The Weekender: Bulls Brake, Bonds Flinch, And The CPI Trigger Awaits

Image Source: Pexels

Stocks Waver, Bonds Wince

Global equity markets hit the pause button, but not before leaving behind the unmistakable scent of scorched rubber—evidence of an overheated rally cooling under the shadow of trade war re-escalation. The S&P 500, having sprinted to a string of record closes, finally ran out of road as President Trump revved the tariff engine again, this time targeting Canadian goods with a 35% wallop while teasing broader levies up to 20% on global partners. Traders, sensing the shift in wind, eased off the throttle.

Like a finely tuned machine jolted by a misfire, stocks wobbled while bond yields lurched higher, especially in the long end, as markets priced in the inflationary sparks from a fresh tariff barrage. Treasury traders, usually the last to blink, finally flinched—pushing yields up in a move that whispered concerns about sticky inflation bleeding through the seams of an already frayed disinflation narrative.

The dollar, meanwhile, strutted back into the spotlight—a bit stronger, a bit sharper, and drawing strength from both haven flows and yield appeal. As the greenback rose, the pound extended its losing streak, weighed down by UK growth fatigue, while the loonie wilted under the direct blast of a Canada-specific tariff threat.

In equities, the broad tape saw fatigue set in. Roughly 400 S&P names slipped into the red, but the Big Tech heavyweights once again played saviour, cushioning the downside. Nvidia (NVDA), now the flagship carrier in the mega-cap flotilla, held firm—its AI-fueled engine still burning bright.

Still, the underlying tone was one of deceleration. Bulls are catching their breath after a near-vertical climb, with many viewing next week’s earnings barrage—led by the six largest U.S. banks—as the market’s next pressure test. Trading desks are hoping for solid revenue rebounds, but even optimists concede that Q2 may be more muted than Q1. The tariff fog likely left some industries navigating blind, delaying purchases, and compressing margins.

Volatility, curiously, has all but vanished. The VIX slid below 16, and trading volumes on down days remain anemic—a sign of conviction-less selling, or perhaps something more ominous: overconfidence. The market’s recent gains were fast and furious, and history suggests such parabolic moves often cool before resuming.

Wall Street strategists, for their part, are slowly coming out from under their April gloom. Price targets are being revised upward, if begrudgingly. Yet caution persists. Bears are flagging stretched earnings optimism in a macro landscape still fraught with tariff effect crosscurrents and hinting that, without an earnings season strong enough to justify lofty valuations, we could enter a long stretch of sideways drift—what’s typically referred to a “grind” market, where gains are hard-earned and easily lost.

In the bond world, the picture is no less nuanced. The MOVE index—Wall Street’s fear gauge for rates—has collapsed to 2022 lows. Strong auctions for 10- and 30-year paper suggest demand remains healthy, even as the inflation debate rages on. But the Fed remains parked, eyes glued to the CPI dashboard. Tuesday’s inflation print looms large, with many expecting more tariff-related noise to start filtering into the data; hence, yields and the dollar are up as July and August may start to see the tariff effect pass-through.

For now, the market is like a luxury yacht navigating choppier waters. The sails are full, but the crew knows a storm could form quickly on the horizon. Bulls still command the helm, but bears aren’t overboard just yet—they’re watching quietly from the lifeboats, waiting for the wind to change.

Game-Time CPI, This is a Big One Folks

Markets are coiled in suspense ahead of Tuesday’s CPI print, the next decisive mile marker on a winding road shaped by tariffs, fading disinflation, and the Fed’s cautious patience. What began as a glidepath toward fall rate cuts is now dotted with inflationary landmines—and the Fed may need to keep its powder dry longer than the market would prefer.

After a brief tariff ceasefire, President Trump reloaded the trade cannon, announcing sweeping new duties on over 20 countries, including a thundering 50% levy on copper set to activate August 1. If enacted in full, this barrage would push the U.S. effective average tariff rate to roughly 18%—a level not seen since the Smoot-Hawley era of 1934. That’s hardly the backdrop for a central bank hoping to pivot dovish.

So far, goods inflation has remained subdued, but this calm may be deceptive. Tariff pass-through is a delayed beast, suppressed by a complex brew of hedging, inventory buffers, long-term contracts, and competitive pressures. Many companies—particularly in commodities, tech hardware, and manufacturing—have absorbed costs to protect market share, especially amid price-sensitive demand. But the longer tariffs persist, the thinner those buffers become.

The Fed is stuck in interpretive mode—unsure how much of the inflation shock has already landed and how much remains in the pipeline. Until that fog clears, Powell and company are likely to stay in neutral. Encouragingly, the June FOMC minutes suggest the staff outlook for GDP and inflation has brightened since May, with recession risk receding and financial conditions improving. Market-based inflation expectations have ticked higher but remain anchored, aligning with the New York Fed’s latest consumer survey showing lower one-year inflation expectations for the second straight month.

However, that rosy top-line view obscures growing unease underneath. The same New York Fed survey shows sticky inflation in key categories: medical care, education, rent, food, and gas. These components are crawling back toward their pandemic-era highs, raising the specter of a more embedded pricing problem—especially in everyday essentials.

That’s why June’s CPI is no ordinary checkpoint. Energy disinflation, the Fed’s ally in the spring months, has waned. Oil surged over 10% in June and gasoline prices held steady, stripping away a major tailwind. Meanwhile, services inflation—where the Fed’s fight has largely focused—is already showing signs of base-level stickiness. With ISM price indices for both manufacturing and services still elevated, the runway for further softening may be limited.

According to aggregated estimates from bank economists, headline CPI for June is expected to rise 0.29% month-on-month, with core at 0.26%—a noticeable pickup from May’s benign 0.08% and 0.13%. Year-on-year, that translates to a move up to 2.6% on headline and 2.9% on core.

Should the numbers surprise to the upside—particularly in goods or rent—it could swiftly reprice the Fed curve. Fed funds futures currently imply a 70% chance of a September cut, but that probability is hanging by a thread. A hotter-than-expected CPI would not only push back the start of easing but also steepen the back end of the Treasury curve as investors recalibrate their inflation expectations.

For now, markets are taking a glass-half-full view—hoping the Fed sees through short-term tariff noise and sticks to the roadmap. But the risk is growing that inflation, long thought tamed, still has a few cards left to play. Tuesday’s report could be the tell.

Tariff Trim on the Table for India-US Trade Deal

The Trump-Modi trade tango is taking shape as Washington signals a softer hand toward India in a global tariff campaign that has otherwise resembled an economic carpet bombing. While much of Asia braces for blunt-force tariff trauma—with Vietnam, the Philippines, Laos, and Myanmar already hit with rates ranging from 20% to 40%—India appears to be charting a more diplomatic course, negotiating toward a sub-20% deal that could spare it from the more punishing blows seen elsewhere.

This is not just a trade negotiation; it’s a geopolitical audition. India, long cast as a swing state in the global supply chain reshuffle, is seizing its moment. In an environment where tariffs are being flung like thunderbolts and demand letters are falling like rain, New Delhi’s quiet, early engagement with Washington may be yielding dividends. Unlike its regional peers, India isn’t staring down a shock-and-awe tariff letter. Instead, an interim deal could arrive not with fire and fury, but with a carefully worded joint statement.

The subtext? India is angling to outmaneuver its BRICS peers, sidestep the tariff tripwire, and position itself as the U.S.’s preferred Indo-Pacific counterweight to China. While Trump has grumbled about India’s role in BRICS—suggesting the country could find itself on the wrong end of tariff retaliation—those threats now appear more rhetorical than real, at least for now.

In tradecraft terms, India is playing the long game: secure a friendlier interim rate (likely sub-20%, down from an initial 26%), buy negotiating time, and fend off the more contentious asks like genetically modified crop access and pharma regulation overhauls. Washington, for its part, seems content to let India hold the middle ground—for now—while it leans hard on other economies for leverage.

If sealed, this agreement would put India in rare company—alongside the UK and Vietnam—as one of the few nations with a bespoke trade accord under the Trump tariff regime. The signal to global investors is clear: in an increasingly bifurcated trade world, India may not just be a beneficiary of China+1; it could be the chosen one.

Of course, this is still a game of brinkmanship. Tariffs remain both a negotiating stick and a headline hammer. And while markets have yet to react violently, the stakes for supply chain realignment are enormous. As U.S. corporations look to derisk from China, a cooperative India could attract a fresh wave of capital and manufacturing reallocation. Conversely, a misstep—or a last-minute Trump reversal—could see the subcontinent swept into the same tariff cyclone hitting its neighbors.

For now, though, the optics are favorable. In a week filled with economic flashbangs, India is threading the needle—with diplomatic tact, economic leverage, and just enough flexibility to stay out of the blast radius.

Election Risk Weighs on Yen as Tariff Tensions Mount

The yen is limping into the weekend like a weary prizefighter—bruised, unresponsive, and conspicuously absent from its usual safe-haven corner, logging its worst G10 performance both on the week and month. The tea leaves suggest this isn’t merely a yield or dollar repositioning story—it’s increasingly a political one.

The initial spike in USD/JPY after the July 3rd jobs report was understandable, if somewhat overstated. Markets had braced for a soft number, and while the print was far from stellar, the modest upside surprise helped reprice yields and fuel dollar strength. But the real fuel came Monday, when Japan received one of the first official tariff letters from Washington: a blunt 25% blanket rate on all goods not already covered by sector-specific duties—autos being the glaring inclusion.

From there, the yen’s troubles deepened. Traders who bought the dip in JPY were quickly met with more weakness as flows shifted, not in panic, but in resignation. The real-time unwind in long-yen positioning is being driven by political risk at home just as much as it is by external trade stress.

The Ishiba government’s strategy—insisting on an auto carve-out before agreeing to anything broader—is bold, perhaps too bold. Tokyo wants what the UK got: a 10% cap and a sector exemption. But it’s playing hardball with a U.S. administration that doesn't blink often and has little incentive to show flexibility when other partners have already taken the deal on less favorable terms. That brinkmanship is injecting uncertainty into a currency market already pricing in defensive positioning ahead of next week’s U.S. CPI.

What’s changed is that the political calendar is suddenly in play. The July 20th Upper House elections—usually background noise for global markets—are now center stage. The Ishiba administration is hanging on by a thread in the Lower House, and the math on the Upper House doesn’t inspire confidence. With only 50 contested seats needed to hold a majority and projections putting the ruling coalition just shy of that, the risk of a government collapse—or at least a forced resignation—looms large.

Election polls point to an erosion of LDP dominance in the single-seat districts where they’ve historically been strong. A potential sub-50 outcome could not only destabilize the administration but also cast doubt on Japan’s ability to quickly cut a trade deal with the U.S. That uncertainty—combined with fading expectations for aggressive BoJ policy tightening—is leading to a recalibration in yen risk.

For traders, the takeaway is tactical: if you’ve been building JPY longs into the recent dollar strength, keep powder dry. The risk-reward still favours a stronger yen medium-term, especially if a more amenable US-Japan trade deal happens. But near-term, we could see further yen weakness before positioning stabilizes. The long JPY thesis isn’t dead, but the political fog in Tokyo means we’re trading around potholes, not through them.

Watch the Upper House election. It may do more to move the yen than anything Powell says next week.

The July 20th Upper House election is shaping up as a critical inflection point—not just for the Ishiba administration, but for the yen itself. A loss of the coalition’s majority would leave both houses of Japan’s Diet adrift, leaderless in practical terms, and would strike a devastating blow to Prime Minister Ishiba’s credibility. While there is no formal trigger for resignation, political gravity tends to do the job. A weakened PM without parliamentary muscle is often a placeholder, not a policymaker.

And in that vacuum, the spectre of Sanae Takaichi looms. Should Ishiba step aside, Takaichi—a close ideological heir to Shinzo Abe—would emerge as a frontrunner. Markets could read her alignment with Abenomics and its aggressive monetary easing bias as a return to ultra-loose policy orthodoxy. In FX terms, that means more downside for the yen.

This political risk premium is already seeping into yen price action. The market isn’t just reacting to tariffs or the absence of a U.S.-Japan trade breakthrough—it’s bracing for the possibility that Japan’s fiscal and foreign policy coherence may unravel just as negotiations with Washington reach their most sensitive phase.

And the window is closing. With key U.S. trade negotiators like Scott Bessent and Howard Lutnick in Osaka next week for ceremonial events around the World Expo, there's no sign of formal progress on tariffs. Japan’s negotiator Akazawa is likely to tread carefully, given the optics of cutting a deal days before a pivotal domestic vote. The post-election landscape could be even trickier—especially if Ishiba resigns or is forced into a broad, unstable coalition. Either outcome would stall trade progress and likely see the yen come under additional pressure.

For traders, the path forward is event-laden and binary. Should the ruling LDP–New Komeito coalition manage to hold its majority, we could see a USD/JPY retracement as the political fog lifts, trade deal hopes revive, and the yen reclaims some safe-haven appeal. But a coalition loss followed by a Takaichi ascension? That’s a formula for fresh yen weakness.

Markets have a way of pre-pricing what’s not yet confirmed, and the yen is already telegraphing that traders see this election as a catalyst, not a footnote. The short-term story is not just what Washington does next, but what Tokyo politics becomes after July 20.

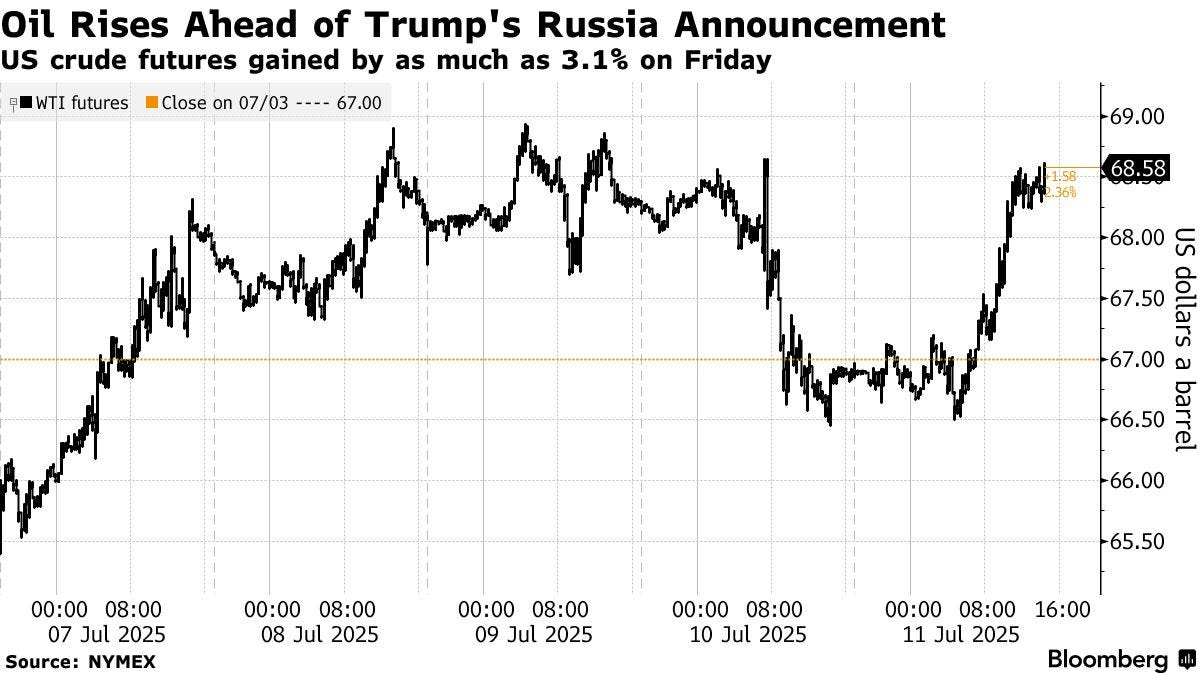

Chart of The Week

Enforcement Risk?

Oil markets are now simmering on a new geopolitical burner after reports emerged that President Trump is weighing a global 500% tariff on Russian crude—an escalation that, if enacted, would amount to an effective embargo with ripple effects across the energy landscape. The Times report that Trump is “closely studying” a bill targeting not just Russian exports but also nations like China, India, and Turkey that continue to purchase Russian oil has jolted traders out of their supply-glut stupor.

The political logic is shifting. Trump, once dismissive of the bill as “too strong,” is reportedly growing increasingly frustrated with Putin’s intransigence and continued civilian attacks in Ukraine. And while the proposed tariff is still under discussion, its mere contemplation is reshaping the oil risk calculus overnight. This isn’t just a new chapter in sanctions policy—it’s a direct challenge to the global structure of energy flows.

A 500% tariff on Russian oil would be so punitive that it essentially functions as a de facto ban. And while the White House appears keen to retain executive flexibility on implementation, the congressional appetite for tighter sanctions is growing—raising the probability that even partial enforcement could become law. That creates enormous tail risk for crude markets, which have so far traded with one eye on physical oversupply and another on faltering demand.

Now, the market has a third eye wide open: enforcement risk.

More By This Author:

Tariffs Talk, Tech Walks And Markets Bet On Backpedals, Not Breakdowns

Wall Street On Mute: Tariff Turbulence Meets Earning Season Vertigo

Markets Slip As Tariff Telegrams Stir Old Ghosts