The Pound Is Recovering But UK Faces Uncertainty (GBP/USD)

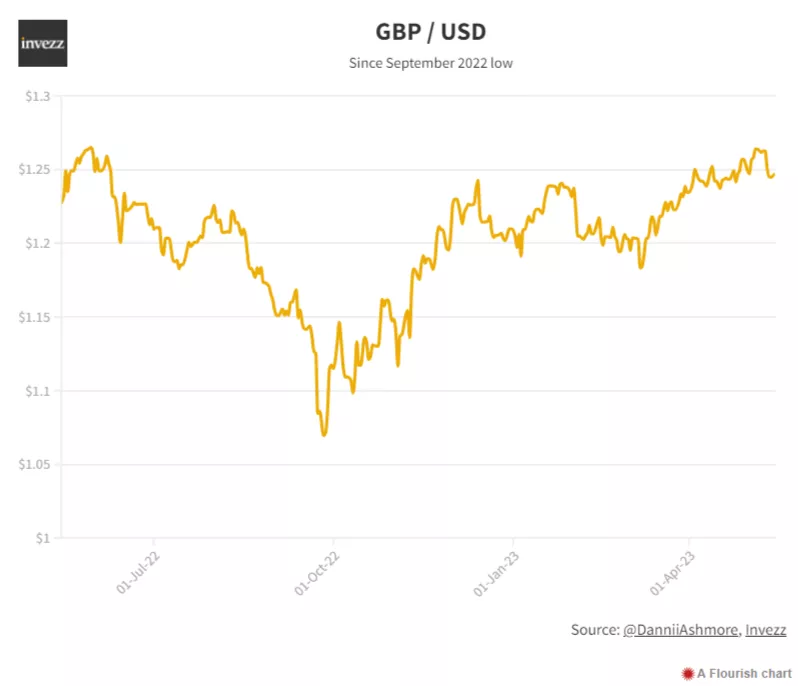

For a long time, holding the British pound has not been a lucrative move. Decades of underperformance have devalued the sterling against the dollar. However, zooming in on the last eight months, the pattern has flipped. In fact, the pound (GBP/USD) is now up over 16% from its lows in September 2022, when it traded at $1.08, with some even speculating parity with the dollar could be in play.

While a lot of the bounceback came in the period after the chaotic mini-budget of Lizz Truss, the pound has also been among the strongest currencies worldwide since the start of the year. The stout performance comes off the back of stronger economic data than expected. The Bank of England may have just hiked interest rates for a twelfth time and things are still gloomy, but they are at least better than the state of affairs at the start of the year.

The IMF had forecasted the UK to be the only advanced economy to enter into recession in 2023. So far, however, this has not been the case. A sharp fall in gas prices has aided the country significantly, while finance minister Jeremy Hunt’s spring budget was significantly better received than the Truss’ mini-budget last autumn, which sent the pound careening to its lowest value since 1971.

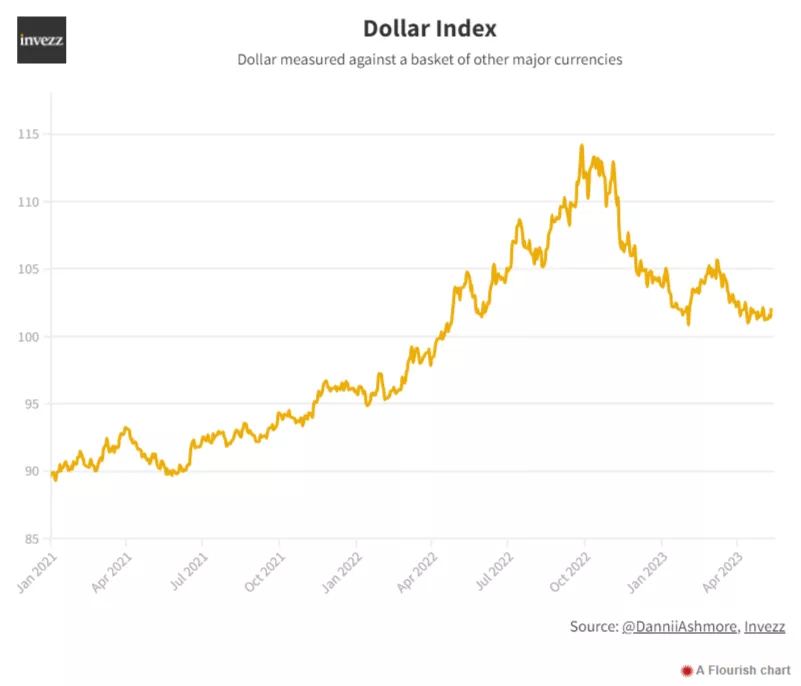

Nonetheless, the most recent GDP data in February was flat, so growth is still stagnating and a recession very much remains a possibility. In truth, a weakened dollar is perhaps the greater reason for the pound’s bounceback. The greenback’s remarkable strength was the biggest story in forex markets for a lot of 2022, but the run has flipped since September.

The market has moved to anticipate a slowing of interest rate rises from the Fed going forward, as inflation numbers in the US have come down. The stark pessimism in Europe of last year as Russia invaded Ukraine has also faded, meaning a lot of the buoyancy offered the dollar last year has dissipated.

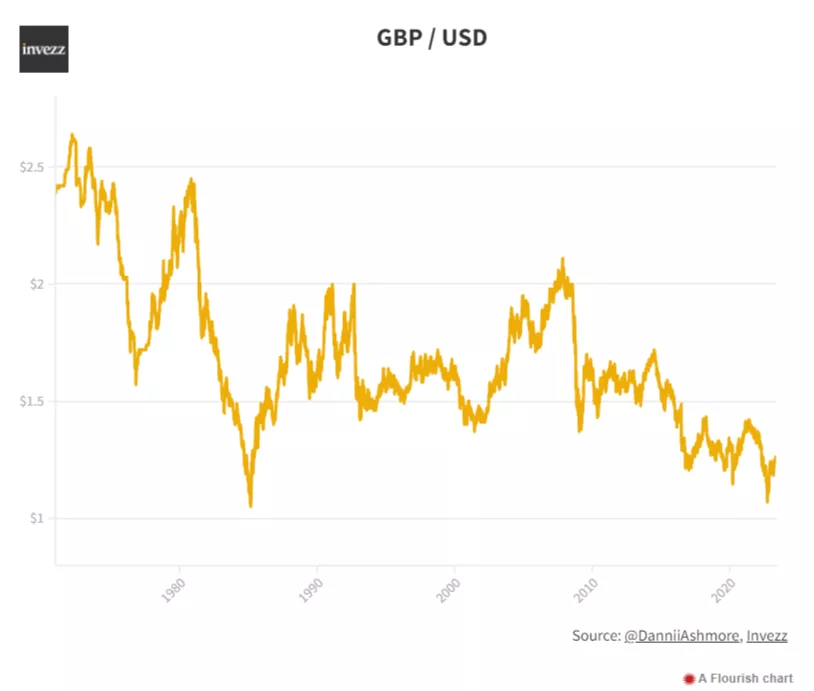

Despite the dollar’s pullback against the pound, it would be remiss not to touch on quite how poorly the pound has done over the last two decades. 16 years ago, one British pound could purchase you over $2. Today, it is $1.25, the same level it was in 1985.

Looking forward, while the picture in Europe looks rosier than it did six months ago, the UK still faces numerous challenges. A lot of the recent moves in currency markets stem from a flip in interest rate forecasts as recession fears displace inflation as the number one concern for markets, with price rises coming down.

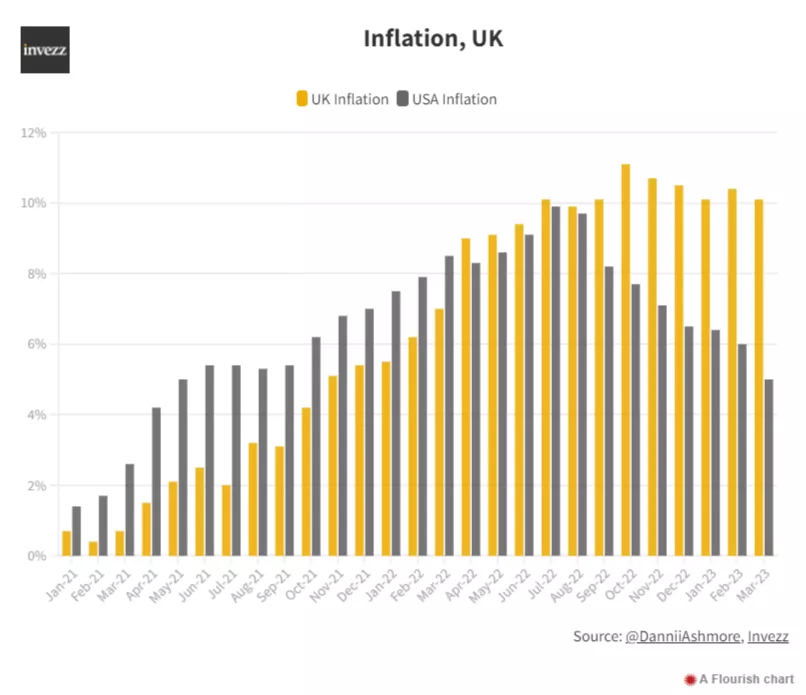

In the UK, however, inflation still persists in the double digits – among the highest in Western Europe. The contrast in trajectory compared to the US is night and day when looking at the below chart.

And while next month’s inflation in the UK is expected to show softened numbers, the Bank of England said last week it expects inflation to still be above 5% at the end of the year, while the targeted 2% rate may not be hit until 2025. The comments paint a picture of the UK’s challenge.

More By This Author:

US Dollar Analysis After Hitting A 5-week High

Jim Cramer On Apple stock: Apple Can Easily Blow To $200

Wheat Prices Forecast Ahead Of Russia Harvesting Season