The Market Is Crazy – January Dividend Income Report

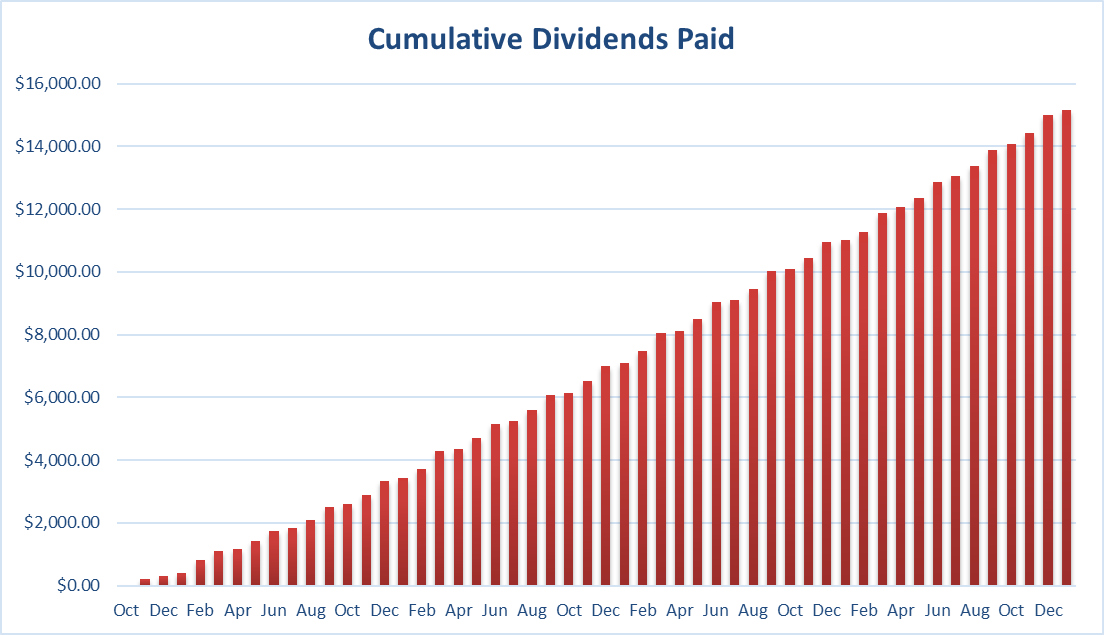

In September of 2017, I received slightly over $100 thousand from my former employer which represented the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all sorts of market conditions. Some months we might appear to underperform, but you must trust the process over the long-term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of Feb. 4, 2022 (around noon):

- Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $217,632.48.

- Dividends paid: $4,174.91 (TTM).

- Average yield: 1.92%.

- 2021 performance: +16.78%.

- SPY= 28.75%, XIU.TO = 28.05%.

- Dividend growth: +3.14%.

- Total return since inception (September 2017 – January 2022): 100.00%.

- Annualized return (since September 2017 – 52 months): 16.99%.

- SPDR® S&P 500 ETF Trust (SPY) annualized return (since September 2017): 16.35% (total return 95.19%).

- iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since September 2017): 11.90% (total return 64.32%).

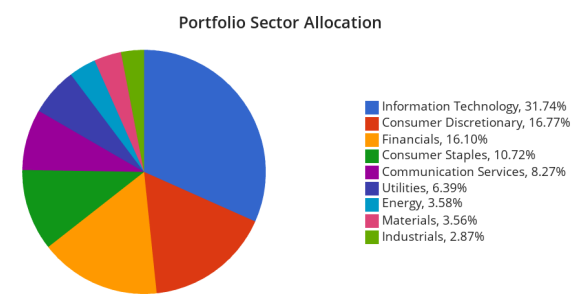

Sector allocation calculated by DSR PRO.

The Market is Crazy (352nd Edition)

If you don’t know that by now, let me write it again: the market is crazy. During the month of January, we saw several days where the market started in one direction (let’s say +1.50% at 11:00 a.m.) to end up in a totally different place (-1% at closing).

That volatility is constantly fueled these days by the vast number of uncertainties:

- Many companies are reporting their earnings. Some show strong earnings, but inflation, chain supply disruption, and the shadow of higher interest rates coming soon are cooling off even the most enthusiastic of investors. We have seen companies reporting amazing results and yet the market is thinking of selling “while it’s time.”

- Speaking of inflation and interest rates, central banks announced the party is over. Both the Bank of Canada and the Fed announced to the market that interest rate increases will come faster than expected. A couple of months ago, they both said they expected to increase rates in the second half of 2022. In January, they changed the narrative to March. The market is still wondering what will actually happen.

- A lot of new investors are facing their first volatile market that doesn’t end with a profit. Everybody is cool with market fluctuations as long as you see your portfolio value going up at the end of the day. In January, that wasn't the case. Following the potential of interest rates going up, growth stocks (including many tech companies) are up for a brutal awakening. New retail investors are likely to go into a panic selling mode.

- Some more experienced investors just forgot what a correction looks like. Again, many wonder how the shares they just bought in the second half of 2021 aren’t showing a double-digit return in January. This illusion of “easy profits” has lasted a while. Now it’s time to remember that even if you are invested 100% in equities, you shouldn’t expect more than 6-7% return each year, not 16% to 27%.

My Strategy for This Volatile Market

If you have been reading my work for a while, you already know the answer: I stick to my strategy. I’ve only been investing for 19 years, but I noticed a major pattern: those who found an investing strategy that works for them and stick to it for decades are the successful investors. For this reason, I’ll stick to being 100% invested and focusing on dividend growers. However, this doesn’t mean I won’t make a few tweaks along the way.

In December, I sold a few shares of Apple (AAPL) and Microsoft (MSFT) along with Lazard (LAZ). I bought more shares of National Bank (NTIOF) and Activision Blizzard (ATVI). I intend to keep my NTIOF shares for decades while ATVI was all about a speculative play. It turned out that ATVI agreed to be bought by MSFT (what comes around turns around).

The price paid is $95 per share, yet ATVI trades around $80 now. What’s happening? The deal is expected to close in 2023. Therefore, you must wait an additional 12 to 18 months (assuming regulators approve the deal) to get the full price. At this point, we are talking about a 20% gain over 12 to 18 months. Considering the volatility of the market, I’ll keep my shares and wait patiently. I doubt the market will give us another double-digit return this year.

My goal in 2022 will be to continue trimming my exposure to information technology. It’s not that I believe the sector won’t do well (quite the opposite), but I’m a firm believer in diversification. With 30% of my portfolio invested in one sector, I’m overexposed.

I’m not in a hurry to make those moves. In fact, as tech stocks are getting hit lately, I might not have to sell that much to get down to around 20%.

Keeping My Eye on Dividend Growers (and on Those Who Omit Dividend Increases)

A while back, I sold my shares of Hasbro (HAS) as the company stopped increasing its dividend. Its dividend triangle was weakening (weaker revenue and earnings growth + no dividend increases). I sold at a good price and made a good profit. My selection was good in 2017, but the business eventually failed to meet my investment thesis.

I recently sold my shares of Lazard based on the same rationale. After a good ride, some generous dividend increases and special dividends, Lazard stopped rewarding its shareholders for their patience. The dividend remained the same since 2019 and management didn’t bother paying a special dividend in 2020 or 2021.

For 2022, I have a few of my holdings on the radar. Gentex (GNTX) remains a strong company with virtually no debt, but the management hasn’t increased the dividend since April of 2020. The last dividend announcement was made in December. I’m waiting for the next announcement to reconsider my position.

I like the business model (dominating a small niche market), but if the stock can’t follow my dividend growth investing focus, I will have no other choice but to cash my profit and move on. I’m not there yet, but I’m sharing my personal notes on the topic. I tend to take those notes and look at a stock for a few more quarters before deciding. However, if the same negative notes happen quarter after quarter, I know that I must make a move.

I will likely be more patient with Sylogist (SYZLF). Why? Because the company is in the middle of a culture shift. They went from a boring/mature business generating lots of cash flow to a hungry-growth-by-acquisition business. I’m willing to wait and see what will happen next. Chances are the dividend won’t increase in 2022 as management is more interested in acquiring other businesses.

SYZLF operates in fragmented markets and it’s relatively easy to find bolt-on acquisitions that will immediately generate positive earnings. That’s enough for me to be patient for now.

The last one on my “kill list” is Andrew Peller (ADWPF). Andrew Peller was once a great trade (back in 2018) as it was in growth-by-acquisition mode. Since then, the dividend triangle is fading, and the only thing left is the dividend growth.

We all know that it’s not possible for a business to keep increasing the shareholders’ paycheck if it doesn’t generate more revenue and more earnings. I’ll wait one or two more quarters before pulling the plug on this one.

Let’s look at my Canadian portfolio. Numbers are as of Feb. 4, 2022 (around noon):

Canadian Portfolio (CAD)

|

Company Name |

Ticker |

Market Value |

|

Algonquin Power & Utilities |

AQN |

6,057.93 |

|

Alimentation Couche-Tard |

ANCTF |

19,177.78 |

|

Andrew Peller |

ADWPF |

4,711.44 |

|

National Bank |

NTIOF |

12,475.10 |

|

Royal Bank |

RY |

8,784.60 |

|

Brookfield Renewable |

BEP |

1,758.96 |

|

CAE |

CAE |

6,330.00 |

|

Enbridge |

ENB |

8,830.85 |

|

Fortis |

FTS |

5,914.26 |

|

Intertape Polymer |

ITPOF |

7,431.00 |

|

Magna International |

MGA |

7,012.60 |

|

Sylogist |

SYZLF |

5,212.50 |

|

Cash |

|

297.54 |

|

Total |

|

$93,994.56 |

My account shows a variation of +$1,313.61 (+1.41%) since the last income report on Jan. 3. Considering the Canadian market has been going sideways (besides the oil & gas industry), I’d say that a jump of 1.4% in value is pretty good. However, this doesn’t mean much as the year just started (and my US stocks aren’t doing that well).

Here’s my US portfolio now. Numbers are as of Feb. 4, 2022 (around noon):

U.S. Portfolio (USD)

|

Company Name |

Ticker |

Market Value |

|

Activision Blizzard |

ATVI |

9,188.36 |

|

Apple |

AAPL |

12,915.75 |

|

BlackRock |

BLK |

11,254.25 |

|

Disney |

DIS |

6,331.05 |

|

Gentex |

GNTX |

7,322.60 |

|

Microsoft |

MSFT |

16,779.95 |

|

Starbucks |

SBUX |

8,049.50 |

|

Texas Instruments |

TXN |

8,492.00 |

|

VF Corporation |

VFC |

5,113.53 |

|

Visa |

V |

11,292.75 |

|

Cash |

|

29.18 |

|

Total |

|

$96,768.92 |

The US total value account shows a variation of -$6,873.82 (-6.63%) since the last income report on Jan. 3. I’m paying the price for having strong exposure to the information technology sector. Microsoft, Apple, Texas Instruments (TXN), and Visa (V) all took a beating this past month (along with many other tech stocks).

Let’s take a look at the most recent quarter’s results for my US holdings.

Activision Blizzard Surges as Microsoft Will Pay the Big Bucks

Activision was #1 on our DSR buy list for January. A few days later, Microsoft announced it agreed to acquire ATVI for $95/share. This is quite an offer as it would become Microsoft’s largest acquisition in its history ($68 billion). ATVI would not only transform MSFT into the third-largest player in the gaming industry, but it would also open the doors to the metaverse.

The deal is expected to close in 2023. ATVI shares have been recently trading at around $81. I’ll hold my shares until they attain a stock price over $90. I’ve discussed ATVI more in-depth previously.

Apple Killed It Once Again

Apple did it again and reported EPS up 25% and revenue up 11% to beat all expectations. Despite ongoing issues affecting the availability of supplies used in some of its products, the company is still managing to turn in the strongest sales in its history. Imagine what will happen when supply issues are solved.

iPhone sales were up 9%, Mac +24%, iPad -38% (the only segment down this quarter), Wearable and home & accessories +13%, and Services +24%. Analysts were pleased and many raised their target price for Apple. We wouldn’t be surprised if AAPL breaks new record high prices this year.

BlackRock (BLK) dominates the market. While the market wasn’t impressed by BlackRock’s results, we have a different opinion at DSR. The world’s largest asset manager completed a fantastic year with a 20% revenue increase for the year and 31% EPS growth. In Q4, EPS growth was modest (+2.4%), mostly related to higher expenses (revenue was up 14%). The company now manages over $10 trillion in assets.

Management also announced an 18% dividend increase bringing the dividend to $4.88/share. BlackRock should be in a strong position to help their clients wade through troubled waters as the market appears to be getting more nervous each week. Since the price drop recently, we upgraded our PRO rating to 5 on this stock.

Gentex is still struggling with supply chain disruptions. The company reported sales declines of 20% as results were impacted by a reduction in light vehicle production in the company’s primary markets of North America, Europe, Japan, and Korea. Again, can you say “supply chain disruption?” Unfortunately, no dividend increases were announced in the press release. Let’s hope it’s coming in the coming months.

Microsoft is the ultimate beast. MSFT reported another impressive quarter with 20% revenue growth and 22% EPS growth. Microsoft’s revenue from Productivity and Business Processes was $15.9 billion, up 19% year-over-year, aided by Office 365, which now has 56.4 million subscribers.

Revenue from the Intelligent Cloud was $18.3 billion, up 26% year-over-year, while Personal Computing, which includes Windows, rose 15% year-over-year to $17.5 billion. The company also agreed to acquire Activision Blizzard for $68 billion. The transaction is expected to close in 2023. This will open the door to more growth in the gaming industry.

Starbucks Keeps Up with Their Same Strategy - And it Works!

SBUX reported Q4 2021 comparable store sales increased 17%, driven by a 15% increase in comparable transactions and a 2% increase in the average ticket. North American comparable store sales increased 22%, while International comparable store sales increased 3%.

The company opened 538 net new stores in the fourth quarter of fiscal 2021, yielding 4% year-over-year unit growth, ending the period with a record 33,833 stores globally, of which 51% and 49%, respectively, were company-operated and licensed.

Stores in the U.S. and China comprised 62% of the company’s global portfolio at the end of the fourth quarter. In the meantime, the SBUX stock price has been down almost 20% since the beginning of the year. This may be a good buying opportunity.

Texas Instruments (TXN) reported solid numbers, too. TXN beat EPS and revenue growth expectations with double-digit growth. Revenue increased 19% from the same quarter a year ago driven by strong demand in industrial and automotive markets. Analog revenue grew 20% and Embedded Processing grew 6% from the year-ago quarter.

For the first quarter, Texas Instruments said it expects revenue to be between $4.5 billion and $4.9 billion, with earnings between $2.01 and $2.229 per share, with an operating tax rate of about 14%. The stock has been down from its peak level ($200), but there is more growth to come in 2022 for TXN.

VFC Reports Double-Digit Growth, but Doesn’t get Any Love

VFC reported Q4 2021 revenue increased 22% to $3.6 billion. Excluding acquisitions, revenue increased 15%. Active segment revenue increased 25% including an 8% increase in Vans brand revenue and a 17% revenue growth contribution from acquisitions. Outdoor segment revenue increased 23%, including a 28% increase in The North Face brand’s revenue.

Work segment revenue increased 6%, including a 4% increase in Dickies. International revenue increased 19%, while Direct-to-Consumer revenue increased 30%. Full-year fiscal 2022 revenue is now expected to be approximately $11.85 billion, reflecting growth of around 28%, including an approximate $600 million contribution from the Supreme brand.

The stock price keeps going down as investors were disappointed with their lower margins. I guess it’s all about expectations, right?

I Thought Visa was Dead Money, Right?

Not too long ago many thought Visa was on a declining path. Amazon wanted to ban Visa in the UK, but that only lasted a minute before they changed their mind. Visa recently reported an amazing quarter with EPS up 27% and revenue up 24%. Strong results were supported by card transactions increasing year-over-year during the card network’s fiscal Q1 and cross-border volume continuing to rise.

Payment volumes rose 20% year-over-year in constant dollars with cross-border volume up 40% and processed transactions up 21%. Visa has proved to the market that it’s still the dominant player in the payment processing industry.

My Entire Portfolio Updated for Q4 2021

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period.

We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. Results have been updated as of January 2022.

Download my portfolio Q4 2021 report.

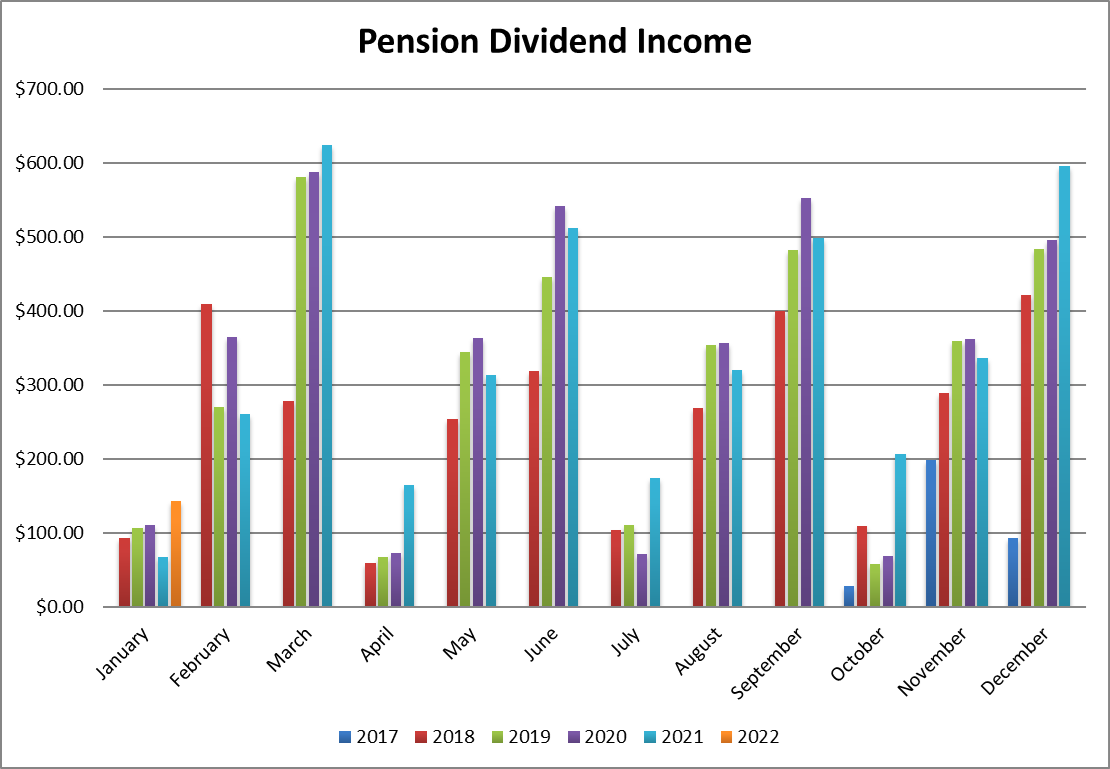

Dividend Income: $143.71 CAD (+112% vs. January 2021)

Wow. This is a nice jump, but it’s not really dividend growth. The bulk of the increase comes from my new position in Algonquin. Nevertheless, this is definitely a good start for 2022.

Here’s the detail of my dividend payments. Dividend growth (over the past 12 months):

- Andrew Peller: +14.3%.

- Algonquin: new dividend.

- Gentex: +0%.

Canadian Holding payouts: $107.72 CAD.

- Andrew Peller: $36.04.

- Algonquin: $71.68.

U.S. Holding payouts: $28.20 USD.

- Gentex: $28.20.

Total payouts: $143.71 CAD.

Please note that I used a USD/CAD conversion rate of 1.2761.

Since I started this portfolio in September 2017, I have received a total of $15,152.84 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio,” as no capital can be added into this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I often say that the yield on cost (the dividend yield you get based on the amount invested instead of the current value) is a “feel-good metric.” It’s fun to claim you are getting a huge yield on your amount invested, but in reality, if you receive $10 thousand on a $300 thousand portfolio, you are getting a 3.33% yield, even if you only invested $100 thousand 15 years ago.

However, this metric shows you how “well” you have done so far. When I look at my current yield, I’m close to 2%. When I look at my yield on cost, I’m getting a yield over 3.8%. This tells me a lot about my investment returns over the past four years. Dividend growth investing works, and I’ll stick with that strategy forever.

Disclaimer: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to have full access to 12 real-life portfolio models, readers can also ...

more