The Impact For The JPY On A BoJ Rate Change

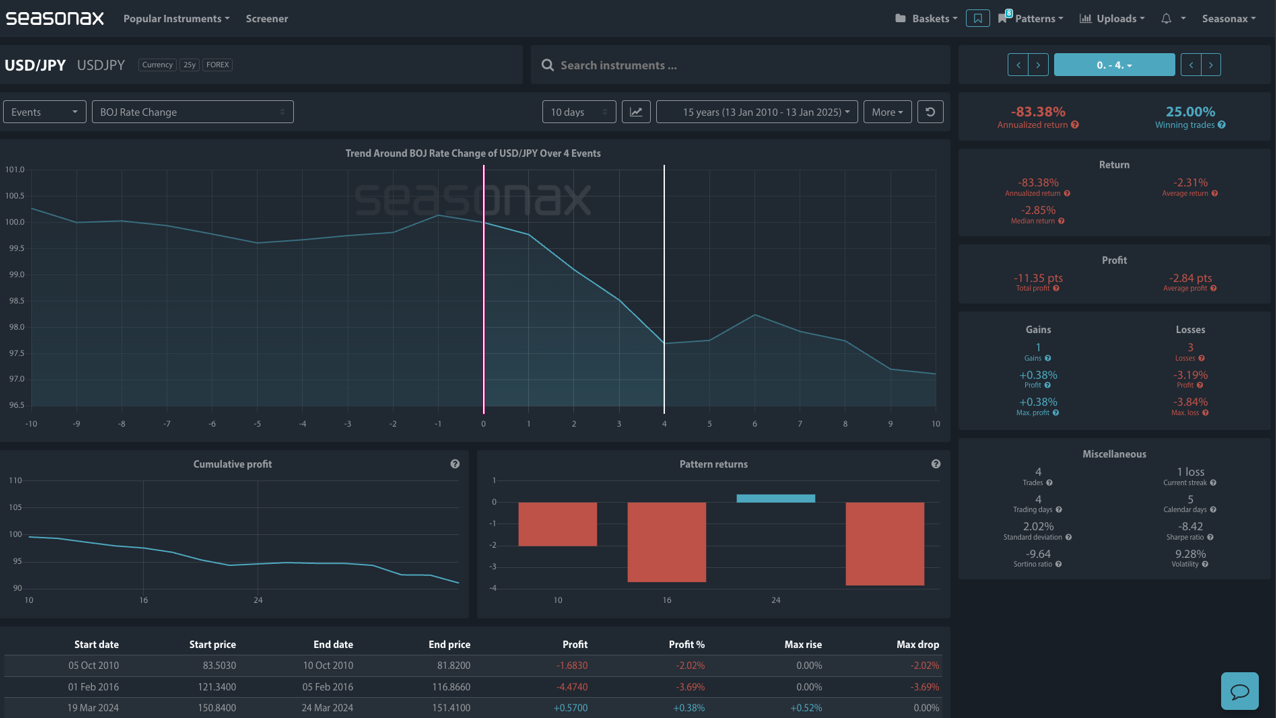

Instrument: USDJPY

Maximum fall: -3.84%

Timeframe: 4 days after a BoJ rate change

Winning Percentage: 25%

The Bank of Japan (BOJ) is scheduled to announce its monetary policy decision on January 24. Recent economic indicators suggest a potential shift in the BOJ’s stance. Deputy Governor Ryozo Himino has indicated that the BOJ will consider raising interest rates in their upcoming policy meeting, motivated by expectations of sustained wage growth and an anticipated clearer U.S. policy direction from President-elect Donald Trump’s inaugural speech on January 20.

If the BOJ proceeds with the anticipated rate hike, it could have significant implications for the USD/JPY exchange rate. Historically, interest rate differentials between the U.S. and Japan have been a key driver of the USD/JPY currency pair. An increase in Japanese interest rates would likely make the yen more attractive to investors, potentially leading to yen appreciation against the U.S. dollar. Conversely, if the BOJ maintains its current rate, the yen may continue to weaken against the dollar. In August 2024, the BOJ increased its interest rate to 0.25%, ending a prolonged period of negative rates. This decision contributed to the yen strengthening against the dollar. STIR markets currently see a 59% chance of a BoJ rate hike. Will we see JPY strength if the BOJ go ahead with a 0.10% rate hike? Watch out for surprises too – if the BoJ hike by 0.20% or more the JPY could strengthen rapidly.

(Click on image to enlarge)

Technically, the closer the USDJPY gets to overhead resistance at 160 the more chance there is of verbal intervention to push the JPY higher and the USDJPY lower from BoJ speakers. The BoJ do not like it when the USDJPY gets too strong as that makes it more tricky for Japanese importers. Note that key support sits at 153 where the 100 and 200 EMA sit on the daily chart.

(Click on image to enlarge)

Trade risks

The main risk is that the BoJ don’t hike rates on January 24 and that sends the USDJPY higher.

Video Length: 00:02:14

More By This Author:

Is USD/JPY Set for Seasonal Gains On Q1?Can United Airlines Boost Its Share Price With Starlink?

Santa Rally Coming To Town?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more