The MENA Region Is Becoming The Next Global Hub For Venture Capital

At the very beginning of 2022, startups in the Middle East and North Africa region (MENA) raised $247 million across 46 deals, a 20% increase month-on-month and a whopping 474% year-on-year. Startups such as Rain, Lean Technologies and Brimore, which are almost located in the leading economies across the region, were the main recipients of those fundraisings.

In a joint statement, the founding team of Rain said: "We are very excited about this funding opportunity as it allows us to continue conversations with regulators across the MENA region, Turkey, and Pakistan about the benefits and potential of cryptocurrency." The company also added that the raising fund will be used to support their expansion with a focus on securing a bigger presence in the whole MENA region, Turkey, and Pakistan.

Hot land for investment

2020 was a turning point for MENA's startup ecosystem and the investor landscape. The pandemic-led growth of the digital sector highlighted the importance and potential of startups. A tech firm that has strengths in technologies and potentials during the pandemic days would be more attractive to investors to shift their investment focus from the traditional sectors like real estate to startups, particularly in fintech, e-commerce, social, gaming, logistic and food tech – the sectors that benefited the most from the pandemic.

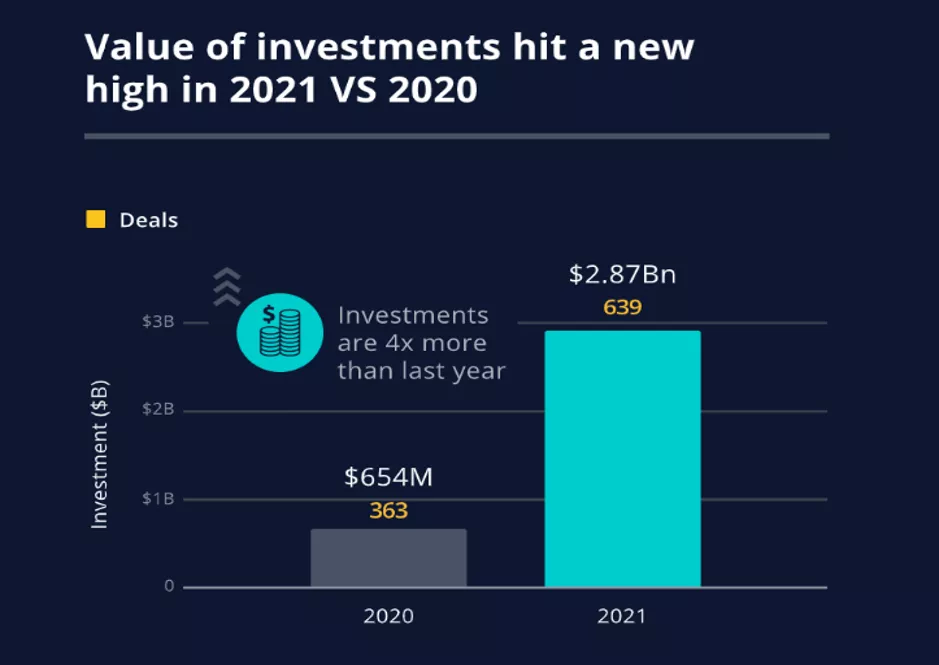

Investment in the MENA region also reached a new milestone in 2021 in which many records were broken. With the arrival of investment funds like Softbank and Sequoia, the total amount of investment raised by startups in the region was US$2.8 billion, a four-fold more than the 2020 level, indicating the region is becoming a global hub for investment.

Source: Wamda

In terms of investments by country, almost half of the US$2.8 billion was raised by startups in the UAE which raised US$1.46 billion across 196 deals, securing its position once again as the Middle East's most active startup incubator. Followed by Egypt (136 deals) and Saudi Arabia (138 deals) which are not far behind in terms of the number of deals, the total amount raised lags behind the UAE with US$445 million and US$647 million, respectively. These three nations alone accounted for 75% of the number of deals and 87% of the total investment value.

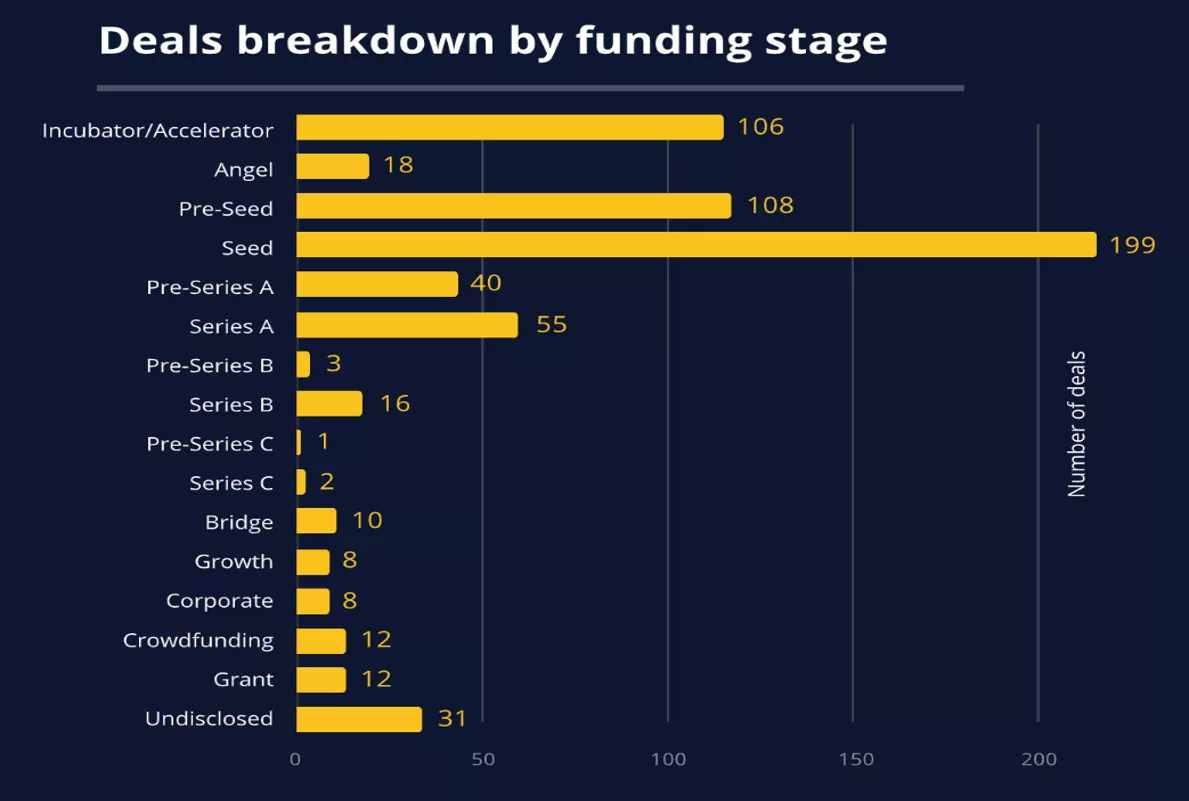

In terms of investment source, capital pouring into startups is largely from MENA-based investors. Investors who come from Saudi Arabia are the most active participants in as many as 214 deals, followed by the UAE with 148 deals and Egypt with 114 deals. In terms of funding stage, accelerators, pre-Seed, and Seed rounds accounted for the bulk of the deals, unveiling a rise in the number of startups that have entered the market.

Source: Wamda

In addition to local investors, 182 deals involved foreign investors. US-based 500 Global Investments (500 Global) was the most active foreign investor with 35 deals across the region. Others from Britain, Germany, and China also engaged in such deals.

A vibrant market

Over the past decade, the MENA region has never been the first choice of investment for global investors due to the outdated image of underdeveloped and lack of opportunity in the region. But things have changed since a broader coverage of the internet has reached the region. It is now home to over 500 million population with more than 400 million people get access to mobile internet and spending more than 3 hours a day surfing, demonstrating great potential for developing the digital industry in this market.

In 2020, the UAE-based voice-centric social and entertainment startup Yalla Group (NY: YALA) gained greater visibility in the market as it was the country's first tech firm to trade publicly in the US. The company's two flagship products, Yalla and Yalla Ludo, are hugely popular among its users in the region led to the company's profitability in 2020. On the day of its US. debut, several UAE dignitaries and royals attended the IPO ceremony to show their support.

In the company's Q3 2021 financial results, it reported revenue of US$71.3 million, net profit of US$25.3 million, and average monthly active users (MAUs) of 25.9 million, achieving positive growth for several consecutive quarters.

Now, let's look at another story. On February 4th this year, Anghami (NQ: ANGH) was officially listed on the Nasdaq after an acquisition of a SPAC (Special Purpose Acquisition Company) called Vistas Media Acquisition Company (VMAC), making it the first Arab company to be listed on the exchange. Anghami is the first legal music streaming platform in the MENA region, giving more than 70 million users in MENA, Europe, and the USA, access to over 57 million Arabic and International songs to stream and download.

A statement released by Anghami showed that the company's revenue increased by 80% over the past three years and is expected to grow by five-fold in the next five years. The cooperation with local telecoms operators and localization strategies were the secret sauces for the company's high growth trajectory. Just as Elie Habib, Anghami's co-founder and Chief Technology Officer, said: "Through 10 years of hard work, we have 58% of the market share in the Middle East market.”

The success of Yalla and Anghami has dawned on investors that the internet boom in the Middle East is undergoing its most fervent stage where a vast of market opportunities and potentials are waiting for exploration. “The next big wave of growth in the next 10-12 years is going to be in emerging markets like MENA,” says Sharif Naseem, founding general partner of venture capital firm Jedar capital.

Supportive policies in place

For a startup to thrive, it is as much about the policy and market environment as it is about the financial backing. At a time when carbon reduction becomes a worldwide policy to tackle climate change and a call for energy shift for new energy, countries in the MENA region that rely on oil production and trade have to rethink the development paths that can help them secure a sustainable economy.

Some countries have already embarked on action plans. Last November, the UAE launched its Entrepreneurial Nation Initiative, aiming to be home to 20 unicorns, or start-ups valued at more than US$1 billion. At the same time, it will also set up an AED 1bn ($272 million in USD) private equity fund for lending to SMEs (small- and medium-sized enterprises) based in the country and operating in strategic sectors. Saudi Arabia has also made strides in finding alternative financing options for startups to positively promote entrepreneurship.

"The UAE, federally and locally, is amending laws because this is the most important factor in attracting capital and also talent," Ahmad Al Falasi, UAE Minister of State for Entrepreneurship and SMEs, said at a conference.

However, the fundamental infrastructures in logistics, e-commerce, and fintech to building up a complete startup ecosystem in the MENA region are far from being well-constructed, which is primarily subjected to difficulty in attracting money to be put into startups and SMEs. Fortunately, regulators across the MENA region have streamlined financing procedures in a bid to activate business activities in the region. With the region is gradually becoming a pool of global capital, enterprises such as Yalla and Anghami which have explored this market early would have the likelihood to grow into a behemoth of their class going forward.

Startups have proven their tenacity and their necessity in the digital era, despite two years of ongoing uncertainty that arose from the COVID-19 pandemic. As the region's ecosystem matures and valuations soar, more investment funds coming to this region are expected. For instance, Sequoia Capital has established a presence in Dubai, and at least 182 venture capital deals last year engaged with foreign investors. Looking forward, there will be more unicorns emerging from this region and land on Nasdaq and Dow Jones.

Reference:

https://www.wamda.com/2022/02/mena-startups-raised-247-million-january-2022

https://www.wamda.com/2022/01/rain-raises-110-million-series-b-funding-led-paradigm-kleiner-perkins

https://www.kdocs.cn/l/cs9MuXIcahD1

https://www.sec.gov/Archives/edgar/data/1794350/000119312521324928/d404040dex991.htm

https://www.wamda.com/2022/01/key-exits-2021-mean-menas-ecosystem

https://www.weforum.org/agenda/2017/09/the-worlds-unbanked-in-6-charts

Disclosure: None.