The FTSE Finish Line - Wednesday, July 23

Image Source: Pexels

On Wednesday, London's primary stock indexes reached a new all-time high, driven by favourable corporate updates, with a U.S.-Japan trade agreement also enhancing global sentiment. U.S. President Donald Trump reached a trade agreement with Japan, reducing tariffs on automobile imports and exempting Tokyo from additional harmful tariffs on other products in return for a $550 billion investment and loan package directed toward the U.S. UK stocks have surged this year, driving the FTSE 100 to reach all-time highs in recent weeks, fuelled by hopes for interest rate reductions, positive sentiment regarding the UK-US trade agreement, and a rise in commodity prices. Traders are now estimating an 87.9% likelihood of a 25-basis-point rate cut by the Bank of England next month, according to data from LSEG. This week, focus will be on the UK’s preliminary Purchasing Managers' Index for July and retail sales figures for June. Additionally, officials have announced that India and Britain will finalise a free trade agreement on Thursday during Indian Prime Minister Narendra Modi's visit to the UK.

In the UK recent economic developments have highlighted two key issues: the unravelling of the government’s planned welfare savings and the OBR’s Forecast Evaluation Report suggesting less optimistic GDP projections for the Autumn Budget. Policy options to restore fiscal headroom within the rules are increasingly limited to either tax increases or revisiting their definition. The IMF has already noted the possibility for “further refinements” to the fiscal framework, and recent reports have hinted at specific ways these goals could be achieved. Given the potential magnitude of required tax hikes, the market's focus may shift back to these discussions. For now, however, news surrounding possible tweaks to fiscal rules has largely flown under the radar. Additionally, a tighter fiscal stance might influence the timing and scale of BoE rate cuts.

Single Stock Stories & Broker Updates:

- The UK's automobiles and parts index rose 1.7%, with Aston Martin increasing by 7.1%. Media stocks gained 2.4%, led by Informa's 5.4% rise after raising its revenue growth forecast. Healthcare stocks were up 2.2%, with AstraZeneca gaining 2.7% following a $50 billion U.S. manufacturing investment. However, construction and materials stocks fell 0.9%, with Breedon Group down 10.8% due to low annual results forecasts. J D Wetherspoon saw a 3% increase after reporting recent sales growth.

- Informa shares rise 4.8% to 866p, leading the FTSE 100, which is up 0.39%. The company raises its 2025 revenue growth forecast to 6% from 5%. It reports HY revenue up ~20% to £2.04 billion and adj. operating profit up 24% to £578.9 million. Additionally, it confirms £150 million in share buybacks for H2.

- Hochschild Mining shares rose 2.6% to 276p, making it a top gainer on the FTSE mid-cap index. The company reported Q2 attributable silver production of 2.0 million ounces, up 9% from JPMorgan estimates and an increase from 1.8 million ounces in Q1. Peel Hunt noted stronger silver grades at Inmaculada. The stock is up approximately 29% year-to-date.

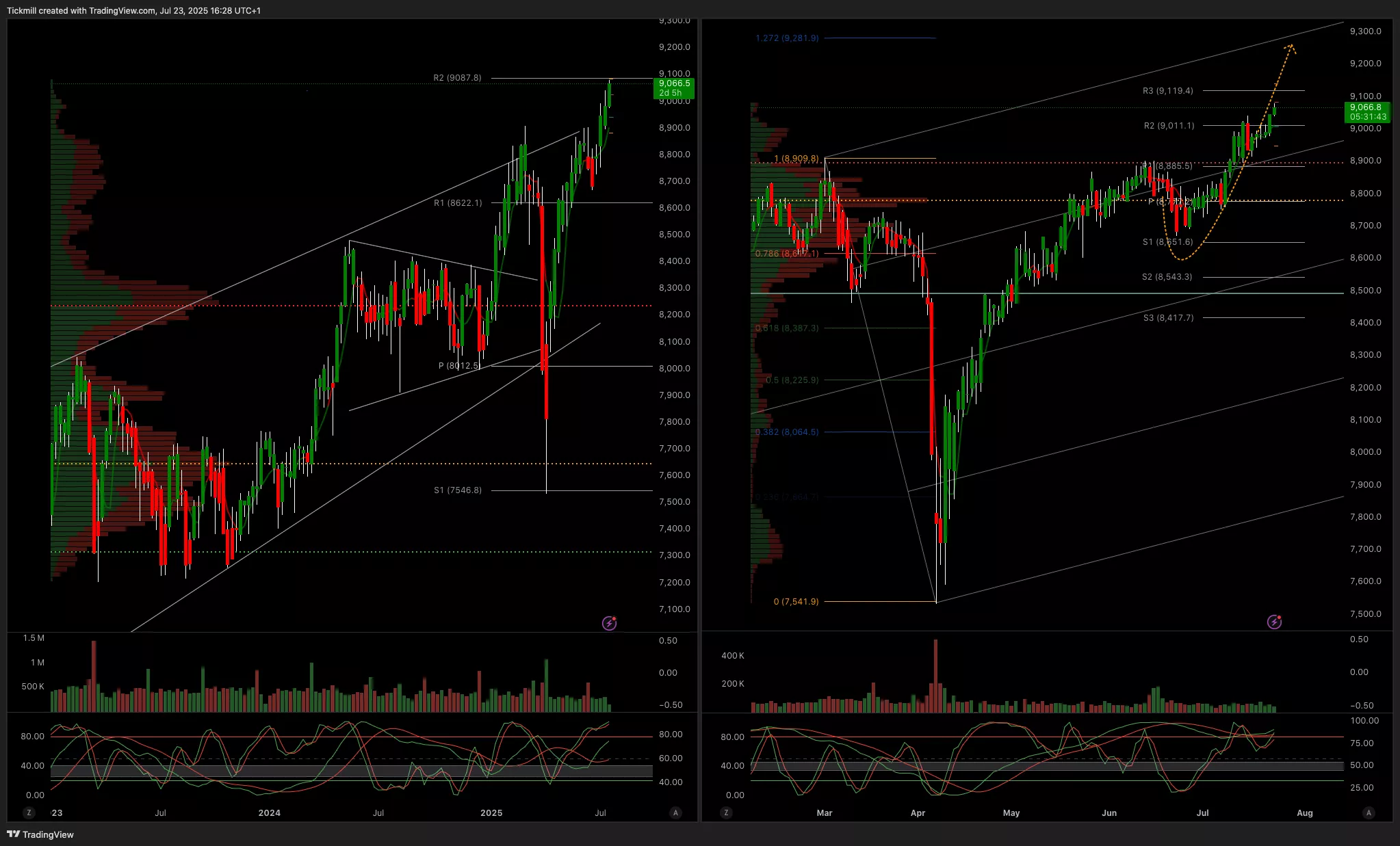

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8600

- Below 8500 opens 8400

- Primary objective 9200

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, July 23

The FTSE Finish Line - Tuesday, July 22

Daily Market Outlook - Tuesday, July 22