The FTSE Finish Line - Wednesday, Oct. 29

Image Source: Pexels

London stocks soared on Wednesday, with the prestigious FTSE 100 hitting an all-time high for the second day in a row. The rally was fuelled by upbeat outlooks from pharmaceutical giant GSK and retail powerhouse Next, adding momentum to the market's winning streak. Attention is now turning to the upcoming monetary policy meeting of the U.S. Federal Reserve. Traders anticipate a 25-basis-point reduction in interest rates and will closely analyse comments from Chair Jerome Powell for insights into the future policy direction. In stock market news, Glencore's shares increased by 6.2% following a third-quarter production report that indicated a 36% rise in copper output compared to the previous quarter. Gold miner Fresnillo saw a 6.5% increase after brokerage Peel Hunt elevated its target price from 1,493 pence to 1,954 pence. Precious metal miners experienced a 4.5% rise, leading sector gains, in line with a rebound in gold prices. Additionally, data from the Bank of England revealed that lenders granted more mortgages in September than in any month thus far in 2025, which may help alleviate recent caution in the housing market ahead of Finance Minister Rachel Reeves' budget announcement next month.

As with the Fed balance sheet, the BoE balance sheet is shrinking due to gilt QT and the winding down of the TFSME, a pandemic-era small business lending programme. With the four-year limit on the last TFSME loans approaching, outstanding balances are expected to drop from ~£65bn to ~£43bn, implying over £20bn in repayments. While this reduces the BoE balance sheet, its repo operations provide liquidity to offset lost TFSME funding. Yesterday’s six-month repo (ILTR) saw record participation at £7bn, and further usage is expected in short-term repos. The BoE aims to stabilise gilt repo rates, which have recently risen to 20-25bps over SONIA, closer to the policy target.

Shares of British pharmaceutical company GSK increased by 2.2% to 1,679.5 pence. The stock is one of the leading gainers in the FTSE 100 index. GSK has raised its full-year sales growth forecast to a range of 6%-8%, up from the previous estimate of 3%-5%. The company anticipates core earnings per share growth between 10% and 12%. For the third quarter, GSK reported core earnings of 55 pence per share, exceeding the company-compiled consensus of 47.1 pence per share. As of Tuesday's market close, GSK's stock has gained 22% year-to-date, compared to an 18.64% increase in the FTSE 100.

Glencore shares rise 5.9% to 351.450p, outperforming the FTSE 100, which is up 0.41%. Q3 copper output increased 36% QoQ to 239.6 kt, supported by KCC and Mutanda in Congo, and Antamina and Antapaccay in Peru. FY copper production guidance is tightened to 850-875 kt, and energy coal guidance is raised to 92-97 mt. Steelmaking and energy coal volumes are expected in the mid to upper guidance ranges. FY marketing adj EBIT is anticipated at $2.3 bln to $3.5 bln, against last year's $3.2 bln. Year-to-date, the stock has fallen 0.55%, while the FTSE 100 has gained 18.64%.

WH Smith shares fell 1.13% to 702p as the company postponed FY results to December 16 from November 12, pending Deloitte's financial review conclusion by November 2025. The review was initiated after a financial discrepancy of about £30 million ($40.26 million) was discovered. The stock has dropped 40.29% year-to-date.

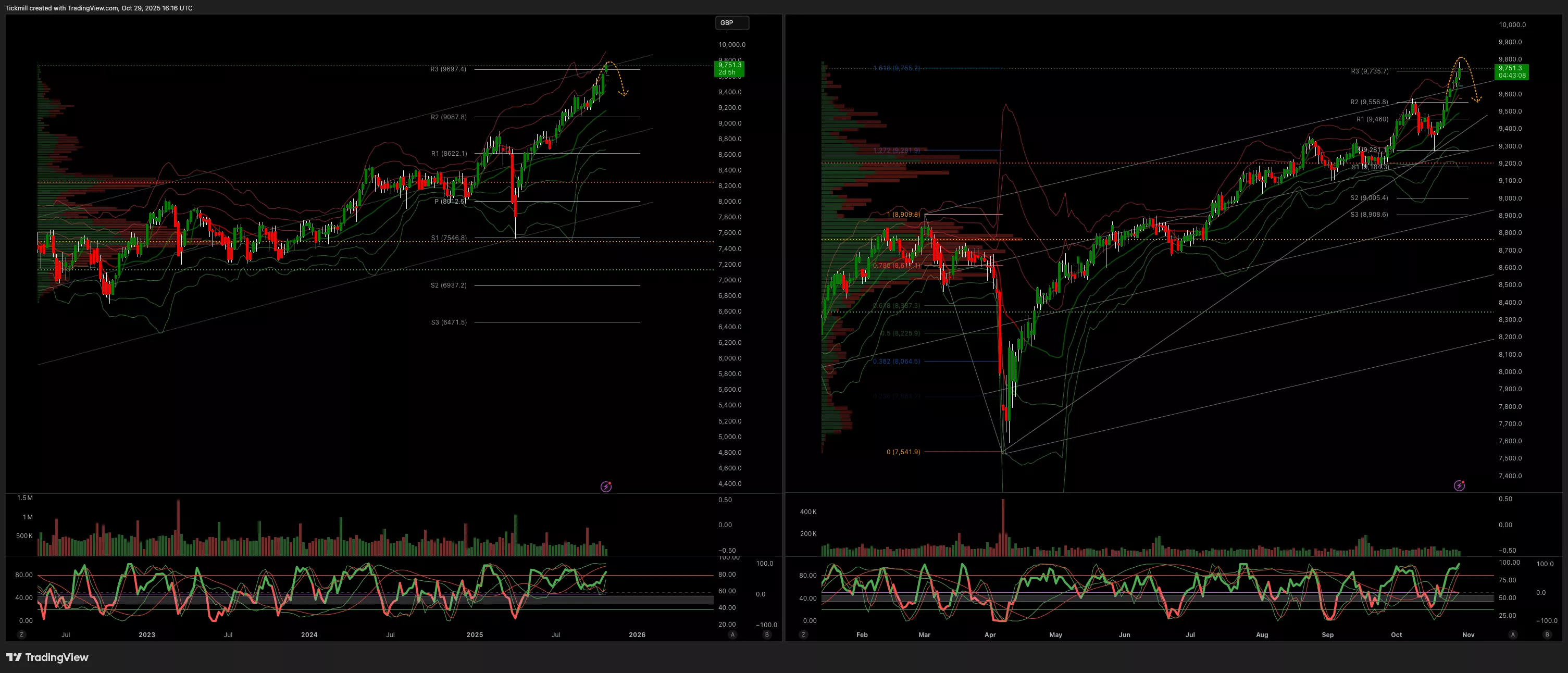

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9668

- Primary support 9500

- Below 9600 opens 9500

- Primary objective 9813

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Oct. 29The FTSE Finish Line - Tuesday, Oct. 28

Daily Market Outlook - Tuesday, Oct. 28