The FTSE Finish Line - Wednesday, Oct. 15

Image Source: Pexels

On Wednesday, London's FTSE 100 experienced a modest decline as investors considered increasing fiscal worries related to persistent inflation and possible tax increases from the UK government, all while processing a variety of corporate news. On Tuesday, the International Monetary Fund (IMF) adjusted its predictions for the UK economy, slightly increasing its growth outlook for 2024 but downgrading projections for 2026. The IMF also cautioned the Bank of England to tread carefully when considering future interest rate cuts, as inflation in the UK is expected to remain the highest among the G7 nations in both 2025 and 2026.

Britain's finance minister, Rachel Reeves, announced she is weighing a mix of tax hikes and spending reductions as part of her upcoming budget, set to be unveiled on November 26. Economists anticipate Reeves will need to generate around £30 billion ($40.1 billion) through tax increases. This comes after a series of financial pressures, including higher-than-expected borrowing costs, the abandonment of plans to reduce welfare spending, and indications that economic growth forecasts may be revised downward.

Shares of British gambling company Entain dropped by 3% to 814 pence, making it the biggest loser on the FTSE 100 index, which edged up by 0.1%.The company reported a 7% increase in its third-quarter net gaming revenue (NGR) at constant currency (CC). However, this marks a slowdown compared to the 10% growth seen in the first half of the year, partly influenced by customer-friendly sports results in September, which had an estimated 1-2 percentage point impact.Entain reaffirmed its full-year guidance, expecting around 7% growth in online NGR on a constant currency basis and core profits ranging between £1.1 billion and £1.15 billion ($1.47 billion to $1.54 billion).Meanwhile, smaller competitor Rank Group announced a 9% rise in like-for-like NGR for its first quarter. As of the previous close, Entain's stock had risen 22.2% year-to-date, outperforming the FTSE 100, which has gained 15.7% over the same period.

PageGroup's shares increase by 5% to 245.6p, making it the leading gainer on the FTSE mid-caps index, which rises by 0.25%. The British recruitment firm reports a Q3 gross profit of 187.8 million pounds ($117.2 million), surpassing the consensus estimate of 184.4 million pounds. The company anticipates that its operating profit for 2025 will align with market expectations of 21.5 million pounds. Year-to-date, PAGE has declined by approximately 28%.

Shares of pet care companies have seen an increase, with Pets at Home Group rising 3.52% to 223.6 pence and CVS Group climbing 6.86% to 1,496 pence. PETSP is among the top gainers on London's mid-caps index. The UK's competition regulator is suggesting significant reforms to the veterinary services market, including the requirement for veterinary businesses to publish detailed price lists and limiting prescription fees to 16 pounds. CVSG expressed satisfaction with the refinement of the regulator's proposals, which were reduced from 28 remedies initially suggested in May 2025, with no new remedies introduced. The final decision from the Competition and Markets Authority is expected by March 2026, with some regulations possibly taking effect before the end of 2026. As of Tuesday's market close, PETSP had increased by 5.06% and CVSG had risen by 66.67% year-to-date.

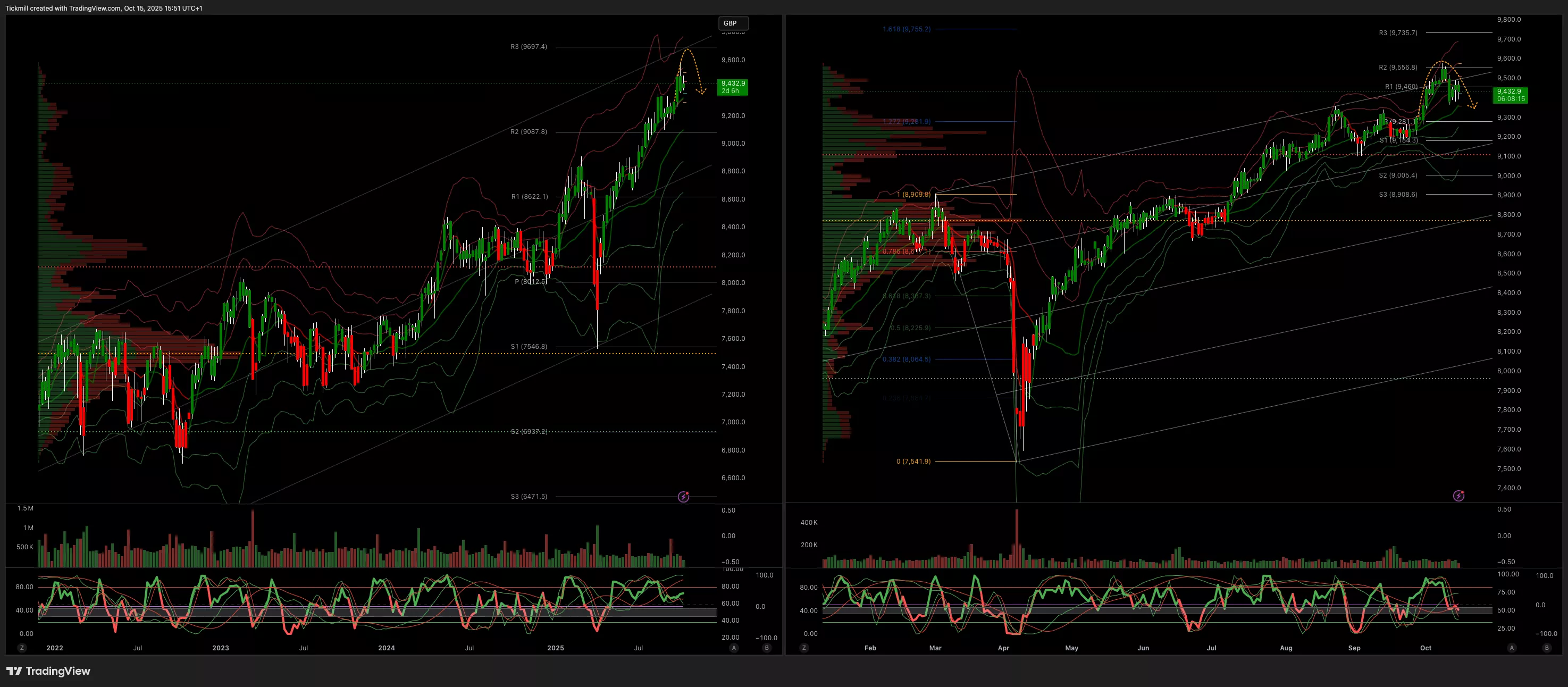

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9300

- Primary support 9000

- Below 9300 opens 9000

- Primary objective 9600

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Oct. 15Daily Market Outlook - Tuesday, Oct. 14

The FTSE Finish Line - Monday, Oct. 13