The FTSE Finish Line - Monday, Oct. 27

Image Source: Pexels

Stocks listed in London remained stable on Monday as investors took a breather following a recent upswing, while HSBC saw a decline after the major lender announced that its quarterly results would be adversely affected by a partial loss in a court appeal in Luxembourg. HSBC shares fell by 1% as it disclosed plans to include a $1.1 billion provision in its third-quarter results, which are set to be released on Tuesday, linked to the appeal concerning Bernard Madoff's Ponzi scheme. In contrast, the overall banks index remained unchanged. Last week, the FTSE 100 reached all-time highs, and the FTSE 250 approached levels not observed in almost four years, as indications of easing price pressures heightened hopes for quick interest rate reductions by the Bank of England. Overall market sentiment was positive due to expectations that the U.S. would finalise a trade agreement with China, leading to a nearly 2% drop in safe-haven assets like gold. Additionally, precious metal miners listed in the UK experienced a 3.1% decline.

Shares of HSBC Holdings listed in London dropped by 2% to 984.4p, making it the biggest loser on the FTSE 100 index. The company plans to take a $1.1 billion provision in its Q3 results following a partial loss in its appeal regarding a lawsuit related to Bernard Madoff's Ponzi scheme. HSBC intends to file a second appeal with the Luxembourg Court of Appeal. This provision will affect approximately 15 basis points of the CET1 capital ratio in Q3. The company notes that the eventual financial impact may vary from the current estimate. Year-to-date, HSBC's share price has increased by about 27.85%.

Shares of British pharmaceutical company GSK increased by 1.2% to 1,639p as the company secures exclusive rights from Syndivia for an antibody-drug conjugate (ADC) targeting prostate cancer. As part of the agreement, Syndivia will receive an upfront payment along with milestone payments potentially amounting to 268 million pounds ($359.68 million), in addition to tiered royalties on future global product sales. GSK will take full control of the ADC programme's development, manufacturing, and worldwide commercialisation. Up to the close on Friday, the stock had experienced a 20.31% rise this year.

Shares of Goodwin PLC surged over 42% to a record 22,000p, marking its best day in nearly 30 years. GDWN is the top gainer on the FTSE Mid 250 Index, which is down ~0.11%. The company expects FY trading profit before tax to exceed £71 million ($95.29 million), a 100% increase from the prior year, supported by a strong order book of £365 million and activity in key defence and nuclear programmes. A special one-off interim dividend of 532 pence per share has been declared. Adam Deeth has been named finance director effective October 28. Year-to-date, GDWN has risen 172.26% compared to the sub-index's 9.19% increase.

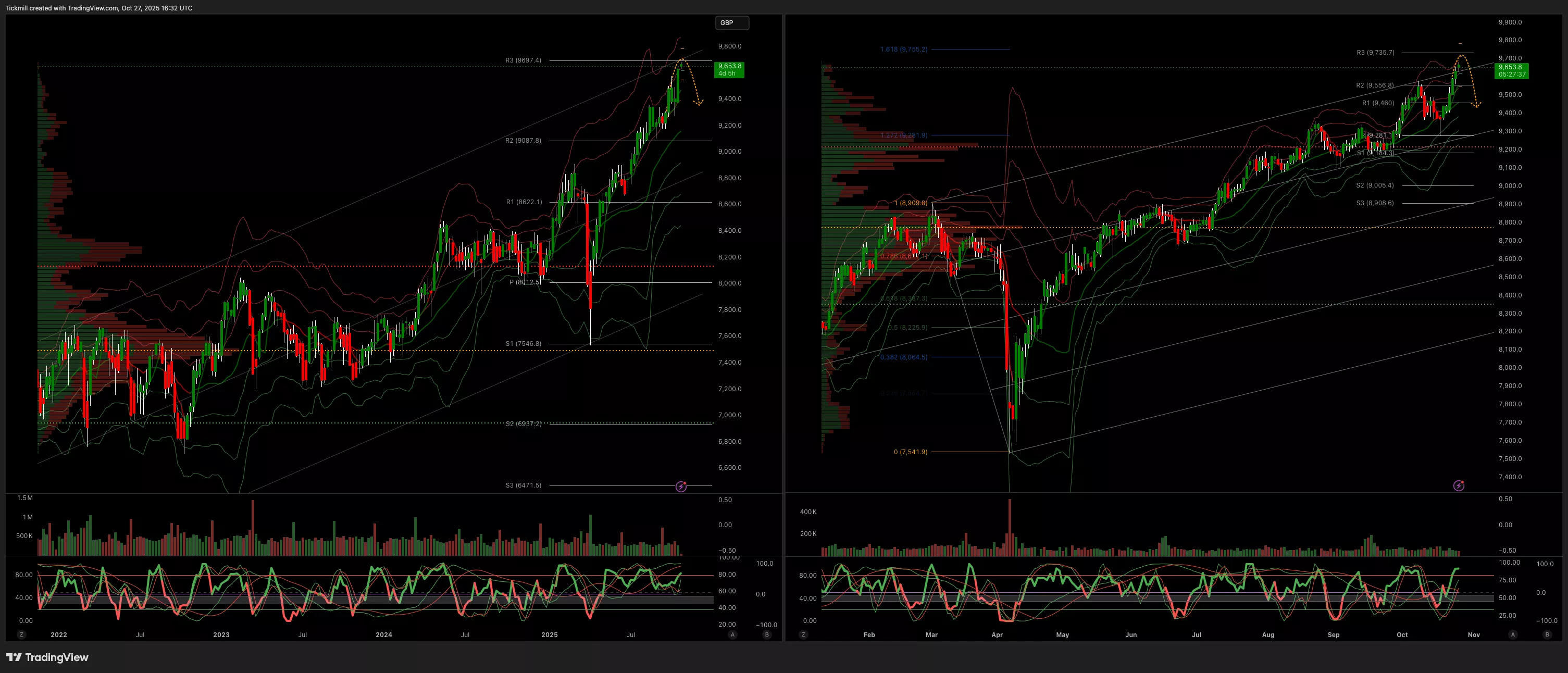

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9550

- Primary support 9350

- Below 9550 opens 9420

- Primary objective 9700

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, Oct. 27Daily Market Outlook - Friday, Oct. 24

The FTSE Finish Line - Thursday, Oct. 23