The FTSE Finish Line - Thursday, Oct. 30

Image Source: Pexels

The UK stock market is showing signs of recovery after briefly dipping into negative territory on Thursday. This rebound comes as investors digest the latest earnings reports from domestic and international companies, alongside fresh regional economic data. Additionally, market participants are evaluating the Federal Reserve's recent interest rate cut and its guidance on future monetary policy.

Among the standout performers, Standard Chartered rose by 2.2% on the back of a stronger quarterly profit and an upgraded income and return outlook. The bank reported a profit of $1.03 billion attributable to ordinary shareholders, a 10% increase from $931 million in the same period last year. Basic earnings per share also climbed 7.7%, reaching 44.5 US cents compared to 36.8 US cents a year ago. Airtel Africa continued its upward momentum, gaining 3.2% after a strong performance in the previous session. Other companies, including Auto Trader Group, EasyJet, Sainsbury's, Rolls-Royce Holdings, Games Workshop, Tesco, and BP, posted gains ranging from 0.4% to 1%.

However, not all stocks fared well.WPP suffered a sharp 14% drop after cutting its growth forecasts. The advertising giant reported declining revenue for both Q3 and the first nine months of fiscal 2025, citing weaker performance across all regions and business segments. The company now expects like-for-like revenue growth, excluding pass-through costs, to shrink by 5.5% to 6%, compared to its earlier forecast of a 3% to 5% decline. In Q3, WPP's total group revenue fell to £3.26 billion, an 8.4% year-on-year decrease on a reported basis and a 3.5% drop on a like-for-like basis. The company has adjusted its outlook for the remainder of the fiscal year, reflecting ongoing challenges.

Shell PLC delivered strong Q3 results, reporting $5.3 billion in income attributable to shareholders—up from $3.6 billion in Q2 and $4.3 billion a year earlier. Adjusted earnings reached $5.4 billion, while adjusted EBITDA surged to $14.8 billion.Computacenter maintained its growth trajectory in Q3, driven by robust performance in North America, improvements in the UK, and a return to growth in Germany, solidifying its positive momentum. HALEON reaffirmed its 2025 organic revenue growth target of approximately 3.5%, slightly exceeding analyst expectations despite mixed Q3 results across various regions. Drax Group announced plans to acquire three battery energy storage projects for £157.2 million. The acquisition will add 260MW of storage capacity across Scotland and England, with payments staggered through 2028. Vodafone Group announced its acquisition of Skaylink GmbH, a specialist in cloud and digital transformation, for €175 million in a deal with Waterland-managed funds. The move underscores Vodafone’s commitment to expanding its digital capabilities..

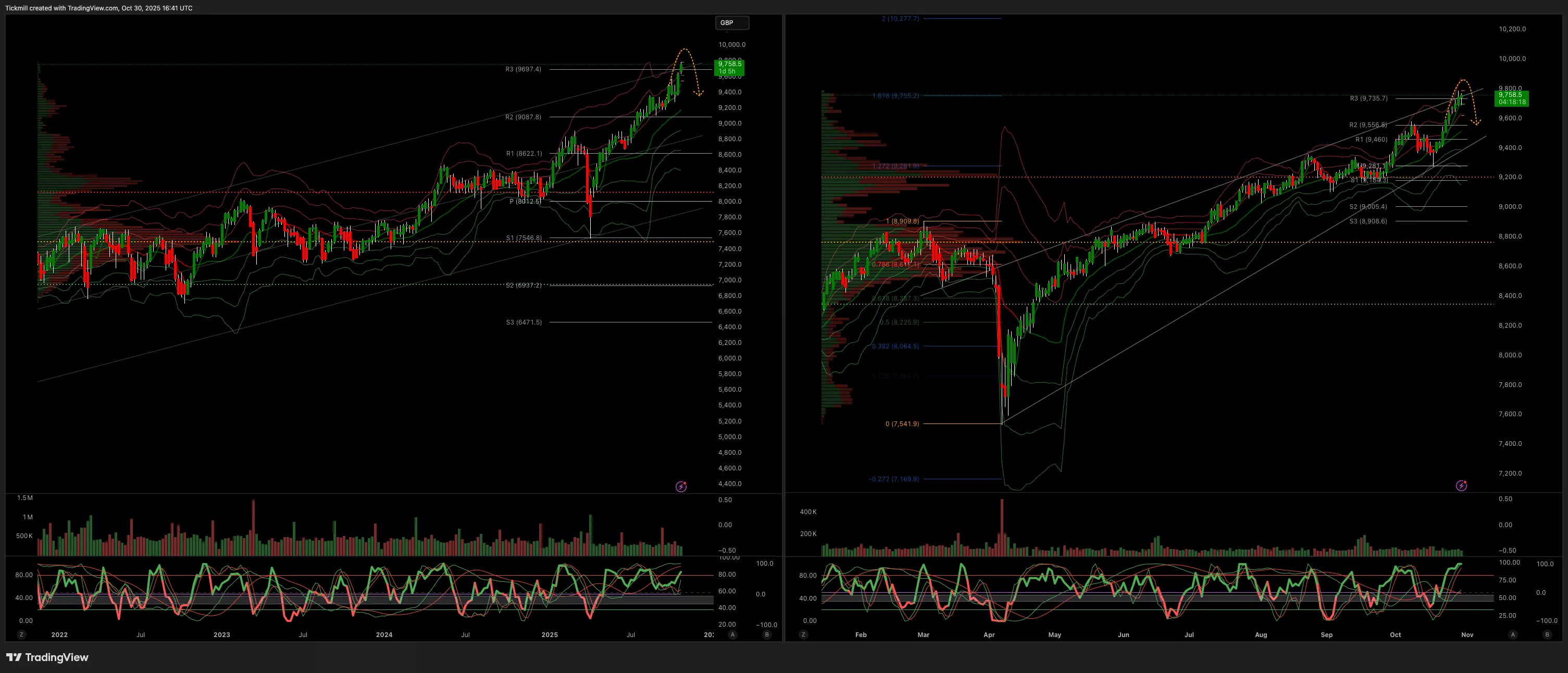

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9704

- Primary support 9500

- Below 9600 opens 9500

- Primary objective 9873

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Oct. 30The FTSE Finish Line - Wednesday, Oct. 29

Daily Market Outlook - Wednesday, Oct. 29