The German Economy Continues To Show Positive Data

During both yesterday's and today's session, we discovered different macroeconomic data related to the German economy, each of which has been very positive in terms of present and future expectations. Not only does it represent better data than that of the previous month, but it also exceeds market expectations.

On Thursday, we learned of the data from the German IFO regarding business expectations, the current situation and the business confidence index. Specifically, we were able to find the following data:

- Business expectations reached 104 points after rising 1.1 points with respect to the last month, thus surpassing market expectations that stood at 103.9 points. This is a sub-index of the German Ifo business index that measures business expectations in Germany for the next six months.

- The current situation index in Germany was set at 99.6 points against the 97.8 points expected, so we can see that the current business conditions in Germany are very positive according to the respondents.

- For its part, the IFO business confidence index is a survey that is carried out approximately 7000 companies and also exceeded market expectations after scoring a rise of 2.6 points with respect to the previous month reaching the figure of 101.8 points, compared to the 100.6 points expected.

In today's session on Friday, we have also known about the GfK index of German consumer climate, which measures the level of consumer confidence in economic activity. As it measures the willingness of consumers to spend their money, an increase in this indicator allows for favorable economic expectations. Today's data has not only been better than the previous data, but it has also been better than expected by the market consensus, standing at -0.3 versus the -4 expected.

Despite such positive macro data, in today's session the DAX30 is trading almost flat with a slight decline of 0.10% at the moment, although in yesterday's session it managed to finish with a rise of 0.86%.

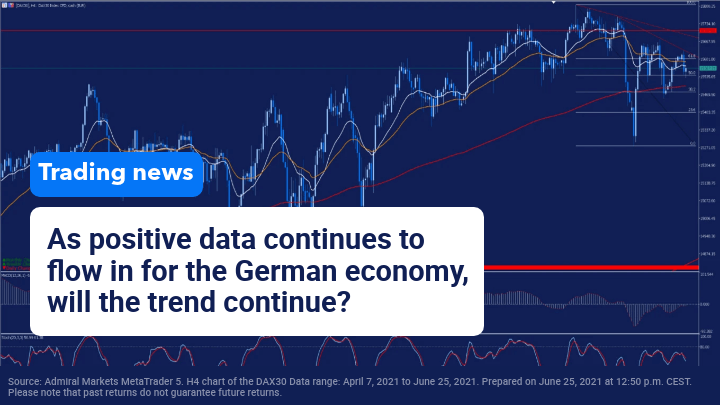

Technically speaking, if we look at the H4 chart in the last few sessions, we can see how the DAX30, after marking historical highs on June 14, performed a consolidation that led it to make a bearish average crossing in H4 and to temporarily lose its average of 200 in the red, although it finally managed to bounce higher.

Currently, the DAX30 has two major resistance levels represented by short-term downtrend lines in the red. The break of these levels could open the door to a new upward momentum in search of its all-time highs. Conversely, if the price loses its average of 200, we could find a further correction to the weekly lows.

(Click on image to enlarge)

Source: Admiral Markets MetaTrader 5. H4 chart of the DAX30 Data range: April 7, 2021 to June 25, 2021. Prepared on June 25, 2021 at 12:50 p.m. CEST. Please note that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 3,6%

- 2019: 25,48%

- 2018: -18,26%

- 2017: 12,51%

- 2016: 6,87%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more