The Service Sector Is Driving Italy’s Growth

The weakening in industry temporarily leaves the onus of growth on services. Demand-wise, expect consumption to benefit from resilient employment and decelerating inflation.

The services sector is helping to drive growth in Italy

Investments will reflect better progress (or the lack thereof) in the implementation of the European Recovery and Resilience funds.

First quarter consumption driven by a strong recovery in purchasing power

The surprisingly strong 0.6% quarter-on-quarter GDP growth between January and March this year was driven by domestic demand. The relative strength of consumption was due to a 3.1% quarterly rebound in households’ real purchasing power, which benefited from the slowdown in inflation dynamics. The resilient labor market, with employment up and unemployment and inactivity down on the quarter, was apparently a decisive factor. Conditions were there for household saving ratios to reach 7.6% (from 5.3% in the fourth quarter of 2022), close to the pre-Covid 8% average, without penalizing consumption.

Weakening industry points to softer growth in the second quarter

Data for the second quarter suggests that the very good performance of the first will be hard to replicate. Industry just managed to propel value-added in the first quarter, but this seems highly unlikely in the second after a very disappointing -1.9% industrial production reading in April.

Business confidence data for May and June and the relevant PMIs point to manufacturing softness through the rest of the second quarter and, possibly, into the third. For the time being, the decline in gas prices has failed to provide any relevant supply push for manufacturers, outweighed by deteriorating order books and stable stocks of finished goods. Services are also signaling some fatigue, but still look to be a decent growth driver, helped by a strong summer tourism season.

The fall in producer prices will bring goods disinflation down the line in CPI

The flipside of industrial weakness is a sharp deceleration in producer price dynamics. Courtesy of declining energy prices, PPI inflation entered negative territory in April, anticipating further decelerations down the line in the goods component of headline inflation.

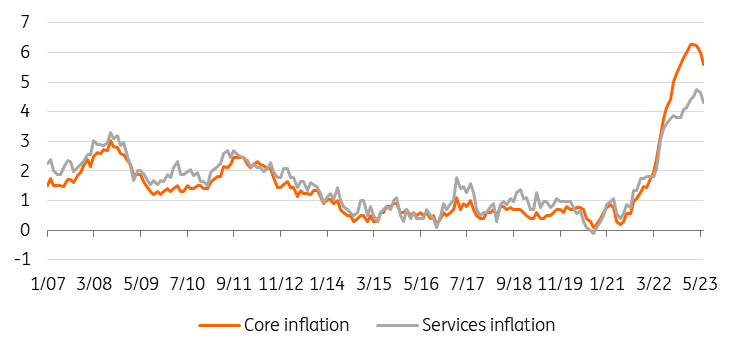

Services inflation is proving relatively stickier, though, possibly reflecting in part a re-composition of consumption patterns out of interest rate-sensitive durable goods into services as part of the last bout of the re-opening effect. With administrative initiatives on energy bills still in place at least until the end of the summer, and with big energy base effects yet to play out, the CPI disinflation profile is still exposed to temporary jumps, but the direction seems unambiguously set.

Stickier services inflation to slow the decline in core inflation

Refinitiv Datastream

Resilient labor market to continue to support consumption

A declining inflation environment will likely coexist with a resilient employment environment, at least in the short term. Labour market data continue to point to residual job creation, with a prevalence of open-ended contracts over temporary ones. This is clearly helping to support consumer confidence and keep concerns about future unemployment at low levels.

Unfavorable demographics and supply-demand mismatches could keep some pressure on wages, at least in certain sectors. For the time being, the impact on aggregate hourly wages has been limited (in May it was up by 2.4% year-on-year), but we can’t rule out it inching up to the 3% area towards the end of the year.

All in all, the combined effect of decelerating inflation, resilient employment and slowly accelerating wages should continue to support real disposable income, ultimately creating room for decent consumption growth in 2023.

Investment at least temporarily affected by a slowdown in the RRF implementation

In the current circumstances, the area more exposed to temporary hiccups is investment. According to the April bank lending survey (BLS), in the first quarter the general level of interest rates was acting as the most powerful drag on borrowing activity, with businesses needing to fund inventories and working capital more than new investments.

A potential counterbalance might come from the push on investments coming from the European Recovery and Resilience Facility (RRF). A delay in the disbursement of the third tranche, due last January, is possibly causing some concerns, inducing extra prudence. However, a quick solution to the current impasse and, even more relevant, the much-awaited disclosure by the Italian government of its revised plan, could give businesses more visibility on viable projects and potentially revitalize investment action.

The pending ratification by Italy of the European Stability Mechanism reform remains a source of friction in the relationship with the European Union. Prime Minister Giorgia Meloni’s claim to make it part of a comprehensive deal encompassing the revision of the RRF plan and the reform of the Stability and Growth Pact seems a bit illusory and overly ambitious. A piecemeal approach would have likely allowed the Italian government to have a better say in the reform of the Stability and Growth Pact, which will be finalized by year-end.

All in all, we expect that the Italian economy will manage to post marginally positive growth in the middle quarters of 2023, mainly thanks to services. If that is the case, building on the strong carryover effect of the first quarter, then an average GDP growth of 1.2% in 2023 seems a reasonable base case call.

Italian economy in a nutshell (%YoY)

Refinitiv Datastream, all forecasts ING estimates

More By This Author:

Rates Spark: The Differing US And UK Strategies To Fight InflationThe Commodities Feed: Key US CPI Release

Higher Deficit And Unidentified Outflows Weigh On Reserves In Turkey

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more