The FTSE Finish Line - Wednesday, March 19

Image Source: Pexels

The UK's FTSE 100 traded near the flatline on Wednesday after five consecutive days of gains, as investors tread cautiously ahead of the U.S. Federal Reserve's interest rate decision later today. In a week dominated by central bank meetings, the Fed's policy announcement takes center stage. The central bank is widely expected to hold interest rates steady, with any hints of future rate cuts to support economic growth being closely scrutinized. Meanwhile, the Bank of England is also anticipated to leave its rate unchanged on Thursday. Market expectations suggest at least two rate cuts from both the Fed and the BoE by the end of the year.

This morning’s FT reported that the UK Chancellor plans a “multibillion-pound public spending squeeze” in next week’s Spring Statement, alongside £5bn annual welfare savings by 2029-30. This aligns with our preview, which estimates £15bn in savings is needed by 2029-30 to maintain the £10bn fiscal rule headroom set last October. Likely measures include: £5bn welfare cuts, departmental spending reductions, and reallocating funds from international aid to defence, with some defence spending on capital excluded from fiscal headroom calculations. Notably, these cuts are expected “later in the parliament,” limiting near-term impact on the BoE’s two- to three-year outlook.

Single Stock Stories & Broker Updates:

- Shares of Ferrexpo drop 11.4%, becoming the biggest loser on the FTSE 250. The Ukraine-focused iron ore producer reports a 30% decline in FY24 core profit to $69M, impacted by weak prices and higher power costs. Separately, the company challenges Ukraine's move to transfer 49.5% of its Poltava mining unit to federal agencies, following a court ruling tied to alleged illegal mining investigations. Stock down ~31% YTD, including today’s losses.

- Shares of Compass Group fell 6%, making it one of the top losers on the FTSE 100, which is down 0.31%. Exane BNP Paribas downgraded the stock to "underperform" with a price target cut from 3,000p to 2,500p, citing a weak start to the year, significant layoffs, and lower client retention in the pressured healthcare sector. The average analyst rating is "hold" with a median price target of 2,900p. The stock is down 7% year-to-date.

- Shares of UK's FDM Group rose 13.5%, its largest intraday gain since March 2020. The IT services company is the top gainer on London's small-cap index, reporting an annual pretax profit of £34 million, exceeding estimates of £32.8 million. FDM notes encouraging trading in early 2025 with a slight increase in client demand. CEO Rod Flavell expresses confidence in the company's positioning for growth as conditions improve, despite a 21.90% decline in stock value year-to-date.

- BAE Systems stock rises 2.1%, among top FTSE 100 gainers. Morgan Stanley increases price target to 2,027p; median price target is 1,540p. BAE gains ~48% YTD.

- Shares of Savills Plc rise 3%, making it a top gainer on FTSE 250. Peel Hunt upgrades the stock to "buy" from "hold" with a target price of 1,100p, citing expected recovery in commercial transactions and strong balance sheet for growth. Savills anticipates increased transaction volumes in 2025 as employees return to offices. Three out of four brokerages rate the stock as "buy" or higher; median price target is 1,263.50p. Session's gains reduce year-to-date losses to about 7%.

- IT services provider Softcat rose 11.06%, ranking among London's top gainers. The company expects double-digit gross profit growth in FY25 and low double-digit operating profit growth, revised from high single-digit. Softcat is well-positioned to benefit from AI and automation adoption. Stifel forecasts FY25 sales of £1.07 billion ($1.40 billion) with a 16.4% EBITDA margin. The stock is up ~15.6% over the past 12 months.

Technical & Trade View

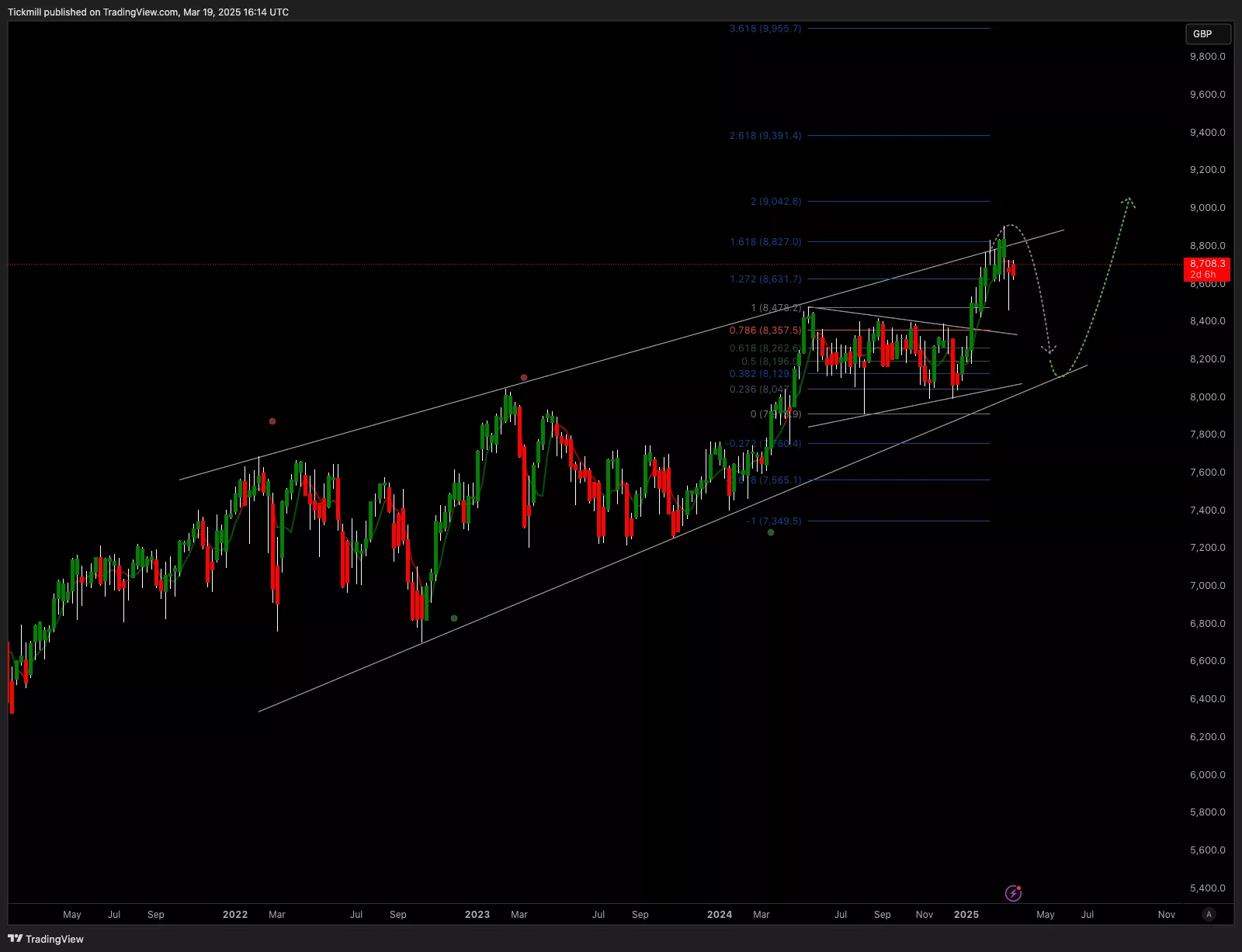

FTSE Bias: Bullish Above Bearish below 8950

- Primary support 8700

- Below 8700 opens 8600

- Primary objective 9050

- Daily VWAP Bullish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, March 19The FTSE Finish Line - Tuesday, March 18

Daily Market Outlook - Tuesday, March 18