The Great BOJ Rotation In Place Of QE Exit

The latest nail in the coffin of beleaguered BOJ Governor Kuroda came in the form of unattributed leaks from his colleagues. These leaks assert that the BOJ will lower its inflation forecast, whilst simultaneously keeping the current monetary stimulus at the same level. The signal is that Kuroda wishes to patiently press on with his journey to hit his inflation target and that this journey just lengthened in time. The problem for Kuroda is that he does not have the luxury of time on his side. If anything, his growing list of critics will use this, inflation forecast lowering and lack of monetary policy response, as a symbol of failure that will cost him his job. Kuroda is increasingly being framed as out of touch with what it takes to perform his part of the initiative known as Abenomics.

Former BOJ Board member and architect of QE Nobuyuki Nakahara was observed in the last report inflicting damage to the straw man figure that BOJ Governor Kuroda has now been framed as. Further damage has now been inflicted by close Abe confidante Etsuro Honda, who has openly called for a change of BOJ Governor. Previously in January of this year, Honda had been for Kuroda, so his recent change of heart may owe more to the deteriorating fortunes of Prime Minister Abe than anything the BOJ Governor is guilty of. Abenomics apparently needs to be refreshed, but the current global central bank imperative to scale back QE to deflate asset bubbles does not provide much potential for Japanese monetary policy rejuvenation. Abe’s recent dismal local election failures and deteriorating public image offer little scope for refreshment in the political arena either; which means that he may have to default to fiscal policy to rebuild his political capital.

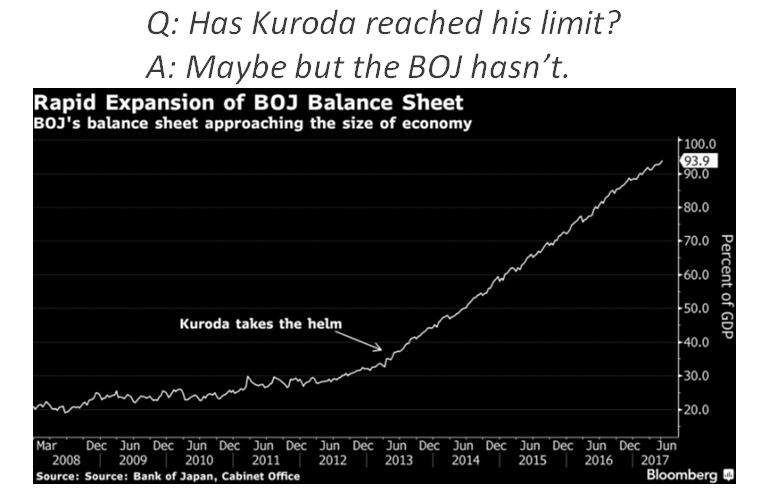

A new BOJ Governor is expected to symbolize said rejuvenation, even though there is little that said new Governor can do in the way of radically new policy to confirm this. Honda basically said as much, when he acknowledged that the current global asset bubble deflation mission cannot be avoided. He also concurred very closely with Nakahara’s prognosis that any BOJ QE exit should be postponed for as long as possible. Nakahara had set this at five years. Honda hinted that there will now be a fiscal stimulus, to pick up the heavy lifting; and that this will be deficit negative since it will not be mitigated with a sales tax increase. Evidently Japan is going to use fiscal policy to weaken the Yen and boost inflation and the BOJ will be required to enable this with its balance sheet.

The problem is that the BOJ’s balance sheet is encumbered with too many ETFs, which will need to be sold in order to make way for the fiscal stimulus JGBs. The BOJ is bound to join the global central banks in de-risking the global economy, so it would appear that it intends to do this by replacing ETF’s with JGBs. Currently there is a lack of JGB supply, which has forced the JGB to purchase ETFs. Going forward, a fiscal stimulus will provide more JGBs for the BOJ to buy. In the last report Nakahara suggested that the BOJ should lighten up on ETFs as its contribution to global macro-stability. Clearly this move, if it occurs, will be made to make way on the balance sheet for JGB purchases to enable the fiscal stimulus. A new BOJ Governor who can articulate this strategy to the markets and stand up to America, when the accusations of currency manipulation come, is therefore needed, in the eyes of Nakahara and Honda. Abe could also do with a scapegoat, to deflect the scrutiny away from his recent political failings. Cue the burning of the straw-man Kuroda.

(Source: Seeking Alpha)

The case against Kuroda is becoming compelling. Kuroda maybe down, but he is not out, and still has a few tricks left up his sleeve. In anticipation of the switch of ETFs for JGBs, the BOJ’s recent open market operations signalled an unlimited debt purchase to the market. This bid for JGBs was made on the eve of the US June Employment Situation report; and immediately following a period of global bond selling following the publication of minutes of the last FOMC and ECB Governing Council meetings. The BOJ wishes to make a policy distinction between itself and its other developed central bank peers. Mr Kuroda has stated clearly that the BOJ will not be following any Fed and ECB reduction in QE stimulus. He has also provided the bid for JGBs that will enable future fiscal policy expansion by the MOF and the switch of ETF to JGB purchases by the BOJ to support this. The weakening of the Yen, through the suppression of JGB yields, will also provide support for the ETF bid that the BOJ will be hitting as it switches its balance sheet holdings. There is clearly more coordination between the BOJ and the MOF than Kuroda’s critics have recently given him credit for.

Interestingly the Ministry of Finance (MOF) does not wish to signal any change in fiscal policy stance to its trading partners, specifically America. It is therefore business as usual at the MOF as far as external observers are concerned. The MOF’s top diplomat for international affairs aka Currency Tsar Masatsuga Hasakawa will retain his position for another year. Japan may wish to maintain the continuity in communications with its trade partners, if it repositions the BOJ’s balance sheet to effectively monetise an expanded fiscal deficit, just in case it comes under heavy criticism for currency manipulation. If and when fiscal policy is expanded, whilst the developed central banks ex-BOJ are normalizing, Mr Hasakawa may opine that fiscal policy is doing the heavy lifting in the absence of monetary policy. What he says when the BOJ then starts buying up the JGB proceeds of the fiscal expansion will be more interesting to hear.

Very interesting, thanks for posting!!

I'm new to TM. Thanks for reading and also thanks for being my first commenter Yash.