The Weekender: Election Speed Bumps Ahead

Image Source: Pexels

MARKETS

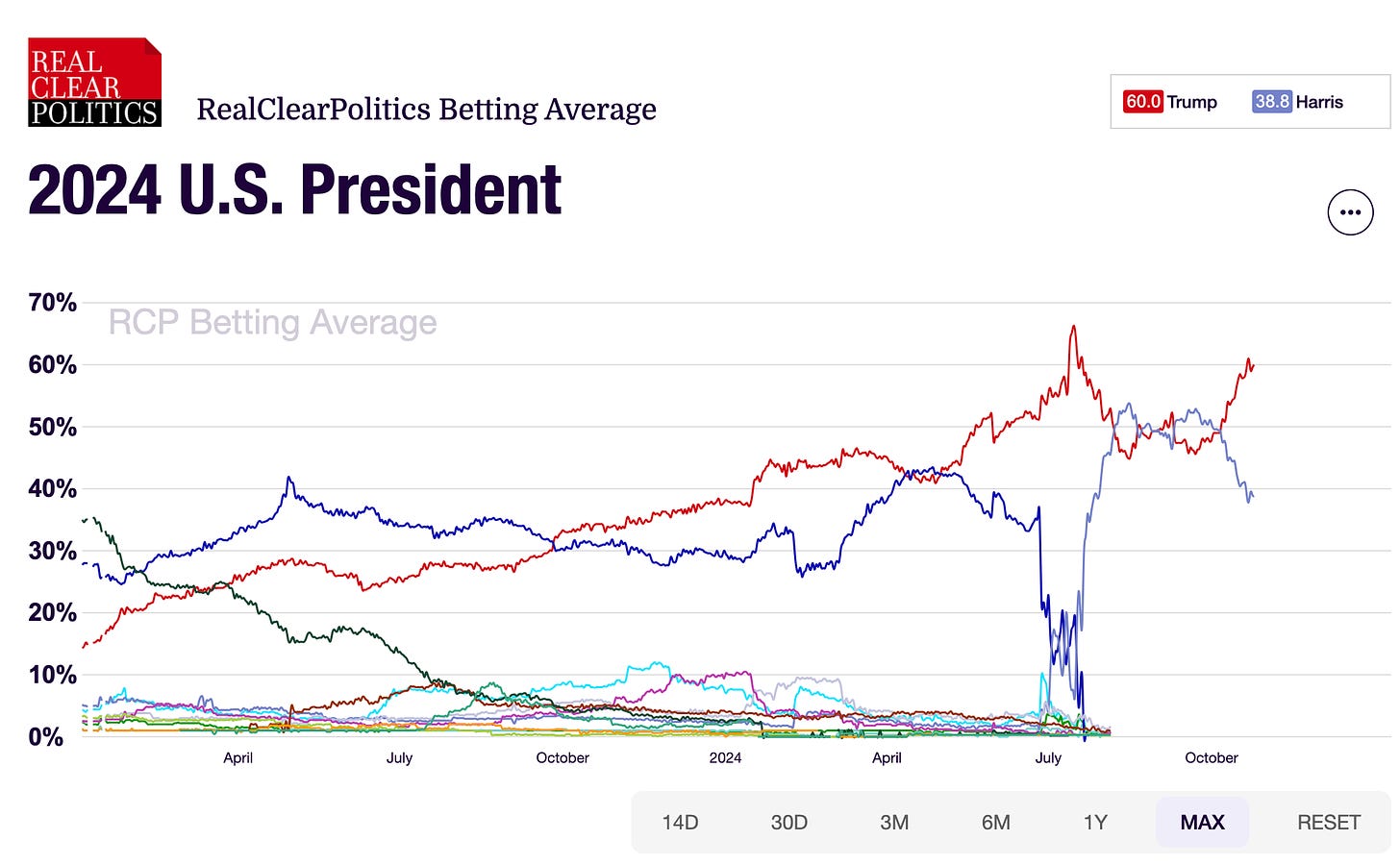

The rally in U.S. stocks is hitting a speed bump as we head into a series of high-stakes events, including blockbuster tech earnings, a much-anticipated jobs report, and—cue the drumroll—the roaring U.S. election. With Trump pulling ahead in both the betting markets and “Blue Wall” state polls, the market mood is anything but calm.

The S&P 500, up a hefty 22% this year, seems to be catching a whiff of exhaustion, pulling back from record highs. With stocks priced to perfection, the real tension lies in the relentless surge in U.S. yields as traders brace for a potentially inflation-fueling Trump presidency. Should the “Blue Wall” polls hold and he clinches victory in November, fresh tariffs on imports could stoke inflation—and yields—higher still.

Yet, while this might be unsettling for much of the market, the mega-cap AI “hyperscalers”—think Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Meta (META)—seem better equipped to handle it. Sitting on cash reserves that could make a central banker blush, they’ve locked in long-term financing at bargain rates. According to BofA Global Research, these tech giants are set to boost capital expenditures by a whopping 40% this year, while capex for the rest of the S&P 500 is expected to dip 1% in 2024. Their balance sheets, which are heavily long cash, even welcome higher rates, insulating them from the broader market's yield sensitivity.

Despite this insulation, pre-election jitters could trigger some de-risking next week, especially among investors hoping for aggressive Fed cuts to keep the broader indexes elevated in 2025.

When hiring traders, I always had one rule: leave politics at the door to keep judgment clear. This year’s “dead heat” narrative in the media often gives investors a skewed sense of binary, high-risk outcomes on both sides, but here’s the kicker: the main tail risk lies in a Trump loss. If history is any guide—looking back at 2016 and 2020—tight polling should tilt toward Trump on election night, even when pre-election polls suggest otherwise. If he does win, though, we could see a classic “sell the news” reaction if the “Trump trade” has already run hot. Headlines love the simplicity of “Trump bad, Harris good,” but that framing does little to give investors a balanced view of the actual stakes.

Here is a composite of all the betting polls.

Even the Tesla (TSLA) news got relegated to the small print once the headlines turned to Elon’s political leanings, given his apparent backing of Trump. Bloomberg’s front page trumpeted “Elon Musk’s Wealth Soars $34 Billion as Tesla Comes Roaring Back,” yet there’s hardly a mention of how the rest of us—everyday shareholders—have done quite nicely holding Tesla too. It’s almost like the focus is less on the company’s performance and more on, well, a click-worthy billionaire narrative.

Sure, Musk’s wallet may have ballooned, but that’s the name of the game: it happens when you founded one of the world’s most electrifying companies, and remember when everyone laughed at him? Now, he is taking the Thunderbirds concept from “Supermarionation" to real life.

The bottom line for next week? Investors should brace for volatility in the lead-up to the election. Good economic news may only fuel the fire, as market sentiment remains vulnerable to pre-election surprises or “truth bombs” from corporate earnings and the jobs report as Nov. 5 inches closer. In the end, buckle up—things are about to get interesting.

Volatility and liquidity challenges mean investors risk having to exit positions when the market’s thin, resulting in potentially sharp price impacts and, consequently, higher potential losses. To compensate for this, you need to look for traders that will provide easy and higher returns as compensation for taking on the risk of adverse price movement during an exit. Hence, I suggested selling the EURUSD at the market yesterday at 1.0830 instead of buying USDJPY 152 ( if you missed buying ahead of the 200 DMA at 151.40). The Euro has a lower volatility profile and is more comfortable handling exit strategies next week.

FOREX

The US dollar has surged to its highest level since August, riding a wave of robust economic data, less aggressive Fed cuts and increasing bets that Donald Trump’s odds in the upcoming presidential election are rising. The dollar index has jumped nearly 4% since late September, spurred by standout US jobs data that led investors to temper their expectations for aggressive Federal Reserve rate cuts.

Frankly, this week’s dollar surge is mainly due to increased odds on a Trump comeback, which has been the real fuel behind the rally. Just look back: we were sitting at 149.25 USDJPY on Monday when the Trump betting odds lit the fuse. (That was the trade of the week.)

Markets are eyeing Trump’s potential tariff-heavy trade agenda, which, if implemented, could drive inflation higher and keep interest rates elevated. With Election Day fast approaching, the Trump-driven “dollar rally” may still have room to run.

I might be among the world's least successful CAD traders as a Canadian to boot !!. I’ve somehow managed to nail the Reuters daily range in the opposite direction—buying at the peak and selling at the bottom during a similar setup( do take this call with a massive grain of salt). Though I still dabble, the loonie never feels as intuitive as USDJPY, which was my bread and butter during my bank trading days. I still think the loonie’s headed for a massive fall. ( famous last words)

Key Points:

-

BoC Rate Cut: The Bank of Canada slashed rates by 50 bps to 3.75%, 125 bps below the peak, as weak Q3 GDP and CPI data forced a bigger move to close the widening output gap. The BoC seems hesitant for another 50 bps cut in December unless more weak data rolls in, possibly signaling a shift to smaller moves.

-

Canada-U.S. Rate Divergence: The rate cut widens Canada’s rate gap with the U.S., now nearly 100 bps below the fed funds rate. With the resilient U.S. economy suggesting fewer Fed cuts than anticipated, Canada’s slowing economy could drive rates even lower, deepening this spread and likely pressuring the loonie further.

-

Historical Pressure on the CAD: If Canada-U.S. spreads widen to new extremes, the CAD could see a significant downturn. A similar divergence in the 1990s saw a 15% loonie depreciation, forcing the BoC to hike rates to stabilize the currency. While we’re not there yet, the risk is real.

-

U.S. Election Risks: The U.S. election adds volatility, with potential tariff threats and USMCA renegotiations from candidates like Trump. Any moves to disrupt Canada-U.S. trade would likely hit the loonie hard, especially in a “risk-off” environment around election uncertainty.

Bottom Line: The Bank of Canada’s message is clear: more rate cuts are coming, contrasting sharply with a more resilient U.S. outlook. Markets are pricing in this widening policy gap, which puts the loonie at risk of reaching lows not seen since past economic shocks. The BoC will need to tread carefully, as a weaker currency could reignite inflation pressures just as they start to ease.

NUTS & BOLTS

Economy Strong, but Voters Aren’t Feeling It: A Snapshot 11 Days from Election Day

With just 11 days left until the big showdown at the polls, you’d think the economy was tanking if you only listened to the flood of negative ads and inflation gripes. Yet, the economic numbers tell a different story – strong, steady growth. But try telling that to the average consumer. The Conference Board’s Consumer Confidence Present Situation Index has taken a nosedive since January, with a particularly steep drop in September. It’s down over 30 points in the past eight months – the sharpest decline since the pandemic, leaving it almost 50 points below pre-COVID levels. Consumers, it seems, just aren’t buying the “strong economy” narrative right now. That’s probably because only the rich can enjoy an inflated state of affairs, and frankly most folks aren’t rich.

The Fed’s latest Beige Book report paints a similarly cloudy picture, with a more subdued outlook on growth. Across the twelve Federal Reserve Districts, economic activity is reportedly flat-lining, and consumer spending has been, well, all over the map.

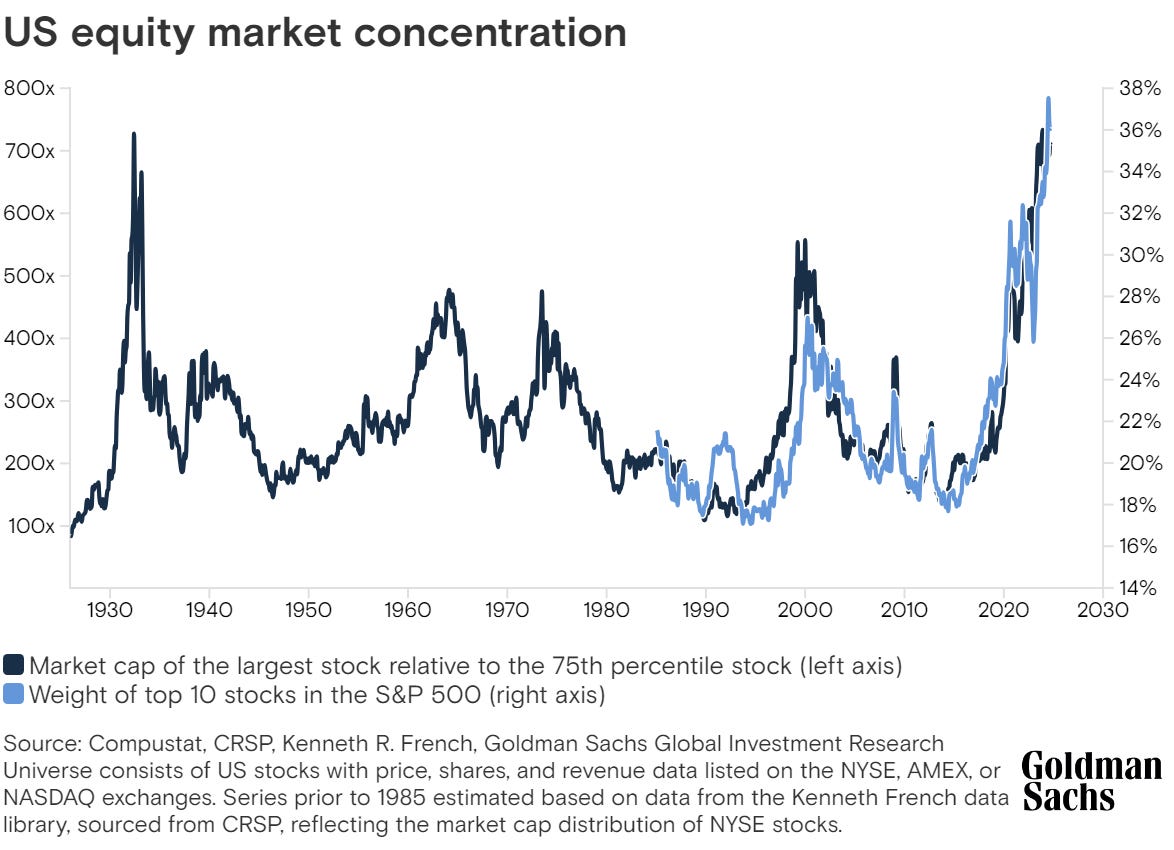

The Chart Below has me champing at the bit to hammer the dollar post-election!!

Down South, hurricane damage hit crops hard, pausing business and tourism; energy prices have weakened, cutting producer profits; and in agriculture, low crop prices barely break even. The silver lining? Inflation’s playing a bit nicer, with most districts reporting only slight increases in selling prices.

Despite the gloom, a lot of the hard data – from retail sales to job numbers – keeps surprising to the upside. Economic optimism has been inching up since July, with September’s job gains, earnings growth, and a healthier trade balance boosting our Q3 GDP growth estimate to a solid 3.0% annual rate, up from 2.2%. If this holds, it’ll be two quarters of consecutive 3.0% growth, which would outpace the long-term potential rate of 1.9%. Not too shabby!

But don’t pop the champagne just yet. The fourth quarter looks a bit more “simmer down” than “full steam ahead,” with growth expected to decelerate to around 2.0%. And if that wasn’t enough to keep everyone on edge, next week’s October Employment Report will be anyone’s guess, thanks to disruptions from hurricanes, Boeing hiccups, and East Coast port strikes. We’re expecting around 125 k new jobs, down from September’s 254k, but honestly, that number could be a shot in the dark.

And let’s talk rates. They’ve been on a wild ride, trending up as Election Day looms, even while the Fed keeps rate cuts on the table. This has made the housing market precarious, with mortgage applications tanking after a momentary high post-Fed’s recent rate cut. Throw in the looming election uncertainties and potential shakeups in tax and spending policies, and it’s likely that businesses and consumers will be holding off on major decisions until the dust settles. In other words, buckle up – it’s going to be a bumpy end to the year!

ELECTION POLLS

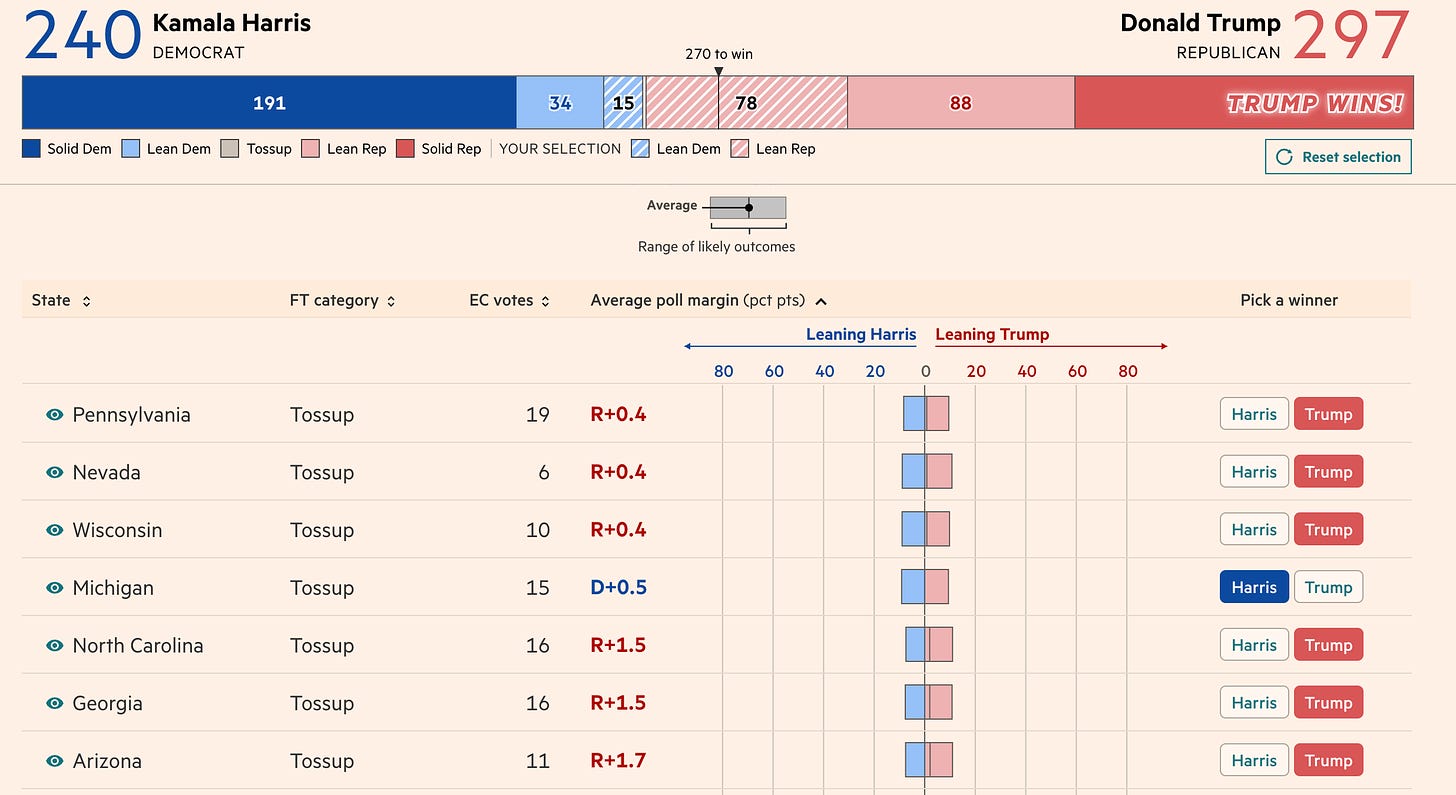

Even if it is neck and neck, US national polls are merely indicators because the overall winner is decided using the electoral college.

Each U.S. state has a set number of Electoral College votes, the sum of its senators (two per state) and representatives (based on population). Washington, D.C., though it has no voting members in Congress, also receives three Electoral College votes.

Most states use a "winner-takes-all" approach: the candidate with the most votes in the state claims all its Electoral College votes. The exceptions are Maine and Nebraska, which allocate votes proportionally by congressional district.

To secure the presidency, a candidate must achieve at least 270 of the 538 Electoral College votes. If a tie occurs at 269-269, the decision falls to the House of Representatives, where each state delegation casts one vote to select the President.

TRUMP OR HARRIS

A few swing states with tight races will likely decide whether Donald Trump or Kamala Harris wins the upcoming presidential election. These states, where neither party has a clear majority, hold many Electoral College votes and often swing the outcome. Given the winner-takes-all system in most states, even narrow victories in crucial battlegrounds could make all the difference on November 5.

In 2016 and 2020, polling consistently underestimated Trump’s support, particularly in swing states, due to what many analysts called the “shy Trump voter” effect—where some of his supporters may have been less likely to respond to polls or more discreet in their intentions. Given that trend, it's conceivable that he could perform better than polling currently suggests, especially in states where the race is close. This polling gap might mean that, theoretically, Trump could be well ahead even if the numbers don’t fully reflect it.

The below interactive charts are taken from the most reliable poll in the business, FiveThirtyEight • Latest poll Oct 25. FiveThirtyEight aggregates multiple polls and applies a weighted approach to account for poll quality, recency, and historical accuracy. This means their results offer a refined view of the race dynamics rather than relying on any single poll, which is especially useful for gauging the potential margin in crucial battleground states.

CHART OF THE WEEK

Goldman Sachs Research expects the S&P 500 to deliver a 3% annualized nominal total return over the next decade—far lower than the 13% returned over the past decade and the 11% long-term average. Our analysts' forecast, which includes a range of outcomes from -1% to 7%, is also lower than the estimates of other market participants: Buy- and sell-side projections of the long-term returns of US equities average 6%.

More By This Author:

Tesla Triumphs While US Bond Yields Hit The Brakes

Wall Street Gripped By Election Anxiety

Spiking US Yields Spook Investors As Political Storm Clouds Loom On Both Sides Of The Pacific