The FTSE Finish Line - Monday, Dec. 8

Image Source: Pexels

UK shares edged slightly lower on Monday as investors prepared for key interest rate decisions from the U.S. Federal Reserve and the Bank of England. Global attention remains fixed on Wednesday’s U.S. Federal Reserve monetary policy announcement, with officials divided over whether further rate cuts are needed to support the labour market or if such moves could exacerbate high inflation. According to CME Group's Fedwatch tool, traders are pricing in an 87% chance of a 25 basis point rate cut this week, driven by mixed U.S. economic data and conflicting statements from Federal Reserve officials. In the UK, a report revealed that the job market remained sluggish last month ahead of Finance Minister Rachel Reeves' budget announcement on November 26, as employers expressed concerns over potential tax hikes. The Bank of England is widely expected to reduce interest rates by 25 basis points to 3.75% next week after holding rates steady for a month.

On the corporate front, Barratt Redrow shares fell 2% after Citigroup cut its target price for the construction company from 530 pence to 506 pence. Unilever dipped 0.2% following the listing of Magnum Ice Cream Company in Amsterdam, completing its spin-off from the consumer goods giant. Meanwhile, SDCL Efficiency Income Trust shares plunged 17.7% after its debt-to-equity ratio reached 71.9% of net asset value, surpassing the investment policy limit of 65%. Shares of British medical products company Smith & Nephew increased by 1.5%, reaching 1,284 pence. The company has unveiled a new strategy aimed at achieving a compounded annual growth rate of 6%-7% in underlying revenue, along with over $1 billion in free cash flow by 2028. Smith & Nephew has revised its 2025 free cash flow forecast for the second time in a month, raising it to approximately $800 million from the previously expected $750 million. The company plans to simplify its product offerings and reduce inventory by around $500 million. Smith & Nephew anticipates 6% underlying revenue growth in 2026 and expects 5% underlying revenue growth for 2025. Jefferies analysts describe this as "material upside" at the current valuation, but they note that investors may require evidence before fully acknowledging this after the third-quarter miss. As of the last close, the stock is up 27.6% year-to-date.

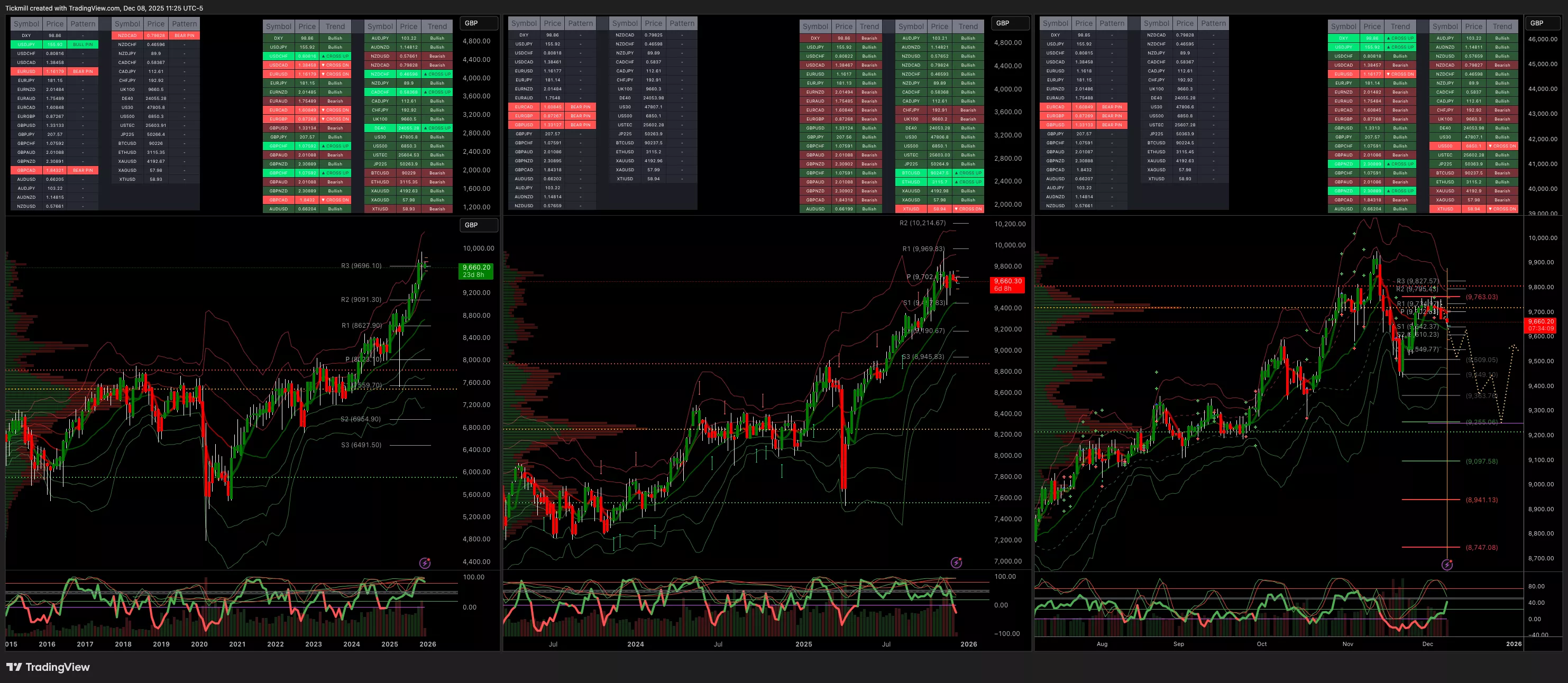

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 9720 Target 9763

- Below 9700 Target 9600

(Click on image to enlarge)

More By This Author:

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Dec. 8

Daily Market Outlook - Monday, Dec. 8

Daily Market Outlook - Friday, Dec. 5