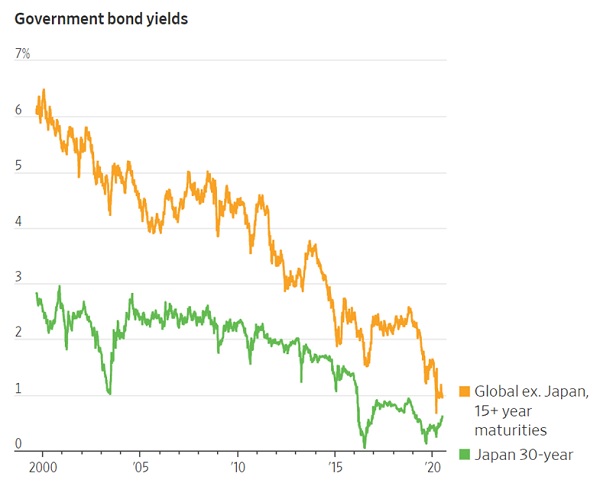

The Global Bond Market Is Turning Japanese, As All Long-Term Rates Plunge Towards Zero

For the bond markets, Covid-19 is apparently a great equalizer. Before the pandemic, Japan’s long-term interest rates were much lower than those of most other countries’, in part because Japan has been deeply in debt – and therefore under pressure to finance that debt with low interest rates – longer than the US and Europe.

But now that everyone has to finance surreal large deficits, government bond yields are falling almost everywhere – except Japan – which raises some interesting questions.

Could this mean that out on the distant end of the yield curve, the seemingly obsolete “zero bound” concept still has some relevance?

Maybe. It seems that as bank deposit interest rates fall, Japanese banks are unable to make money lending longer-term at also ever-lower rates. So long rates can’t fall further without decimating the banks. And the banks, as everyone knows, are the economy.

What happens when everyone else’s interest rates fall to Japan’s level? Lots of bad things, including:

Central banks lose the ability to lower rates to counter future recessions. Normally, it takes a reduction of five or so percentage points to re-ignite growth. Those days, at least for the long end of the curve, may be over.

Meanwhile, central banks have already bought up most of the world’s sovereign bonds in order to push rates down to current levels, so QE in its current form is also a spent force. The Fed and its peers will have no choice going forward but to start buying other assets like stocks and real estate (and junk bonds, which for some inexplicable reason the Fed is already buying).

Central banks manipulating stock prices pretty much brings down the curtain on capitalism as we used to know it. With equities no longer measuring anything other than central bank appetite, entrepreneurs will be flying blind, which means ever-more-massive misallocation of capital, which means an end to rising societal wealth and eventual financial collapse, etc. You know that story.

With monetary policy out of the game, governments will be forced into even greater paroxysms of fiscal stimulus, most of which will – like the bets of the aforementioned blind entrepreneurs – be mostly malinvestment. Wasted money all around, with wildly inadequate resulting cash flow.

Somewhere along the way Modern Monetary Theory, in which direct money printing replaces borrowing and spending, might be adopted. But it hardly matters. We’re already pretty much there when central banks buy government bonds and rebate the interest back to the issuer.

So all roads lead to the printing press. And when the pressure of the whole crazy show falls onto currencies – a very narrow set of shoulders – it’s game over.

The above chart shows this game to be in its very late innings.