"They've Cut It Way Back" - WTI Holds Gains After Trump Comments On Indian Imports, Record US Crude Production

Image Source: Pixabay

Oil prices are higher this morning (extending yesterday's gains) on a report the US and India are nearing a trade deal that could see the South Asian nation gradually reduce imports of Russian crude, which would boost demand for alternative supplies.

President Trump said on Oct. 21 that Indian Prime Minister Narendra Modi has agreed to scale back India’s imports of Russian oil in response to Russia’s ongoing invasion of Ukraine.

As Aldgra Fredly reports for The Epoch Times, Trump told reporters in the Oval Office that he spoke with Modi about the matter during a phone call on Tuesday. He said that their conversation primarily focused on U.S.–India trade relations.

“We just have a good relationship, and he’s not going to buy much oil from Russia. He wants to see that war end as much as I do. He wants to see the war end with Russia–Ukraine,” he said.

“And, as you know, they’re not going to be buying too much oil. So they’ve cut it way back and they’re continuing to cut it way back.”

Modi took to social media to thank Trump for his warm Diwali greetings and the phone call, but provided no details about what was discussed during their call.

“On this festival of lights, may our two great democracies continue to illuminate the world with hope and stand united against terrorism in all its forms,” Modi stated in a post on X.

Trump said last week that he had received assurances from Modi that India would stop purchasing oil from Russia.

“That’s a big stop,” he told reporters in the Oval Office during a press conference on Oct. 15.

“Now [I’ve] got to get China to do the same thing.”

Experts at the Observer Research Foundation think tank estimate that India accounts for more than one-third of Russia’s crude exports, behind China’s 50 percent share.

Meanwhile, European Union leaders are expected to greenlight a 19th Russia sanctions package at a summit on Thursday, after Slovakia dropped its objections.

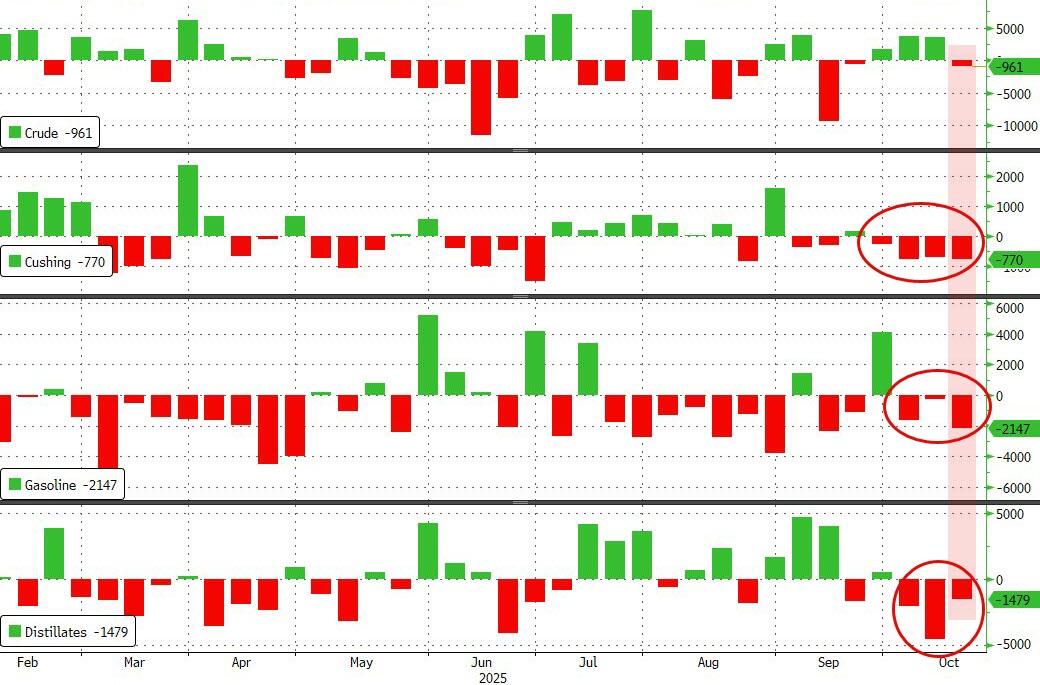

Crude inventories fell (and gasoline stocks dipped) according to a report from API overnight. Traders will now focus on the official data

API

-

Crude -2.98mm

-

Cushing

-

Gasoline -236k

-

Distillates -974k

DOE

-

Crude -961k

-

Cushing -770k

-

Gasoline -2.147mm

-

Distillates -1.479mm

Official inventory data confirmed the trend of API overnight with across-the-board drawdowns (though smaller than API). This is the 3rd straight week of drawdowns for products and at the Cushing hub...

Source: Bloomberg

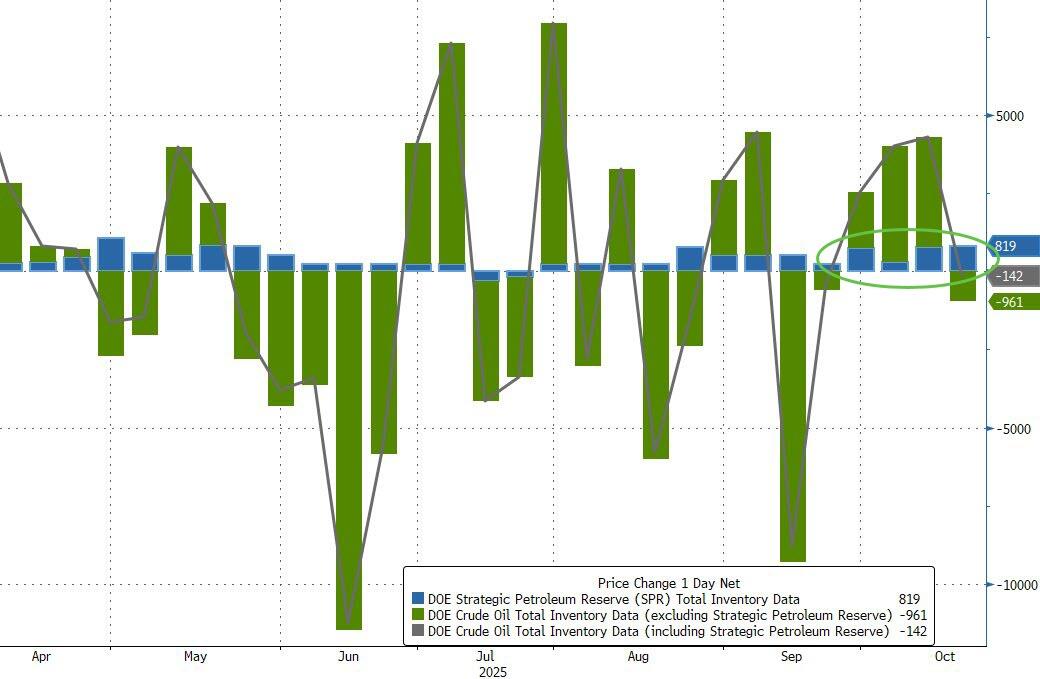

As we detailed yesterday, the Trump administration announced plans to buy 1 million barrels of crude to add to the SPR. As the chart below shows, that's not exactly 'unprecedented' as weekly additions have been around 500k barrels all year. The 819k barrel addition last week was not quite enough to offset the961k barrel decline from DOE...

Source: Bloomberg

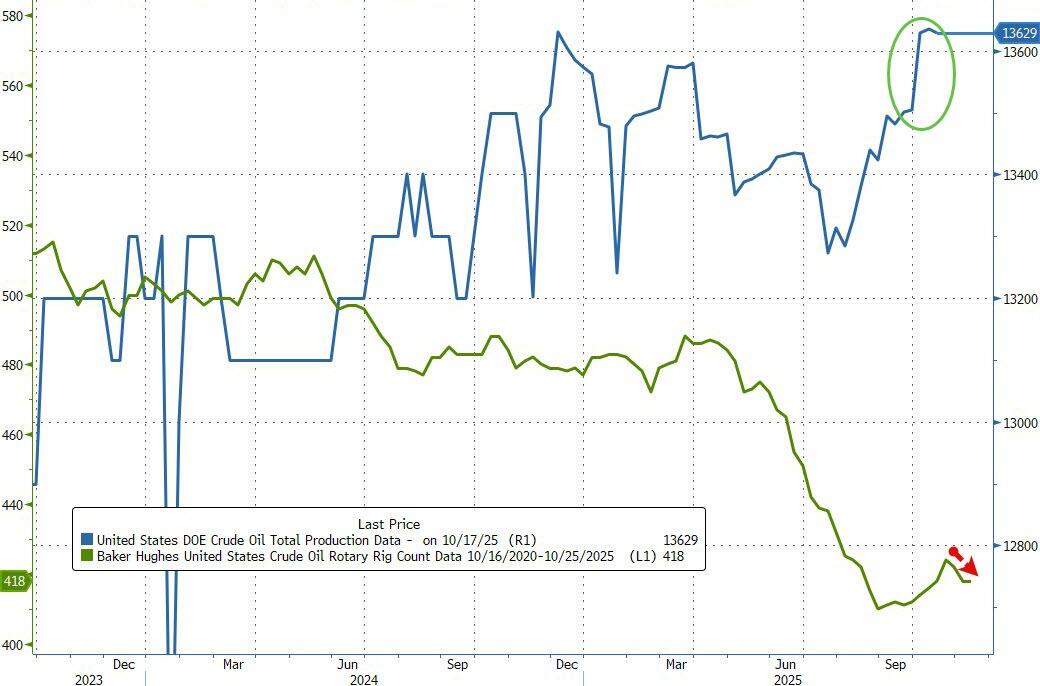

US crude production hovered near record highs (as the rig count started to decline again)...

Source: Bloomberg

WTI is holding gains for now, back above $58.50...

Bloomberg notes that oil still remains on track for a third monthly loss as signs of a global surplus put downward pressure on prices, though that’s provided an opportunity for the Trump administration to buy crude for strategic reserves.

“Traders are beginning to question the prevailing supply-glut narrative, as movements in the Brent and WTI forward curves remain far from levels that would typically reflect such an imbalance,” according to Ole Hansen, commodities strategist at Saxo Bank AS.

The premium that front-month Brent futures command over the next month’s contract, known as the prompt spread, has narrowed over the past few months but still signals tight short-term supplies in a price structure known as backwardation. That’s also true for West Texas Intermediate crude.

More By This Author:

Netflix Crashes After Musk's "Cancel" Crusade Leads To Top, Bottom Line MissChina GDP Grows At Slowest Pace In A Year Amid Crumbling Domestic Demand, Crashing Real Estate Market

Ray Dalio Explains Why Gold & Why Now...

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more