The FTSE Finish Line - Tuesday, Nov. 18

Image Source: Pexels

London stocks faced further losses on Tuesday, driven by financials leading the decline as global markets struggled with heightened uncertainty. Investor confidence was shaken by diminishing hopes for a Federal Reserve interest rate cut, prompting caution ahead of key economic data. The FTSE 100, the leading index of blue-chip companies, fell over 1% in a broad sell-off, marking its fourth consecutive session of losses. Similarly, the mid-cap FTSE 250 dropped more than 1%, on track for its fifth straight losing day. Globally, sentiment remains clouded by concerns over inflated tech valuations and growing doubts about a potential Fed rate cut in December. Investors are closely watching upcoming U.S. economic data releases, delayed by the recent government shutdown. In the UK, attention is focused on the inflation report due this week, while next week's government budget announcement looms.

Banking stocks bore the brunt of the downturn, with the sector plunging 3.3%. Heavyweights Barclays, HSBC, and Standard Chartered saw declines ranging between 3.1% and 3.6%, dragging the FTSE 100 further down. Industrial miners also struggled, as Anglo American led losses with a 3.6% drop, while Rio Tinto and Glencore fell 2.1% and 1.1%, respectively, amid extended weakness in copper prices. Precious metal miners slid 2.6%, reflecting a one-week low in gold prices. Travel and leisure stocks shed 2%, echoing similar declines across European markets, exacerbated by mounting geopolitical tensions between China and Japan.

Among individual movers, FirstGroup saw its shares plummet 14.2% following a report of a 4% drop in underlying passenger volumes for its First Bus unit during the first half of 2025.In contrast to the broader market slump, cigarette maker Imperial Brands rose 1.3% after posting annual profits that exceeded analyst expectations. Intermediate Capital Group surged 5.1% on news that Europe's largest asset manager, Amundi, had acquired a 9.9% stake in the company. Greencore, a convenience food producer, jumped 5.6% after reporting a full-year adjusted operating profit of £125.7 million ($165.37 million), up from £97.5 million the previous year.

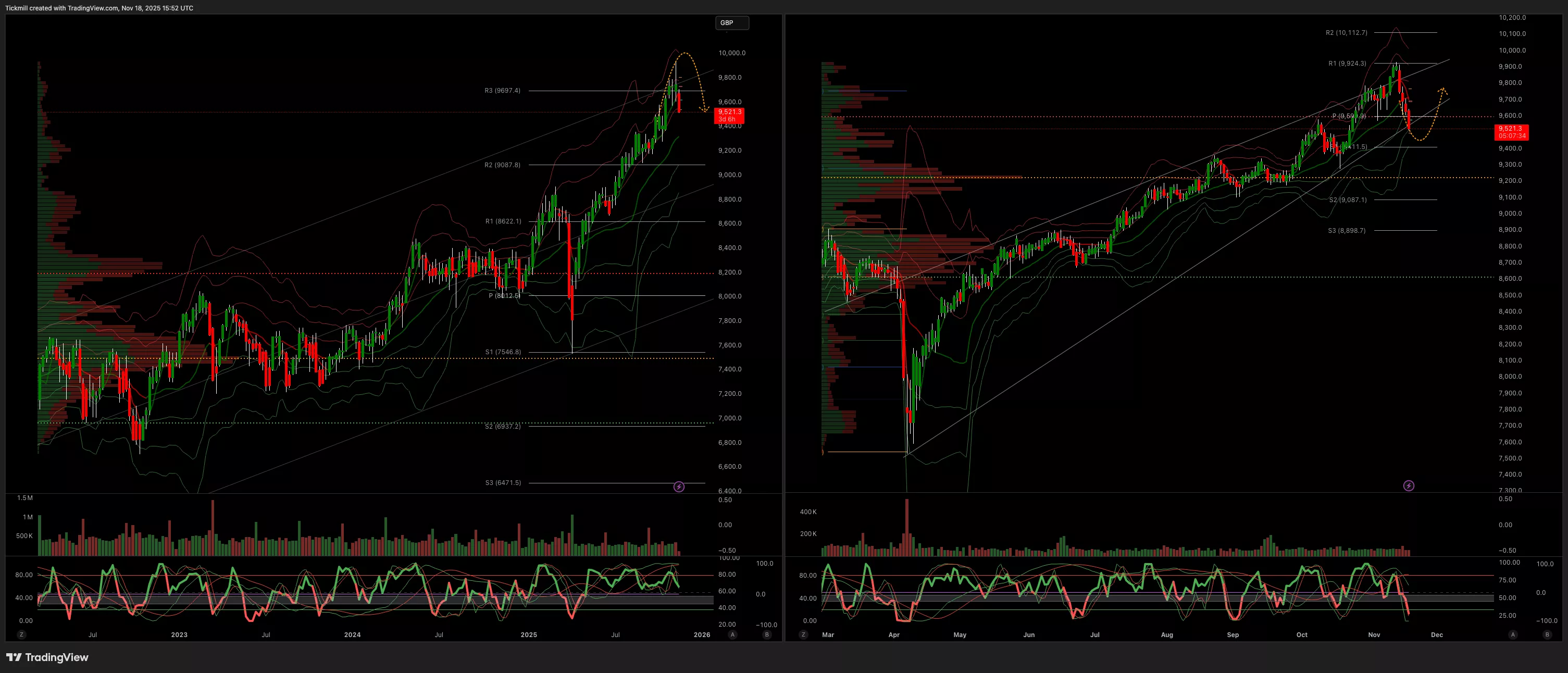

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 9700 Target 9813

- Below 9612 Target 9410

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Nov. 18The FTSE Finish Line - Monday, Nov. 17

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 17