The Top 3 Uranium Stocks For 2022

Uranium plays a pivotal role in producing nuclear power. As a result, investors looking to capitalize on the long-term growth potential of nuclear energy might be interested in learning more about uranium stocks.

To be sure, uranium stocks are highly risky–most have low market caps below $1 billion, and only a few pay dividends to shareholders. However, like many commodities sectors, uranium stocks could provide attractive long-term growth as demand for nuclear power rises around the world.

This article will give an overview of the uranium industry, and the top 3 uranium stocks to look at now.

Industry Overview

Uranium was discovered in 1789. It is a metallic chemical element, primarily found naturally in soil, rock, and water. In the mid-20th century, uranium was found to have potential use as an energy source.

Today, uranium’s primary industrial application is to power commercial nuclear reactors that produce electricity. Uranium is also used to produce isotopes for medical, industrial, and defensive use. In 2020, the total global production volume of uranium from mines was 47,731 metric tons. This compares with global production of 54,752 metric tons in 2019.

Kazakhstan is the largest uranium producer in the world, with a production volume of 19,477 metric tons in 2020. This total was down from approximately 22,808 metric tons the year before.

By contrast, the U.S. produces very little uranium. According to Statista, U.S. uranium production totaled just six metric tons in 2020. In 2010, production was 1,660 metric tons of uranium in the U.S.

However, the U.S. is the largest consumer of uranium, as nuclear energy use is widespread. In 2018, the U.S. consumed over 19,000 metric tons of uranium, more than twice as much as the next-highest consumer. After the U.S., the largest consumers of uranium are France and China.

Uranium does not trade on an open market like other commodities. Instead, buyers and sellers negotiate contracts privately. Prices are published by independent market consultants. Recent publications show the price of uranium at around $42/pound. The price of uranium has nearly doubled in the past five years, signifying the potential investment case for buying uranium stocks.

Indeed, the growth potential of uranium stocks is clear. First, roughly one-third of the global population lives in “energy poverty,” meaning a lack of access to reliable electricity. Next, the world faces the challenge of climate change, making thermal replacement a strategic priority for many developed nations. The electrification of multiple industries that previously relied on coal for energy is a major task.

Not surprisingly, global demand for electricity is expected to rise by 75% from 2020 to 2050, according to the 2021 IEA World Energy Outlook. This is where uranium stocks come in. The following section will discuss the top 3 uranium stocks to look at now.

Uranium Stock #3: NextGen Energy (NXE)

NexGen Energy Ltd. is an exploration and development stage company engaged in the acquisition, exploration, and evaluation and development of uranium properties in Canada. The company was incorporated in 2011, and currently has a market capitalization of $2.2 billion.

NextGen, like most uranium stocks, is highly speculative. As an exploration and development stage company, the company does not have revenues (and typically reports operating losses each year). To that end, as of the end of the 2021 third quarter, NextGen had an accumulated deficit of C$317 million.

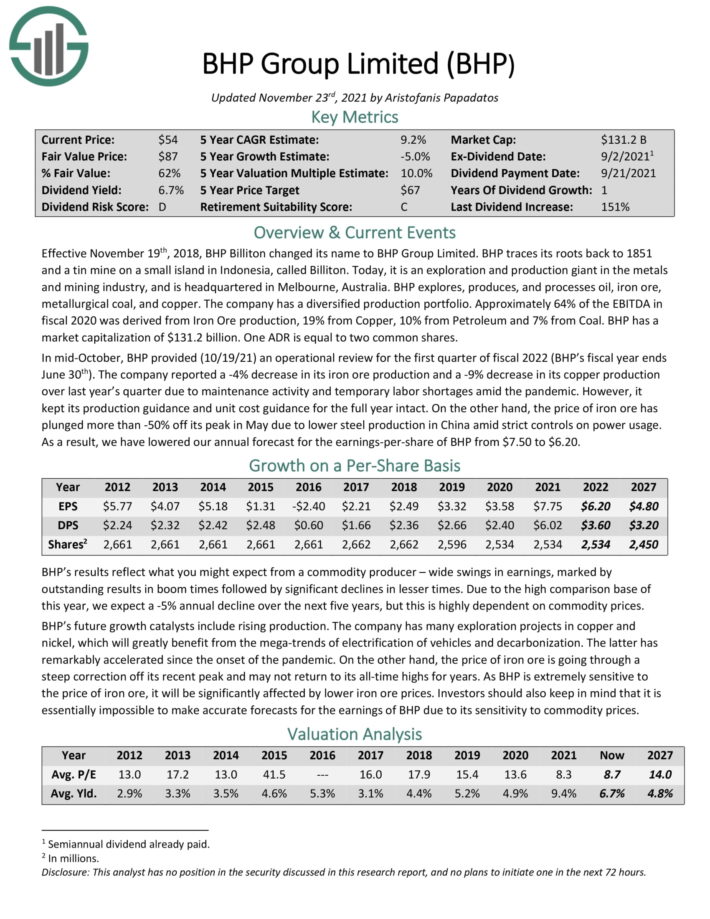

Therefore, investing in NextGen is essentially a bet on the company’s assets. To be sure, the company does possess quality uranium assets. A notable example is the company’s Rook I Project, the largest development-stage uranium project in Canada.

Source: Investor Presentation

The company has a relatively strong balance sheet with cash of C$227 million and total liabilities of C$94 million, as of the end of the 2021 third quarter.

Investors interested in safety or stability should not buy the stock. Only the most risk-tolerant investors looking for exposure to uranium stocks should consider NextGen. That said, the stock could provide attractive returns, in the form of capital gains, if it is able to execute on its growth initiatives.

Uranium Stock #2: Cameco Corp. (CCJ)

Cameco is one of the largest uranium producers in the world. It has the licensed capacity to produce more than 53 million pounds (100% basis) of uranium concentrates annually, backed by more than 464 million pounds of proven and probable mineral reserves.

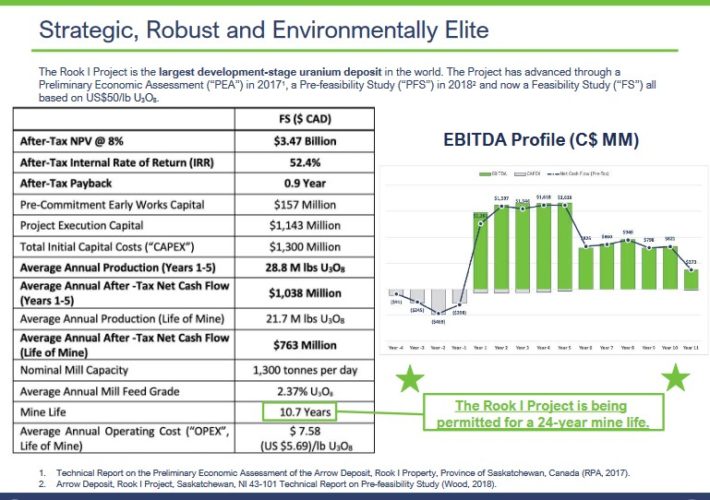

It is also a supplier of uranium refining, conversion, and fuel manufacturing services. Its land holdings, including exploration, span about 2 million acres of land. Cameco has a dominant position in the largest uranium mine in the world, the McArthur River.

Source: Investor Presentation

The company generated fourth-quarter net earnings of $11 million, and adjusted net earnings of $23 million. For 2021, the company posted an annual net loss of $103 million and an adjusted net loss of $98 million.

Cameco is still feeling the effects of the coronavirus pandemic on its business operations. In 2021, the company operated at roughly 75% below its productive capacity. By 2024, the company plans to operate at about 40% below production capacity.

However, the long-term potential of the company remains intact.

Source: Investor Presentation

Therefore, while the near-term picture remains cloudy for Cameco, the company could be a rewarding long-term growth pick.

Cameco stock pays a dividend. But even with a planned 50% dividend increase for 2022, shares currently yield less than 1%. Therefore, Cameco stock is more of a dividend growth stock than a suitable pick for current income.

Uranium Stock #1: BHP Group Ltd. (BHP)

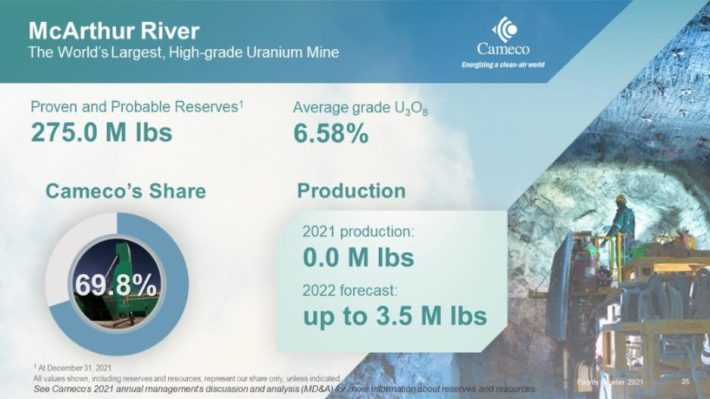

Uranium stocks are highly risky and can be volatile. As a result, the top spot goes to BHP Group Ltd. While BHP is not the largest uranium producer in the world, it offers investors the biggest scale and relative stability. BHP is a global giant with a market cap of around $244 billion.

BHP is headquartered in Melbourne, Australia. The company has a diversified production portfolio. It explores, produces, and processes oil, iron ore, metallurgical coal, copper, and more. Almost two-thirds of the company’s annual EBITDA is derived from iron ore production, but it is also involved in uranium.

BHP produced approximately 3.3 million metric tons of uranium in the most recent fiscal year ending June 30, 2021. This was a decrease of 411 thousand metric tons from the previous year, but it still makes BHP a major uranium producer.

In mid-October (Oct. 19, 2021), BHP provided an operational review for the first quarter of fiscal 2022 (BHP’s fiscal year ends June 30). The company reported a 4% decline in its iron ore production and a 9% decrease in its copper production over last year’s quarter due to maintenance activity and temporary labor shortages amid the pandemic.

However, it kept its production guidance and unit cost guidance for the full year intact. In addition to its size and competitive advantages, BHP is the top pick because it has the highest dividend yield of all uranium stocks.

With a dividend yield above 6%, BHP is a high dividend stock.

Final Thoughts

Uranium stocks are risky, and investors should carefully weigh the various risk factors before buying uranium stocks. Many uranium stocks are small companies with uncertain futures. Very few uranium stocks pay dividends to shareholders.

However, for investors willing to take the risk, the long-term potential could be rewarding. Uranium stocks are set to benefit from continued long-term growth of nuclear energy around the world. Therefore, the top uranium stocks could generate attractive returns over the long run.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more