The Global Decline In Consumer Confidence

Charting the Global Decline in Consumer Confidence

Our plans to buy new things, travel, invest, and save money, all rely on one crucial factor—our ability to pay for it.

This ability in turn is dependent on not just our current savings, but our expected income and confidence in the economy, i.e. consumer confidence.

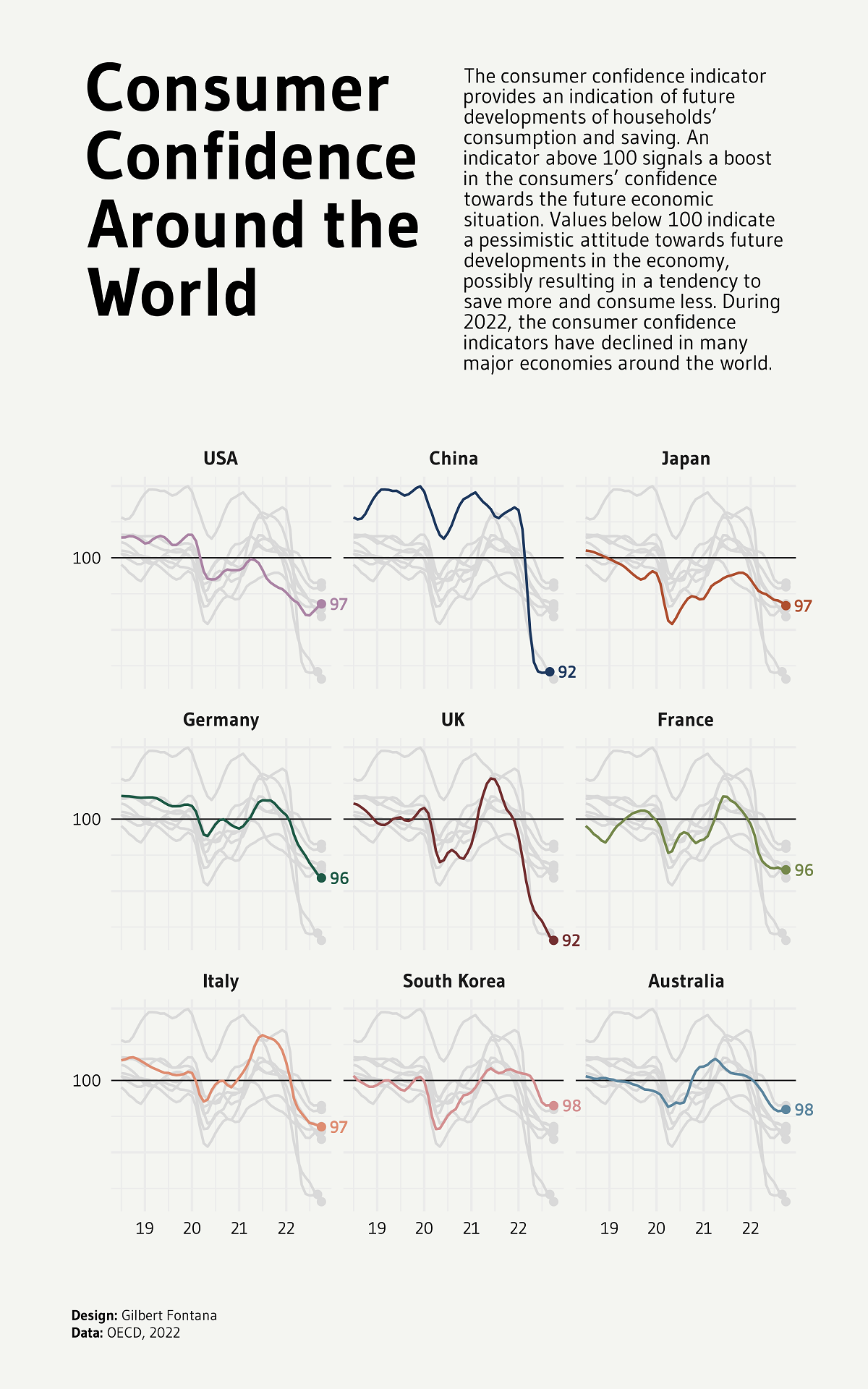

This graphic by Gilbert Fontana uses OECD data from 2019‒2022 to chart the rise and fall of consumer confidence in nine major economies.

What is Consumer Confidence?

Measured at a base value of 100, the Consumer Confidence Index takes consumers’ expectations and sentiments about their financial futures into account to indicate household consumption and saving patterns in the future.

An indicator above 100 means that there is a boost in people’s confidence towards economic prospects. This means that they are less likely to save and more inclined to spend money in the near future.

On the other hand, a value below 100 indicates that consumers are pessimistic about their economic standing in the future. This can result in them saving more and spending less.

Inflation, job losses, and expectations of a not-so-bright financial future can shake this confidence, making consumers think twice about their consumption.

Global Consumers are Becoming Pessimistic

After falling down and quickly recovering during the COVID-19 pandemic in 2020, consumer confidence seems to be trending downwards across the globe.

The UK was hit the worst as its Consumer Confidence Index (CCI) dropped down to 92 in 2022, from 100.6 in 2021. Just behind is China, which also fell to 92 in 2022 despite sitting at 103 two years prior.

The remaining countries had CCIs between 96‒98, including France, Germany, and the U.S.

Even with the most optimistic populations and a CCI of 98, South Korea and Australia, were below the ideal 100 mark and indicated pessimism.

The main culprits of this declining confidence in global economic markets including expectations of rising inflation—especially for food and gas—as well as high interest rates, the threats of a looming recession, and layoffs in major sectors.

More By This Author:

Mapped: The World’s Major Earthquakes From 1956‒2022Super-Sized Super Bowl Bets 2013-2022

Decoding Google’s AI Ambitions, Anxieties

Disclosure: None.