The Holders Of France's Debt Must Remain Secret, According To The Senate

Those who demand greater transparency in the name of democracy will be disappointed. The public debt is mainly held by foreign investors, but it is impossible to know which countries and in what proportions. I have long lamented this fact – first in my books on debt, then in this article from August 2024, in which I attempted to reconstruct this list based on the countries visited by Agence France Trésor.

The information is kept secret for good reasons, according to a Senate report entitled “On the issues associated with the structure of government debt”, published on September 24, 2025. We are asked to comply. However, the United States publishes this data on the Congress website. Moreover, France appears there with $332 billion. But for the French authorities, the answer is no.

To be clear, we are talking here about government debt, strictly speaking:

"In the first quarter of 2025, France's public debt stood at €3.3454 trillion, or 113.9% of gross domestic product (GDP). Of this total, the debt of the central government (the state and various central government agencies) amounted to €2.7931 trillion, or 83.5% of France's total debt. The debt of local public administrations (local authorities and their public institutions) amounted to €262.5 billion, or 7.8% of total debt, and that of social security administrations reached €289.9 billion, or 8.6%. The state's debt alone amounted to €2,723.4 billion, corresponding to 81.4% of France's total debt.

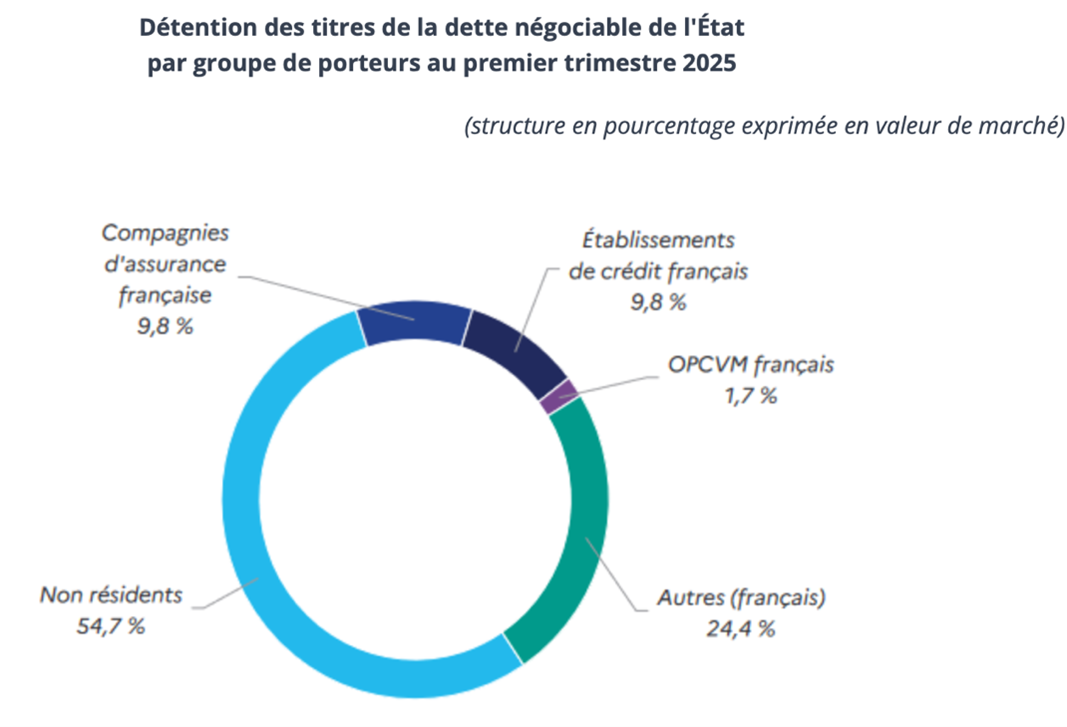

Here are the holders (the graph is taken from the report):

“Non-residents” refers to foreign holders – the majority, therefore – while the “others” category corresponds to the Bank of France, which holds around a quarter of the government debt. These securities were acquired as part of the purchase programs decided by the European Central Bank (ECB) following the subprime, Greek, and Covid crises. This is literally money printing, as the money to acquire these Treasury bills is created ex nihilo on this occasion, which then generates inflation. These purchases have now been halted. However, if France were to experience a debt crisis and no longer be able to finance itself on the markets, they would certainly resume, subject to certain conditions. But that's another story.

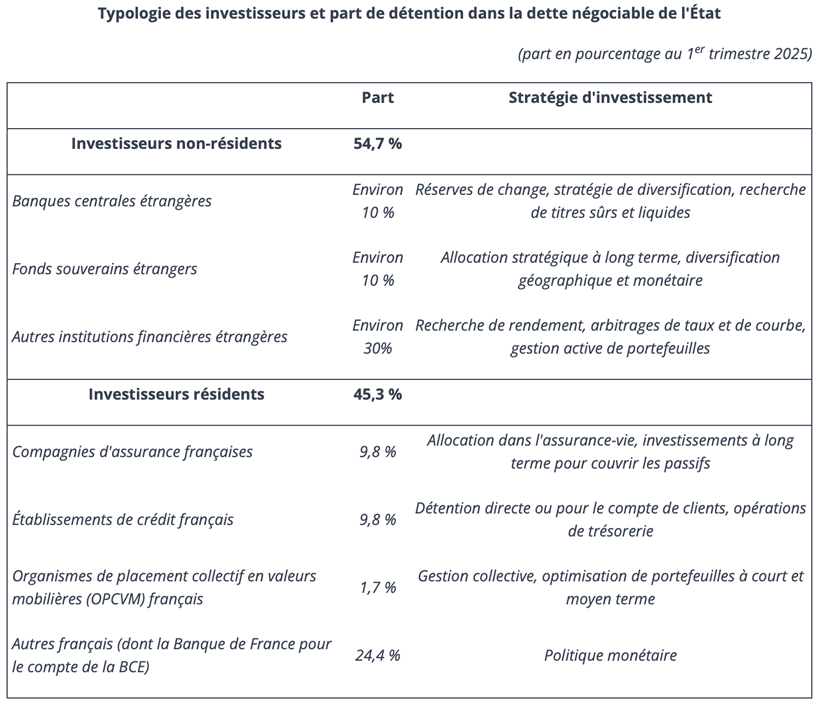

We are nevertheless entitled to an interesting typology of investors:

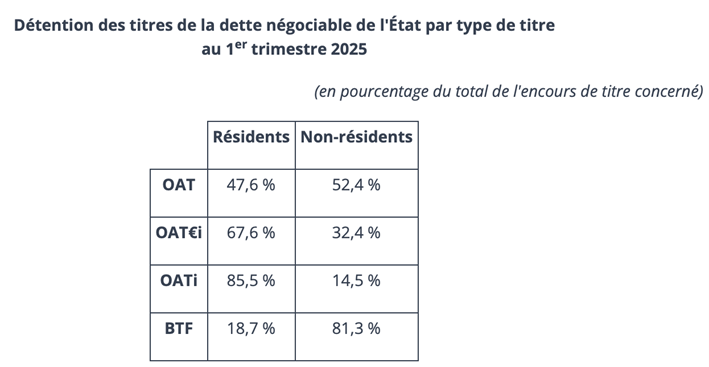

This report also reveals that “non-residents” hold 81.3% of short-term debt (BTF) – securities that are easy to resell. And this is precisely what worries senators, the French Ministry of Finance, and the government: a loss of confidence among international investors would cause interest rates to skyrocket immediately. This is particularly worrying given that the debt burden will reach €100 billion within a few years.

So we mustn't upset these people: “Demand from international investors can be more volatile and sensitive to any changes in economic conditions or perceptions of risk on expected returns.”

The first thing to do is to avoid following Donald Trump's lead on tariffs and to back down if the terms of trade are unfavorable to us. The report acknowledges:

"Rumors of using debt holdings as a means of exerting pressure on the United States have thus emerged in a particular geo-economic context, after the US administration unilaterally and arbitrarily increased tariffs against almost all countries in the world. However, there is no reason to believe that France would take a similar decision against its trading partners, if only because trade policy falls within the competence of the European Union."

And precisely, another factor could scare off these international investors: exposing them to public scrutiny. However, the law is clear: “Under current French law, Article L. 228-2 of the Commercial Code provides that any legal entity issuing bonds or negotiable debt securities other than public law entities may identify the holders of the securities concerned by name.” But the fact is that this law will not be respected, because the report states in black and white that “New constraints adopted unilaterally with regard to the identification or geographical origin of investors would affect the attractiveness of French debt and lead to an increase in its cost to the public finances.”

The report goes even further: “In view of these increased pressures on public finances, and given that deficit financing is heavily dependent on the attractiveness of French debt on the bond markets, it is important to refrain from any ill-advised initiatives that would affect investor confidence, particularly among non-residents.”

We would not want to discover – these are just hypotheses that I examined in my article – that a tax haven like Luxembourg is fond of our debt, just like the already very present Qatar. Or even the world's leading producer of cannabis resin, Morocco.

In short, let's censor the information, the Senate tells us.

More By This Author:

Silver: “Reset” Underway In A Frozen MarketBig Picture Silver Charts Point To Triple-Digit Prices

From Monetary Metals To Strategic Metals: The End Of A World Based On Trust

Disclosure: GoldBroker.com, all rights reserved.