These Are The 5 Banks Most Exposed To Turkish Chaos

Despite Erdogan's ever more desperate attempts to keep the lira elevated ahead of this weekend's local elections, culminating with sending overnight TRY swap rates to an insane 1300% on Wednesday, consensus is now that after this weekend's catalyst passes things will quickly go from bad to worse for Turkey as Turkish official foreign reserves plummet, putting the nation on the verge of a liquidity (and solvency, if enough foreign investors have lost faith) crisis.

This sentiment is shared not only by locals, where government data showed a panic scramble out of lira as Turkish residents increased their their hard-currency holdings for an 11th week running, the longest streak since September 2013, to a record $179 billion, but also foreigners, with TD Securities strategist Cristian Maggio tempting fate (and Erdogan's assassination squad) overnight with a recommendation to buy USDTRY calls with a 7.9 target, predicting that "attempts to maintain lira stability ahead of local elections may ultimately prove unsustainable and USD/TRY may move significantly higher when normal conditions are restored."

In any case, the Lira has been a one way train lower ever since the Turkish Central Bank ended the idiotic experiment with crushing all foreign investor confidence by boosting swaps to mindblowing levels.

Amid the collapse in Turkish central bank reserves, the plunge in the lira and local financial assets, should a worst case scenario for Turkey materialize, questions relating to European banks exposure to Turkey have once again resurfaced as they did last summer.

Responding to these questions, and seeking to mitigate some of investor panic, overnight Goldman's Jernej Omahen writes that the most recent data suggests:

- Turkey exposure of EU banks is limited in scope and scale;

- Contagion channel via EU banks is somewhat limited

- Deteriorating outlook might incrementally add to (the already changing) strategies of European banks in Turkey as this is the second period of elevated volatility in Turkish assets within the past c. one year, the first being Q3-18;

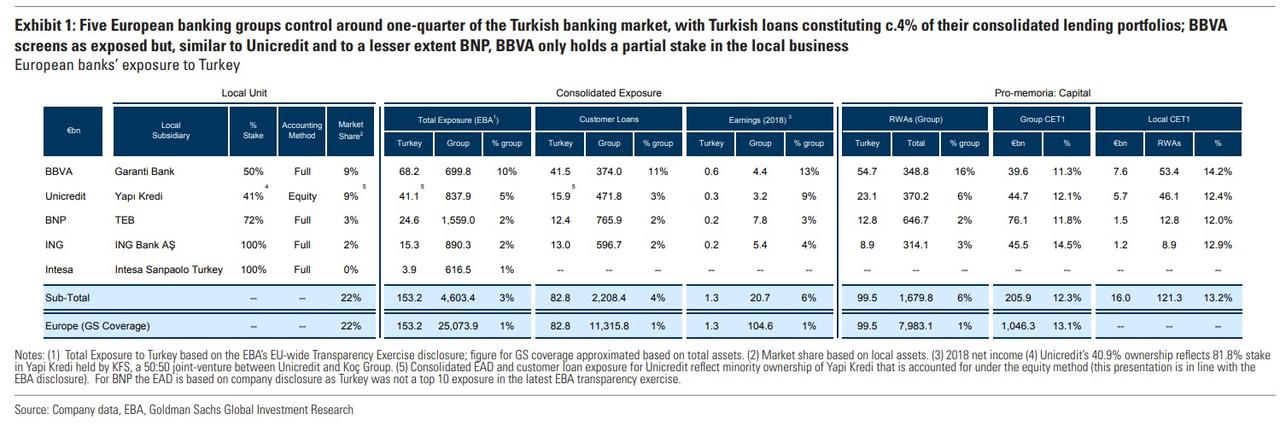

With that disclaimer in mind, Goldman claims that Turkey exposure of EU banks is "limited in scope and scale" as Turkey accounted for <1% of total EAD and c.1% of Net Profit for Goldman's EU banks coverage in 2018: of more than 50 banks under Goldman coverage, five have Turkey exposure of >1% of total EAD, with gross exposure ranging from 10% of EAD for BBVA, 5% for Unicredit to 2% or less for ING (2%), BNP (2%) and ISP (1%). Also worth noting that European banks tend not to have 100% ownership of Turkish subsidiaries, so one needs to adjust for the actual shareholding.

Here is the details from Goldman:

Within our European coverage of >50 banks, 5 groups list Turkey as a meaningful exposure according to the transparency data published by the European Banking Authority (EBA). Notably, the affected banks remain relatively well diversified; although together they control roughly one-quarter of the Turkish market, their respective Turkish exposure stands on average at c.3% of consolidated EAD. While BBVA screens as an outlier, we note that similar to Unicredit and BNP, the Spanish group only holds a partial stake in the local business. For our coverage as a whole, Turkey accounted for <1% of total EAD in 2018 and c.1% of our Net Profit for 2018.

Some more details: while Bank for International Settlements (BIS) statistics do not provide name-by-name exposures, Goldman uses it to provide context for the single-name disclosure published by the European Banking Authority (EBA) as a part of a 2018 EU-wide transparency exercise. According to the BIS data, total foreign claims of the foreign banking sector against Turkey stood at US$175bn as of the end of 3Q18 (of which Europe accounted for US$144bn), down from a peak of US$269bn at the beginning of 2016. Note that the BIS data captures private as well as public sector lending to Turkish residents as well as interbank lending.

In light of the country's intransigent executive branch, where Erdogan has already hinted he may soon push for a rate cut, Goldman concedes that Turkish economic volatility will likely maintain a spotlight on banks present in Turkey. Yet Goldman bizarrely claims that "while the EU banks control broadly a quarter of the Turkish market, the overall risk for the European sector appears small" asthe Turkish exposure is:

- small, in an absolute sector context;

- concentrated among a handful of larger banking groups; and

- represents a small fraction of these banks’ overall balance sheets - this is due to the respective Euro banks’ size, diversification and partial ownership of local units.

All in, Goldman concludes that the EU bank contagion channel is limited, however in the context of limited contagion. As a reminder, it was just last summer when Goldman calculated that beyond a certain level of the Turkish lira, the country's local banks would collapse. If and when that happens, we strongly doubt that European banks with exposure to Turkey will find their contagion to be "limited."