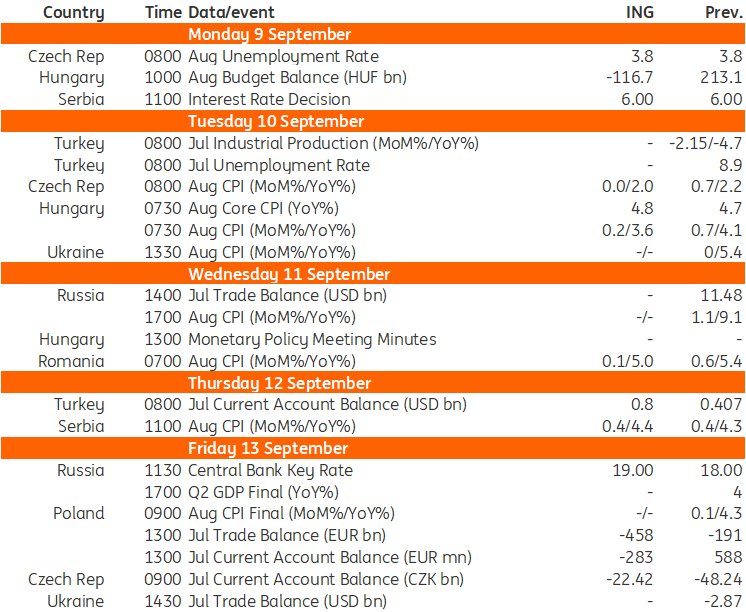

THINK Ahead for Central and Eastern Europe

Poland (Adam Antoniak)

- Balance of payments (Fri): We estimate that July's current account was in the red and the deficit amounted to €283mn vs. a surplus of €588m in June, as the deficit in trade in goods widened. According to our forecasts, exports in euro terms jumped up by 3.3%YoY, while imports rose by 5.4%YoY. In the previous month, trade turnover declined in annual terms. Still, the external position remains very sound. The 12-month cumulative current account surplus is expected to narrow to 1.3% of GDP in July from 1.4% in June.

- CPI (Fri): The StatOffice will likely confirm its flash estimate of August CPI inflation at 4.3%YoY. Detailed data should allow for a more precise estimate of core inflation, excluding food and energy prices. We currently estimate that it amounted to 3.7-3.8%YoY and did not change markedly from July (3.8%YoY). Persistently elevated core inflation is one of the arguments for the NBP to maintain restrictive monetary policy. We expect the NBP to keep rates unchanged this year.

Hungary (Peter Virovacz)

- Inflation (Tue): The rollercoaster ride of Hungarian headline inflation continued in August. After a significant increase in the previous month, mainly due to non-core factors and policy measures, we see a retreat in monthly repricing in August. Fuel prices fell, and we expect food inflation to moderate on a monthly basis. In addition, we expect to see consumer durables prices decline in line with global developments and the appreciation of the HUF. While we expect monthly price increases in services to decelerate, the year-on-year print will again be close to 10%. Against this backdrop, while headline inflation will drop to 3.6% YoY, we see core inflation rising slightly, reaching 4.8% on a yearly basis in August.

Czech Republic (David Havrlant)

- Unemployment (Mon): The Czech unemployment rate likely remained unchanged in August as the economic recovery continues. We saw layoffs in manufacturing aligned with the protracted weakness in the sector, while demand for workers in the service segment remains solid. At the same time, industry also retains or hires skilled professionals hoping for a turnaround, as this segment of the labour market remains tight. The current account is expected to have remained in deficit in July, reflecting the lukewarm demand from main European trading partners.

- Inflation (Tue): Czech annual headline inflation likely softened in August and returned to the target, reflecting the decline in fuel prices and further disinflation of regulated energy prices. Food prices likely remained in marginal annual decline. Meanwhile, core inflation likely increased in August, driven by strong consumer spending in previous months amid continued robust real wage growth. We see a downward risk to this estimate on account of potentially weaker fuel prices and final prices of electricity and natural gas.

Key events in developed markets next week

Source: Refinitiv, ING

Key events in EMEA next week

Source: Refinitiv, ING

More By This Author:

US Payrolls Fails To Resolve The 25 Or 50bp Rate Cut CallFX Daily: Three Scenarios For Payrolls And The Dollar Today

Rates Spark: If Payrolls Come In Line With Consensus, Then Forget The 50bp Cut Narrative

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more