The Minus Signs Return

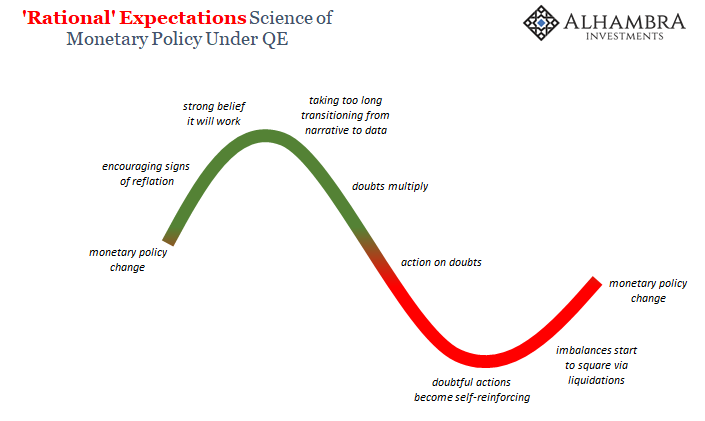

Ambiguity favors the path of least resistance. If there isn’t any direct refutation of the thing everyone believes in, everyone will continue to believe in that thing and only that thing. Human nature.

In economic terms, people respond near exclusively to negative numbers. This is less evolution and more a process of modern times. There is a very strong attachment to figures of authority, particularly those who deal in complex topics. This isn’t necessarily a harmful development, so long as those in position of authority know what they are talking about.

If the “establishment” says the economy is booming, then no level of positive numbers will dispel that notion. It won’t matter, and it hasn’t, that the level of “growth” over the past so many years always deserves the quotation marks. So long as the numbers are above zero, it is consistent with at least the idea of growth.

The minus signs, however, they begin to get people’s attention. It is far more difficult (and increasingly impossible) to argue growth during the proliferation of negative numbers. And if they do show up and multiply (math pun) the direct result can be anything from disappointment to panic in the streets.

Expectations do matter, just not as much (in the end) as particularly central bankers hold.

The global economy is now transitioning from low positive numbers (not a boom) to the spread of negatives (some undetermined form of downturn). There were a few contractions in certain places during last year, mostly in the outer reaches of some EM economies. That won’t ever be enough to change the narrative other than for those places (Argentina is just Argentina, for example).

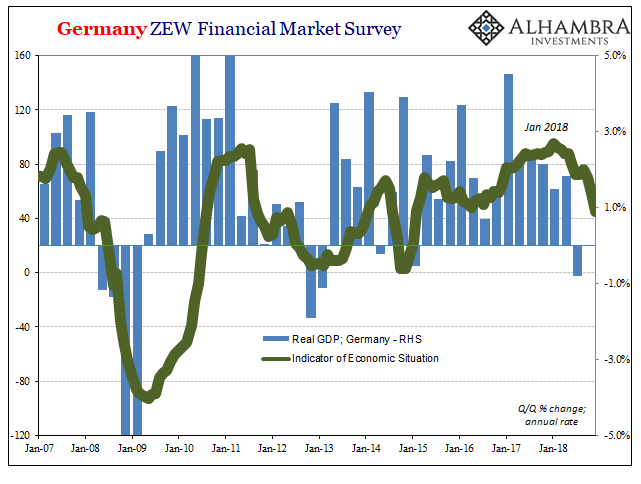

The wrong direction has now reached the interior, the booming developed world. The latest is out of Germany, which in the context of expectations is even more damaging. You might forgive the European economy for a minus sign in Italy or Greece, but Germany? That’s only bad news.

Factory orders in that country fell in November 2018, according to the latest estimates from DeStatis (Statistisches Bundesamt). Seasonally-adjusted, new orders placed with manufacturers were down 4.3% from November 2017, far and away the largest decline since the last time Europe was in recession.

There is no ambiguity here. It’s not just the level of decline but more so the rate of change. I am a gamma guy through and through, which means we pay attention to how quickly things develop. Meandering to the upside isn’t consistent with a boom. A gentle downslope can mean a number of things, including a possible future downturn.

A sharp descending lurch leaves far fewer options, all centered on downturn. Germany’s economy, as Europe’s, seems to have fallen off a cliff starting around January 2018.

We’ve seen this time and again, and to no surprise. What happened last January (the first set of global liquidations) across global markets was an announcement of what was coming, these increasingly down and now negative statistics merely the proved result.

In the almost one year since the official booming narrative has remained undaunted; Economists rationalize more than stock bubble enthusiasts. Each time concerning low positives were announced they have been dismissed as temporary or “transitory” factors nothing whatsoever to concern globally synchronized growth. People tended to rely on the ambiguity.

At some point, in markets, that benefit of the doubt was lost. This was December in a nutshell. The “nothing to see here” explanation finally took the presence of desperation far more than rational analysis, too many factors moving the wrong way and quickly.

To the specific German case, “they” said it was drought on the Rhine and vehicle emissions regulations. As time passes, instead it looks much more serious and not so temporary.

In a general sense, the negative numbers announce the end of the first transition – the one that comes between “the economy is booming” narrative and something else. Last year was a transition year, one that began with inflation hysteria pegging convention firmly on the side of that boom. It ended in a rapid flush which pushed it toward outright fearing downsides again.

As markets transition, so does economy; one to the other and then self-reinforcing. December was a deep red month, and we’ve seen it now progress into economic statistics (even those formerly at the high end speaking in booming tones) as well as really fright-inducing market turns (curves).

In other words, market and now economy gamma suggests the probability of this just being minor bumps on the transition to normal, as the BIS wants to suggest, was small last May 29, smaller still in early October, and now down to its smallest share since perhaps 2015 if not 2011-12 (especially for Europe).

Since there is no such thing as decoupling in the global economy, a fact markets understand, if Germany goes down that simply means it’s a matter of time for anyone and everyone else. To what degree it all works out in various places is still unknowable, that’s the next transition stage being worked on right now. It could be a minor downturn (like Europe in 2015-16; or the US 2011-12), a massive 2008-style crash, or anything in between.

There is little ambiguity left about Transition #1 (I know the nomenclature is getting a little crowded and dull; Transition #1 between Reflation #3 and the products of Eurodollar #4). Markets are already trying to price what comes next because there are fewer doubts we are at next. The only thing that’s near enough to certain is that there is no good in next.

Germany’s economy is a global bellwether, and it lives and dies by manufacturing. These negative numbers and more so the speed with which they’ve arrived are unambiguous.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more