The Weekender: The Grand Bargain Mirage

Image Source: Unsplash

Feel-Good Friday

It was one of those Fridays that felt like a slow exhale after a few weeks of shallow breathing — a collective relief as Wall Street’s feel-good Friday instinct kicked in. Inflation came in cooler, not cold, but enough to whisper that maybe the fever is breaking. The market didn’t roar; it purred. Traders, half-blind after a month of navigating in the dark, finally got a signal and didn’t blink red. And like weary sailors spotting land, they pushed risk higher — cautiously at first, then with something close to conviction.

The S&P 500 climbed to new highs, pressing past the psychological 6,800 mark, while Treasury yields softened as if bowing to the data. The CPI print — just 0.2% month-on-month, 3% year-on-year — was the market’s love letter to the Fed: proof that inflation’s grip is loosening, even if only finger by finger. In a world starved for good news, that was enough.

For traders, this wasn’t just about price levels; it was about tone. The Fed’s path has shifted to “how far.” The October cut is already inked into the curve — swaps markets all but guarantee it — but now the chatter has moved to December and beyond. The conversation isn’t whether Powell cuts, but when he stops cutting. And lurking in the background, the bigger question: how much longer can the Fed drain liquidity before the pipes rattle again?

That’s where the subtext matters. For weeks, repo desks have whispered that quantitative tightening is at its limit. Reserves are near the floor, and the once-mighty Reverse Repo Facility — the Fed’s shock absorber — has thinned to a puddle. You can feel it in the funding markets: the subtle stiffness in overnight rates, the tell-tale hum of stress. Even hawks can hear it. Powell can too. Ending QT early isn’t policy capitulation — it’s plumbing maintenance.

This is what traders understand instinctively: monetary cycles don’t pivot in a single meeting; they bleed across the tape like watercolour. And this week’s CPI was the first stroke of a new palette — softer hues, looser brushwork, less fear of shadow. The Fed now plays the role of careful gardener rather than fireman. The risk isn’t overheating anymore; it’s pruning too slowly and stunting the bloom.

Of course, the skeptics are still out there. Some argue this rally is more sugar rush than structural re-pricing — that valuations are stretched, that the bull has become too comfortable in its own reflection. Maybe so. But liquidity always finds an excuse to run downhill, and right now it’s flowing toward equities. With corporate earnings still humming, the labour market merely softening rather than breaking, and inflation tame enough to justify policy ease, risk assets have no immediate reason to surrender.

The real story isn’t about inflation cooling; it’s about fear cooling. It’s the storm that never made landfall — thunder on the radar, but barely a drizzle on the ground. Traders had braced for October’s seasonal impact, hedges raised like seawalls, only to watch the pressure system dissipate into nothing. That absence of panic — the inflation surge that never arrived — has forced bears to unwind, fueling the slow, grinding squeeze that only gathers strength in still air. Markets climb most stubbornly when nobody believes they should.

And yet, beneath the optimism, the traders’ realism remains: this is a tactical rally inside a structural slowdown. The Fed’s easing isn’t stimulus, it’s stabilization — an insurance cut, not a celebration. The economy isn’t sprinting; it’s pacing itself, lungs heavy but steady. That nuance — the difference between easing because you can and easing because you must — is what defines the next leg.

For now, the tape reads almost dreamlike. The dollar wavers, yields soften, equities melt higher. The “good news on a Friday” refrain carries across desks. But every trader knows euphoria wears thin. Momentum can masquerade as confidence until the next data point breaks rhythm.

Still, the market dances — not wildly, but with deliberate grace. The bull, once battered and wary, lifts its head again, horns catching the late-October light. The traders don’t call it victory; they call it breathing room. And in a world where every whisper from the Fed can rewrite the script, that alone feels like fortune.

The Year-End Melt-Up Machine

You can almost feel it—the hum of the year-end liquidity engines warming up, the familiar rotation of risk appetites turning back on. What began as a grind through uncertainty is starting to resemble a seasonal migration of capital: the retail crowd marching back into equities with the same enthusiasm that drove the February 2021 meme fever. Retail flow has become a price-setter again, dictating tone and tempo while institutions still sit in the bleachers, waiting for a “better entry” that may never come.

You can see it most vividly in the options tape. The call-buying frenzy is outright manic—charts of retail flow look like heart-rate monitors at full sprint. It’s the kind of conviction that tells you sentiment has flipped from cautious curiosity to full-blown participation. Retail traders are buying dips with both hands, front-running the calendar’s most forgiving stretch for equities. The best seasonal window of the year starts next week, and history says you don’t fade this one unless you enjoy standing in front of a snowplow.

Meanwhile, corporate America is about to step back into the buyback lane. The blackout period ends, and the machines that hoover up supply will start purring again—incremental demand at a time when institutional positioning remains clinically underweight. Hedge funds have de-grossed, factor books have twisted, and discretionary managers are still too light to chase if the tape accelerates. That’s the irony: everyone knows the setup, but few are actually long enough to enjoy it.

Last week, CTAs never delivered their “flush.” Systematic supply that might have broken trendlines failed to materialize. Technical support held, volatility spiked briefly, then cooled—a perfect reset. November often marks that quiet slide lower in vol, where risk premia compress and equities melt higher almost in embarrassment.

Add to that the Super Bowl of earnings next week—forty percent of the S&P’s market cap, including five of the Magnificent Seven, all dropping results into a week that also marks mutual fund fiscal year-end repositioning—and you get the sense that the powder keg is dry but the fuse is lit.

Institutions remain the only wall of worry left to climb. Their caution is our kindling. Performance chasers are rediscovering their appetite for high beta, cyclicals, and anything that still has torque. And if history is any guide, positive equity years have a bad habit of finishing even stronger.

So as the calendar turns toward the holiday stretch, this market feels like it’s loading the slingshot—tight vol, under-ownership, buybacks returning, retail back in charge. Everyone knows the setup, but as always, few will have the nerve to ride it through the final sprint.

The Grand Bargain Mirage

For the past fortnight, traders between espresso shots and strategy huddles have been chewing on one question — will Trump and Xi really meet in Seoul and tie the knot, or is this just another act in their long-running political play?

The setup feels familiar: two alpha players circling the same table, each convinced the other blinks first. Trump says they’ll “make a deal on everything,” which sounds less like diplomacy and more like a poker bluff shouted across the felt. Xi, for his part, will arrive with the stoic patience of a man who knows the West always runs on shorter election cycles and thinner nerves. And while the APEC sidelines are supposed to provide neutral ground, there’s nothing neutral about what’s in play — fentanyl, soybeans, Ukraine, chips, and the rare earths that literally keep modern industry spinning. That’s not a conversation; it’s a geopolitical chessboard disguised as a dinner menu.

The reality is that both economies have stopped pretending this is about reconciliation. The relationship is being rewired, quietly but deliberately. In Beijing, the latest Party plenum made it official — China is doubling down on self-reliance, putting faith in foundries and fabs instead of the fragile promise of global cooperation. Xi’s corruption purge has left empty seats in the Central Committee, but the absences only highlight who’s still standing: loyalists willing to bet the next decade on domestic tech sovereignty.

Meanwhile, Washington is drawing its own battle lines in minerals and machinery. The Trump-Albanese pact this week reads like a resource alliance from another century — two industrial democracies building a moat of rare earths to keep Beijing’s leverage at bay. Over a billion dollars will flow into Australian mines and processing plants, a modern Manhattan Project for critical materials. It’s not subtle: when a Treasury Secretary describes China’s new export rules as a “bazooka aimed at the free world’s supply chains,” you know this isn’t about tariffs anymore — it’s about control of the periodic table.

So even if Trump and Xi do shake hands, what happens after the photo op? The polite communiqués will speak of “constructive dialogue” and “mutual respect,” but under the surface, both sides are tightening their own bolts. The U.S. is prepping software export curbs that could carve into China’s digital spine, while Beijing is mapping new corridors of resilience — chips, robotics, and AI factories designed to live outside the reach of Western sanctions. It’s decoupling with better manners.

Traders see it for what it is: a slow-motion divorce disguised as a family reunion. The dollar barely twitches, Asian equities lift out of muscle memory, and every portfolio manager knows this dance by heart — buy the rumor, hedge the peace, sell the disappointment. Because when the world’s two largest economies call a truce these days, it’s less a peace treaty and more a ceasefire between machines still loading their next round.

The market, ever the romantic, will keep believing in a “grand bargain” right up until the screens remind it that this marriage was never about love — it was about leverage.

China’s Quiet Reckoning: The Long March Toward Balance

Every few years, Beijing releases one of those communiqués that lands with the weight of an oracle’s whisper — dense, formal, and deceptively restrained. The Fourth Plenary Session’s latest script reads no differently. But beneath the calligraphy and caution, there’s a subtle shift — not in slogans, but in self-awareness. The Party has begun to look itself in the mirror, and that’s no small thing.

What struck me most wasn’t what was said — “high-quality development,” “technological self-reliance,” “common prosperity” — we’ve heard those refrains since the 14th Plan. What mattered was the tone. It carried less triumphalism, more pragmatism. A government that once thundered about outpacing the West now speaks of eliminating “bottlenecks,” widening “open doors,” and admitting, almost humbly, that rebalancing a vast, investment-heavy machine toward consumption will take time.

China’s planners have long viewed their economy like a bonsai — pruned and shaped to fit the Party’s aesthetic of control. But years of overwatering infrastructure and starving household demand have left the roots uneven. Now, at last, there’s recognition that you can’t build a “modern industrial system” without healthy soil — meaning higher wages, steadier jobs, and consumers confident enough to spend rather than hoard.

There’s also a sense that the leadership has accepted a world it can’t fully choreograph. Phrases like “seek to share opportunities” and “achieve common development with the rest of the world” aren’t diplomatic niceties — they’re quiet acknowledgments that isolation, whether self-imposed or externally enforced, isn’t a viable growth model. In trade, as in diplomacy, walls rarely generate wealth.

And yet, the communiqué’s silences are as revealing as its words. Notably absent is any fresh remedy for the property malaise still hanging over local economies like smog over a winter skyline. For all the talk of stabilizing employment and refining income distribution, the reality remains that housing — once the great multiplier of confidence and collateral — continues to wilt. The Party seems unwilling to rescue it outright, perhaps fearing moral hazard, or perhaps simply out of ammunition. Either way, this omission speaks volumes.

The call to “eliminate local protectionism” offers a glimmer of genuine reform. If acted upon, it could dissolve some of the bureaucratic sludge that gums up China’s internal markets — that subtle form of self-sabotage where provincial fiefdoms guard their turf at the expense of national efficiency. True unification of the domestic market would be revolutionary, not rhetorical.

Even the military emphasis, while unsurprising, feels part of the same larger rhythm — a recognition that the external landscape is no longer permissive. China’s long-term ambition to reach “mid-level developed” status by 2035 will play out not on a global stage of cooperation but on one of strategic friction. Hence, the insistence on technological independence, the “modern industrial system,” the drive for self-reliance — these are not vanity projects; they’re survival instincts.

Still, the most telling line isn’t about machinery or missiles — it’s the implicit admission that China’s growth model is creaking under its own contradictions. “New demand drives new supply” — a simple phrase, but a radical inversion of the old command economy reflex that supply creates its own demand. It suggests Beijing understands that future prosperity won’t come from more steel and cement, but from confidence and consumption.

This was not a communiqué meant to dazzle investors or soothe foreign critics. It was more of an internal memo to a nation at a crossroads — a subtle confession that the old playbook has reached its limit. There’s humility in that, and even a touch of optimism. For the first time in years, the Party seems willing to admit that the path forward begins not with more control, but with letting parts of the system breathe.

In markets, that kind of recognition — the acceptance of constraint — often marks the bottom of a cycle. China may not be there yet, but at least it has stopped pretending the pain doesn’t exist. The first step to solving a problem is acknowledging it, and in the understated cadence of this Plenum, you could almost hear the sound of that realization breaking through the marble halls.

When the Dragon Dreamed in Silicon

China’s great innovation story was never supposed to end quietly — it merely went dormant, buried under years of policy tightening, global suspicion, and investor fatigue. But beneath the dust, something was still humming. The world had been watching Silicon Valley mint trillion-dollar legends while assuming China’s tech pulse had flatlined. In truth, it was just re-routing — shifting from imitation to invention, from export dependency to internal genius.

Now, that hum has turned into a low mechanical roar. The country’s tech complex — once the cautionary tale of regulation gone wild — is finding rhythm again. HSTECH, that battered proxy for ambition, is starting to climb with intent. Not in bursts of speculative fever, but in disciplined steps — the kind that hint at rediscovered belief rather than random luck. There’s a quiet conviction returning to the market — the sense that innovation has a state sponsor again, and that the oxygen of policy support is flowing back into the system.

UBS (UBS), never one for hyperbole, has called Chinese tech its most attractive global equity idea — not out of nostalgia, but out of math. A 37% earnings growth forecast by 2026 — the fastest of any major sector worldwide — supported by three sturdy pillars: innovation, policy alignment, and localization. The playbook echoes the early FAANG years, though this time the script is written in Mandarin. Valuations near 20x forward earnings look almost vintage next to America’s stretched multiples, and that valuation gap alone could become the gravity field that pulls global allocators back toward Shanghai and Shenzhen.

AI, naturally, is the accelerant. The same capital-expenditure supercycle that re-wired the U.S. tech market is now unfolding across China’s industrial parks and research labs. Every data-center ground-break, every chip fabrication line is a declaration of autonomy. Beijing isn’t chasing the Valley; it’s building its own circuitry of destiny.

Cambricon — the quiet chipmaker once left for dead — is now brushing against its all-time highs, its chart echoing Nvidia’s (NVDA) early ascent. Few talk about it, but the price tape does. You can’t spell “China” without “AI,” and this time the acronym stands for something far deeper than algorithms — it’s about Ambition Institutionalized.

The STAR 50, China’s innovation index, has just thrown off its longest shadow, printing its largest up-candle in weeks — a sign that domestic money is inching back into the arena. Margin debt remains near record highs, not as a sign of recklessness, but of readiness. The retail crowd still hasn’t gone euphoric, suggesting this rally isn’t mania; it’s momentum rediscovered.

Meanwhile, global fund allocations to China hover near record lows — the perfect contrarian seedbed. Foreign investors still trade ghosts of past policy shocks while the ground reality is shifting under their feet. When that perception gap closes, it won’t be rotation; it will be re-pricing.

This is what a slow-burn renaissance feels like — not a fireworks display, but a reawakening. Innovation, policy, and purpose are beginning to march in step again. The Western narrative may still cast China’s tech as a caged dragon, but anyone listening closely can hear it breathing heavier by the day.

The innovation bull is no longer sleeping — it’s dreaming in silicon.

Chart of The Week

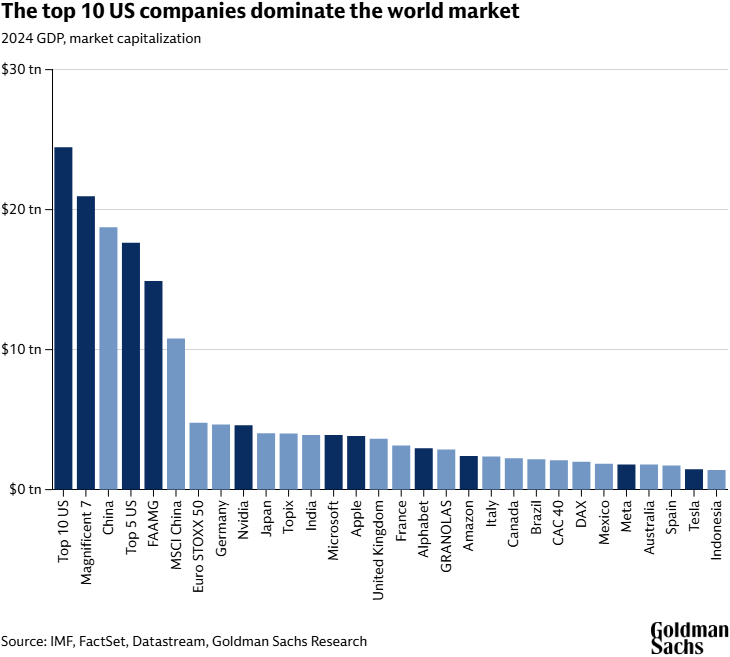

Why Stocks Are Not Yet in a Bubble

Global equities, and especially technology stocks, show early signs associated with financial bubbles. But core differences set the current cycle apart from past episodes, writes Peter Oppenheimer, Goldman Sachs Research’s chief global equity strategist.

-

The market’s gains reflect sound fundamentals rather than rampant speculation or unsustainable leverage. Surging valuations for firms involved in AI and technology have largely arisen from the robust performance of established firms, not shaky startups.

-

Although market concentration is high, it’s not unprecedented. Similar cycles of industry dominance in finance or energy lasted for decades without necessarily culminating in crisis. In addition, most capital expenditures in tech are now financed internally rather than fueled by debt. This means financial leverage remains contained, limiting systemic risk even if sector corrections occur.

“On balance, valuations are looking increasingly stretched but not yet at the levels that were typical in other bubble periods before they burst,” writes Oppenheimer in his team’s report. “The biggest risk is that earnings disappoint and investors start to question the sustainability of their current rates of return.”

Running Update – October Grind

It’s been an October to forget. Coming off that hamstring injury, I ran straight into what I call the old car syndrome — fix one part, and another starts creaking. The hamstring finally eased up, only for the right flank to pull while I was lifting a box too fast. A non-running injury of all things — classic.

Still, it hasn’t kept me off the road. I’m managing three runs a week, though they’re shorter and more controlled than I’d like. No speed work, no long tempos — just getting out there, keeping the rhythm alive. That’s running in a nutshell: constant negotiation with adversity. Every runner knows it — the body never gives you a free pass for long.

Heading into the November–December window, things get busier — meetups with friends, travel plans, the usual holiday chaos — so it’s about making the best of every window that opens. The right flank is still tender, but improving bit by bit, and the Zone 2 runs don’t seem to aggravate it.

For now, it’s just about staying in motion, keeping the streak intact, and trusting the process to carry me through to stronger days ahead.

More By This Author:

The Yo-Yo Tape Keeps Its Bounce

When The Momentum Music Stopped

Risk Finds Its Rhythm "Everything Is Bid "