The Weekender: Out Of The Deficit Frying Pan, Back Into The Tariff Fire

Image Source: Pexels

The Never-Ending Tariff Carousel

The tariff carousel just cranked back into overdrive, and markets—lulled into a false sense of calm—snapped back to attention. President Trump dropped twin hammer blows on Friday, threatening a 50% tariff on European Union imports and signaling that iPhones assembled outside U.S. borders—particularly in India—could face punitive levies. Apple got the first slap, sliding over 2%, but the broader message hit like a warning shot across the bow of global commerce: no corporate crown jewel or allied bloc is immune in this new iteration of trade brinkmanship.

The initial reaction was textbook risk-off, but what followed told a deeper story. U.S. and European equities sold off, though not in panic mode. It was the creeping discomfort in rates and FX markets that spoke volumes. Treasuries reversed earlier weakness, with 10-year yields sinking back to 4.51% and 30-year yields retreating below 5.04%, a stark turn from the fever-pitch selling triggered by the House’s razor-thin passage of Trump’s tax-and-spend bill. Gold surged over 2%, while haven currencies—yen and Swiss franc—squeezed higher, even the euro rallied, counterintuitively. This isn’t your grandfather’s flight-to-quality—this is a recalibration of risk premia across the board.

After a week dominated by fears over the U.S. fiscal trajectory—courtesy of a CBO-scored $500 billion annual deficit injection for the next four years—the market barely had time to digest the long-term damage before Trump reignited the trade war. We went from deficit-fueled bond vigilante reawakening to stagflation-lite hedging in under 72 hours. And the clearest signal wasn’t even in yields—it was in the sell America unison: stocks tanked, the dollar sagged, and safe havens went rogue as risk smouldered with intent.

If Banff was supposed to be a forum for clarity, it ended in a whimper. Finance chiefs from the world’s most powerful economies issued a joint statement so sanitized it could have been written in advance by AI. The word “trade” appeared once; “tariffs,” not at all. The communique’s talk of “balanced macro policy” and “declining uncertainty” read like satire in the face of mounting evidence that economic fracture lines are widening, not healing. EU officials reportedly pushed hard for stronger language but ran into the same American wall that now seems to prefer tariffs as diplomacy by other means.

Meanwhile, Trump’s public comments poured accelerant on the fire. He wasn’t looking for a deal, he said, and signaled further escalation if Europe didn’t play ball. Apple was just the beginning. Samsung, other handset makers, and likely pharma firms are all potentially in the crosshairs. Markets know the playbook by now: threats first, then selective walk-backs, but the lingering damage is cumulative. The U.S. is constructing a tariff scaffold around its own economy—and the world is watching whether it’s scaffolding for renovation or a gallows for the dollar’s credibility.

What’s different this time is the absence of a counterweight. During Trump 1.0, fiscal firepower helped mask the underlying structural drift. That baton was then passed to Biden—COVID stimulus checks, infrastructure pledges, and the CHIPS Act all gave political cover for an increasingly aggressive trade stance. But now, the U.S. is heading back to the tariff well while piling on trillions in new deficits—without the growth bang to offset the fiscal buck. In contrast, Europe is quietly teeing up real stimulus. Germany, once the poster child for budgetary belt-tightening, is now ramping up fiscal support that’s set to bite in 2026. And while investors are scrutinizing every dime spent in Washington, they’re barely flinching over debt sustainability across the Rhine.

That divergence is showing up everywhere. Eurozone balance of payments data shows massive repatriation of foreign equities back into euro assets—nearly €40 billion in March alone. The euro, increasingly, is the only viable liquid alternative to a dollar that looks overvalued, overleveraged, and overexposed to political risk. Meanwhile, in Asia, the yen is regaining relevance as rising inflation and hawkish signals from the BoJ put a July rate hike firmly on the table. Japanese core CPI just hit its fastest pace in two years, and Tokyo long-end yields are melting up, dragging global curves with them.

Still, nothing screamed “fragile equilibrium” louder than the markets’ behaviour on Friday. The backdrop is one of extreme asymmetry—markets are navigating blindfolded through a minefield where the next detonation could come from tariffs, deficits, central bank missteps, or geopolitical drift. And in this environment, every whisper matters.

Memorial Day offers a temporary reprieve—markets are closed Monday—but the narrative doesn’t take a holiday. The U.S. appears determined to go it alone, walling itself off with trade barriers, while the rest of the world tentatively sketches out new alignments. What happens if America's allies decide that a world without U.S. hegemony isn't so scary after all? We’ve seen it before: Japan revived the TPP, the EU built the MPIA, and multilateralism adapted. If this keeps up, the next global order won’t just function without the U.S.—it might thrive without it.

And that’s the real risk. Not just a tariff here, or a tech sector shiver there—but a systemic shift where the U.S. becomes the periphery of a world that no longer defaults to its rules. The fear isn’t just inflation or rates or trade—it’s irrelevance. And for markets, that’s the one risk you can’t hedge.

Banana Peel Economics: The Dollar Slips on Its Own Twin Deficits

The greenback just slipped on a banana peel of its own making. Fresh tariff salvos from the White House and a deficit gushing wider than the Mississippi have knocked the Bloomberg Dollar Spot Index to depths last seen in 2023—down another 0.8% on Friday and more than 7% on the year. Hedge funds smell blood: CFTC data show they’re still stacked net-short, wagering that America’s reserve-currency halo is starting to flicker.

Trump’s threat to slap a 50% levy on EU imports—and drag Apple’s offshore iPhone supply chain onto the scaffold—has traders re-pricing everything from recession odds to risk premia. The result? A broad G10 stampede higher. Kiwi and Aussie dollars vaulted over 1%; Canada’s loonie clawed back to seven-month highs. And as has been par for the course this year, traditional safe havens like the yen and Swiss franc flexed as capital tiptoed out of U.S. assets.

Treasury Secretary Scott Bessent tried damage control on Friday’s airwaves, hinting at “big” trade deals in the pipeline and brushing off talk of a weak-dollar doctrine. Markets weren’t buying it. Each pledge from Washington now lands like a lifeline cast from a listing ship: too little, too late, and fraying at the seams.

Layer in Senate wrangling over a tax-and-spend bill that could stuff hundreds of billions more into the deficit while bumping the debt ceiling right up against a late-summer deadline, and you’ve got the makings of a full-blown credibility squeeze. The “U.S. exceptionalism” premium—once the envy of every central banker—now looks more like a brittle shell. Budget angst, sticky inflation, spluttering growth: every crack widens the fault line under the dollar. Until Washington swaps brinkmanship for balance sheets, expect the world’s reserve currency to keep shedding feathers while the rest of the FX land learns to fly without it.

Chart of the Week

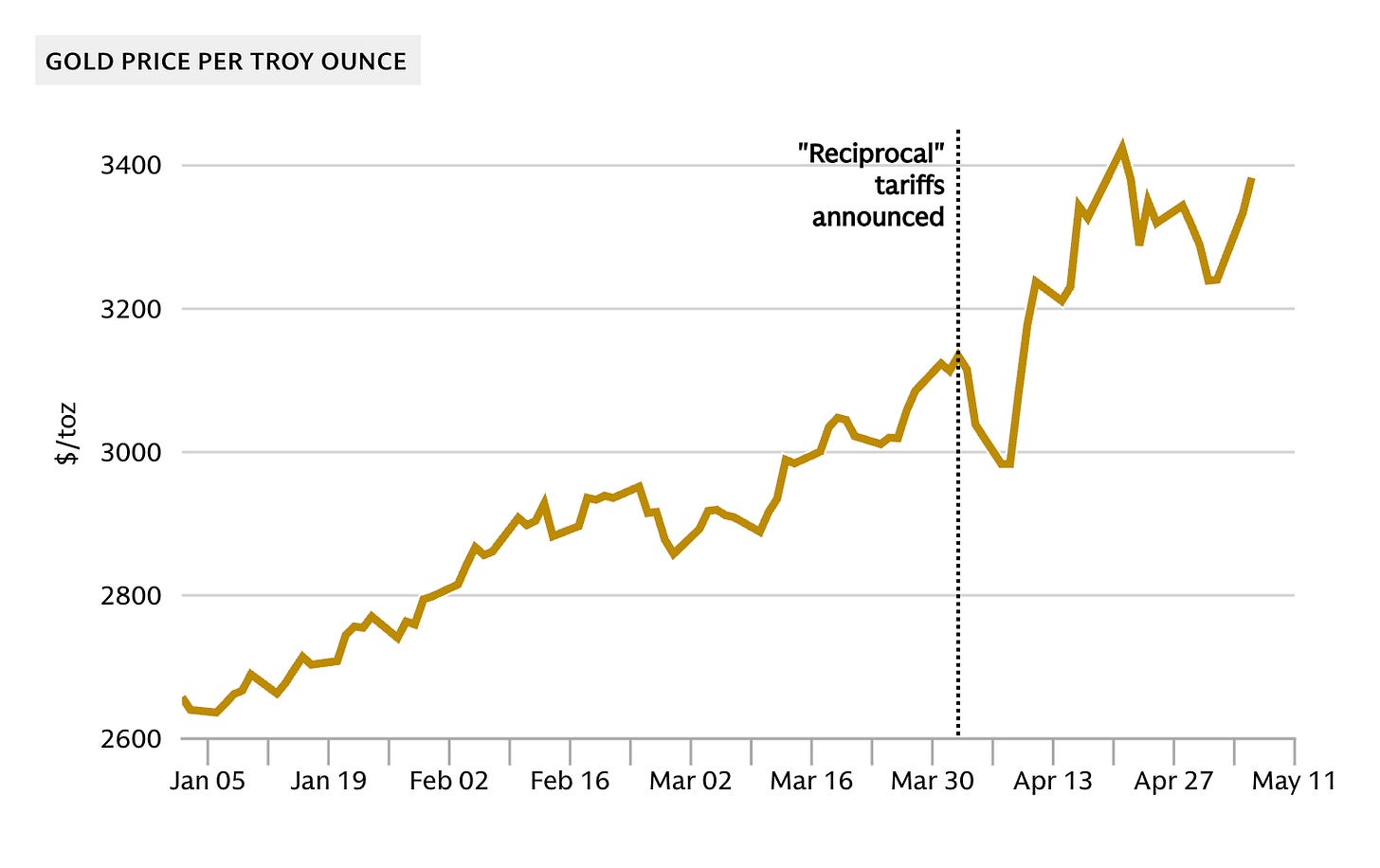

Gold isn’t just shining—it’s on a tear. With prices hovering around $3,356 as of May 23, the metal has smashed through record after record over the past year, and the rally shows no signs of slowing. Consensus forecasts now peg gold climbing to $3,700 per troy ounce by the end of 2025, driven by a powerful combination of renewed investor appetite and a deep structural shift in demand from central banks.

This year’s move higher has been anything but technical. Tariff tremors from the Trump administration have sent fresh waves of uncertainty across global markets, prompting investors to rotate into hard assets. Since March, gold holdings have surged as buyers seek a hedge against policy risk, fiscal erosion, and economic slowdown.

But this isn’t just another knee-jerk safe haven bid. Central banks are building long-term positions, diversifying reserves in a way that suggests gold is evolving into a foundational pillar of sovereign strategy. Layer in rising market volatility and creeping distrust in fiat regimes, and gold’s ascent looks less like a trade—and more like a regime shift.

Gold is the market’s favorite parking spot when visibility disappears. Whenever uncertainty spikes—whether it’s geopolitical tension, fiscal chaos, or central bank whiplash—traders like me instinctively rotate into gold. It’s not about yield or momentum at that point, it’s about safety. But as soon as clarity returns and the path forward becomes obvious, we pull that money out and redeploy it into something with directional upside—equities, bonds, commodities, whatever fits the macro.

What’s interesting this time around is that the so-called “temporary parking” in gold feels a lot stickier. Central banks aren’t just hedging—they’re building strategic positions. So while I still use gold as a volatility hedge in my playbook, I’m starting to view the demand base as far more durable. That shifts the game.

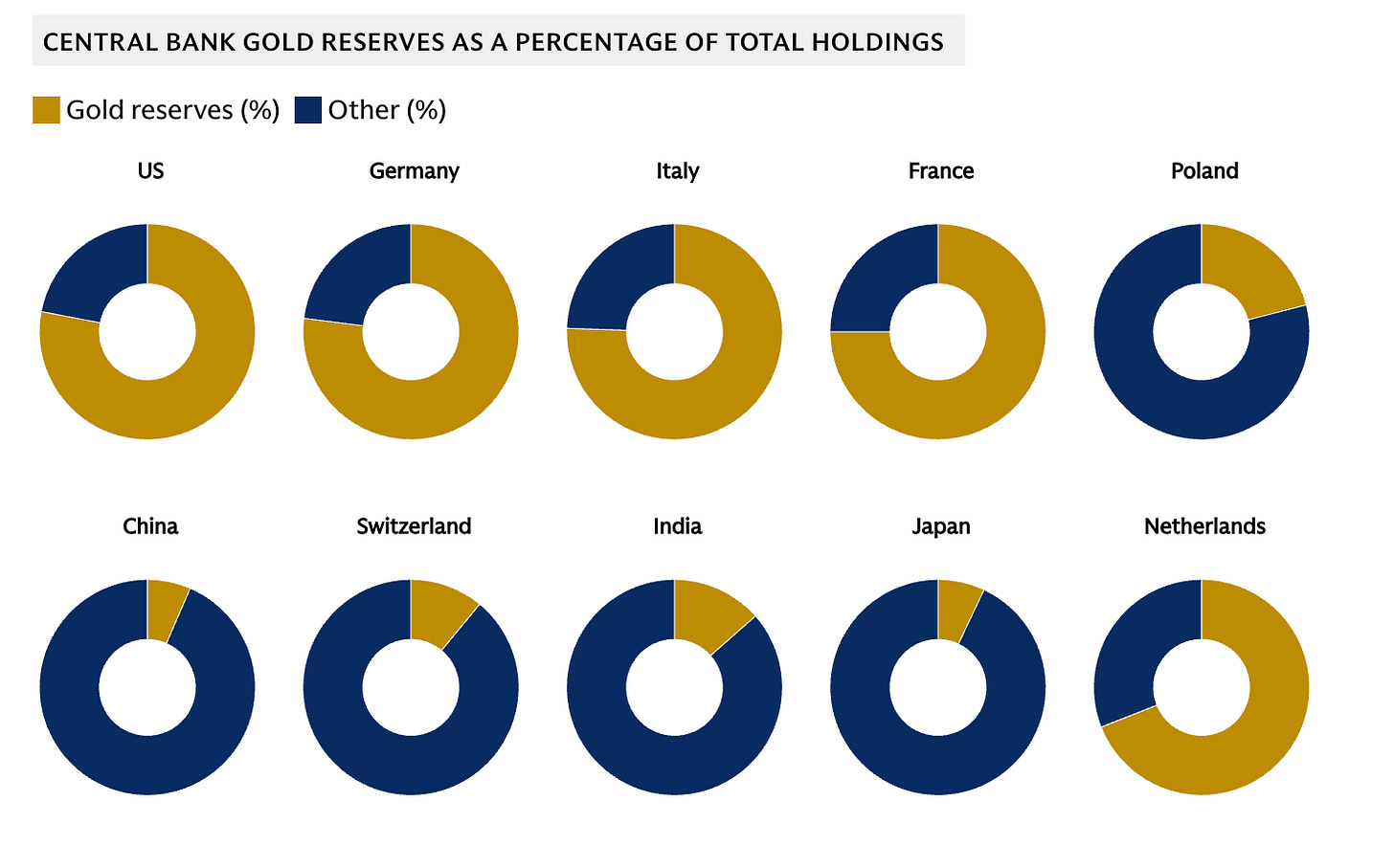

A big tell is what emerging market central banks are doing—and it’s clear they’re playing catch-up. Unlike developed economies that already have a hefty chunk of their reserves in gold (we’re talking 70% or more for the U.S., Germany, France, and Italy), many EM central banks are still underweight. Take China, for example—less than 10% of its reserves are in gold. That gap isn’t just a statistic; it’s a structural driver for long-term gold demand.

It makes sense when you zoom out. Developed nations inherited their gold stacks from the old gold standard days, when money supply was literally tied to bullion. That legacy still echoes in reserve portfolios. Emerging markets didn’t have that same historical anchor—but with the global monetary system looking shakier and fiat trust thinning, they’re now rebalancing toward gold as a hedge, a store of value, and, increasingly, a form of geopolitical insurance.

More By This Author:

Equities Flicker, Then Fade—The Fiscal Fire’s Still Smouldering

Yields Surge, Stocks Crack, Dollar Falters As Treasury Buyers Step Back

Wall Street Sours, Tokyo Trembles — Bond Vigilantes Call The Shots