The FTSE Finish Line - Tuesday, Oct. 28

Image Source: Pexels

The UK's FTSE 100 reached a record high on Tuesday, buoyed by a surge in HSBC's stock prices following the bank's increase in its income forecast, while investors prepared for a series of significant events later in the week. HSBC's shares climbed by 3.1% as the financial giant raised its income projections and signalled a shift towards growth with its acquisition of Hang Seng Bank in Hong Kong, even though it reported a steep decline in third-quarter profits attributed to $1.4 billion in legal expenses. Global markets took a breather following their recent surge, as hopes for a potential US-China trade agreement continued to fuel investor confidence. Market participants are now setting their sights on upcoming earnings reports from major tech giants on Wall Street, alongside key interest rate decisions from major central banks, including the Federal Reserve and the European Central Bank.

Meanwhile, closer to home in the UK, fresh data revealed that retailers slashed prices in October, with food prices experiencing their sharpest drop in nearly five years. This development brings some relief to households while also aiding the Bank of England and the government in their economic efforts. UK Finance Minister Rachel Reeves has also pledged to tackle the rising cost of living through her upcoming budget, aiming to provide further support for struggling families. However, the FT reports that the OBR is expected to lower its trend productivity growth forecast by 0.3 percentage points, a sharper cut than the anticipated 0.2ppt. This revision could create a £21bn hole in the projected 2029-30 budget balance. Combined with policy changes like welfare spending, addressing a £10bn headroom gap may require at least £30bn in fiscal measures. Building a larger fiscal buffer could necessitate even greater consolidation, likely involving tax increases that challenge manifesto commitments. The government faces a key trade-off between market-friendly outcomes (e.g., larger headroom) and politically acceptable measures (e.g., smaller tax hikes), a decision that will dominate Downing Street's agenda in the coming weeks.

Recent rate market movements have seen the 10yr gilt-UST yield spread narrow by ~25bps, though gilts still yield ~34bps more. This narrowing is driven mainly by reduced short-rate expectations, with the 1y1y forward GBP OIS rate falling from ~3.70% to 3.43% amid weaker UK data, including softer wages and lower inflation. However, hawkish MPC elements and historically significant support levels may limit further short-rate declines. For additional gilt-UST spread compression, focus may shift to term premium adjustments, influenced by the upcoming Budget. Despite the government’s fiscal rule commitment, questions remain about the political viability of expanding fiscal headroom beyond the £10bn buffer after Wales’ by-election results.

Shares of Airtel Africa surged by up to 10.7%, reaching a record high of 255.20p. The stock became the leading gainer on the FTSE 100 index, which posted a slight increase of 0.05%.In the first half, revenue grew by 25.8% year-on-year to $2.98 billion, fueled by tariff adjustments in Nigeria and significant growth in Francophone Africa. Adjusted EBITDA for the half-year rose by 33.2% year-on-year to $1.45 billion, supported by ongoing operational momentum and benefits from cost efficiency initiatives. The company has declared an interim dividend of 2.84 cents per share, representing a 9.2% increase. Year-to-date, including today's movements, the stock has appreciated approximately 103%, compared to an 18.16% rise in the FTSE 100.

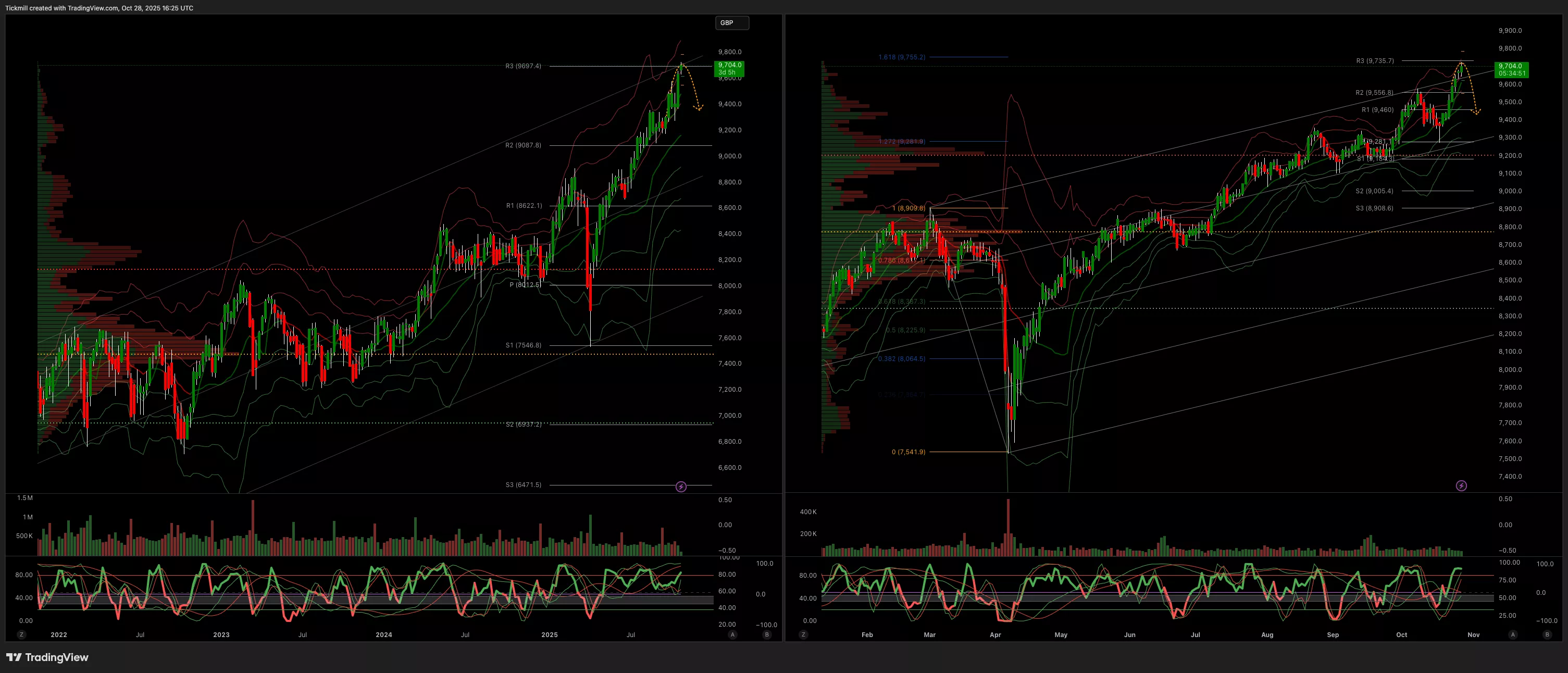

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9550

- Primary support 9350

- Below 9600 opens 9420

- Primary objective 9700

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Oct. 28The FTSE Finish Line - Monday, Oct. 27

Daily Market Outlook - Monday, Oct. 27