The FTSE Finish Line: FTSE Lingering At One Month Lows

At the opening of the market on Thursday, the UK's FTSE 100 index experienced a decline. This drop was primarily attributed to the decrease in defence-related stocks, particularly driven by a slip in BAE Systems' stock price down 4.5% on the session. Additionally, global market sentiment shifted toward caution due to the perception of hawkish signals in the minutes from the U.S. Federal Reserve's July meeting. The blue-chip FTSE 100 index is registering a decline of 0.4% heading into the close.

The minutes from the Fed's July meeting indicated a division among policymakers regarding the necessity for further interest rate hikes. "Some participants" expressed concerns about the potential negative impact on the economy if rates were increased excessively, while "most" policymakers continued to prioritise combating inflation. Moreover, there was a 0.9% decrease observed in the stocks of precious metal miners. This decline was influenced by gold prices reaching a five-month low, primarily due to a stronger dollar and an uptick in bond yields.

Entain sits at the bottom of the index today, even as Barclays has established a target price of 1,450 for the company. This target price is in comparison to the opening share price of Entain PLC, which stood at 1,223 on August 17, 2023. The target price suggests a potential increase of 18.6%. Throughout the last year, the company's stock has traded within a range of 1,045 as its lowest point and 1,597 as its highest point. On a daily basis, an average of 1,488,263 shares are exchanged. The company's current market capitalization, as of the time of writing, is £7,518,417,060. These figures offer insights into the stock's recent performance and the market's perception of the company's value. ABRDN is also under pressure vying for the bottom spot shedding 4.54%, the former flagship fund is set to undergo a merger into the Diversified Income strategy. As part of this transition, the Diversified Income strategy has been rebranded as "Abrdn Diversified Income & Growth," coinciding with the name of one of Abrdn's trusts. This move represents a strategic realignment and integration of investment approaches within the organisation.

On the positive side of the ledger Admiral sits at the top of the table adding another 1.6% as investors continue to bid up shares after yesterday’s positive earnings announcement and outlook for the year ahead.

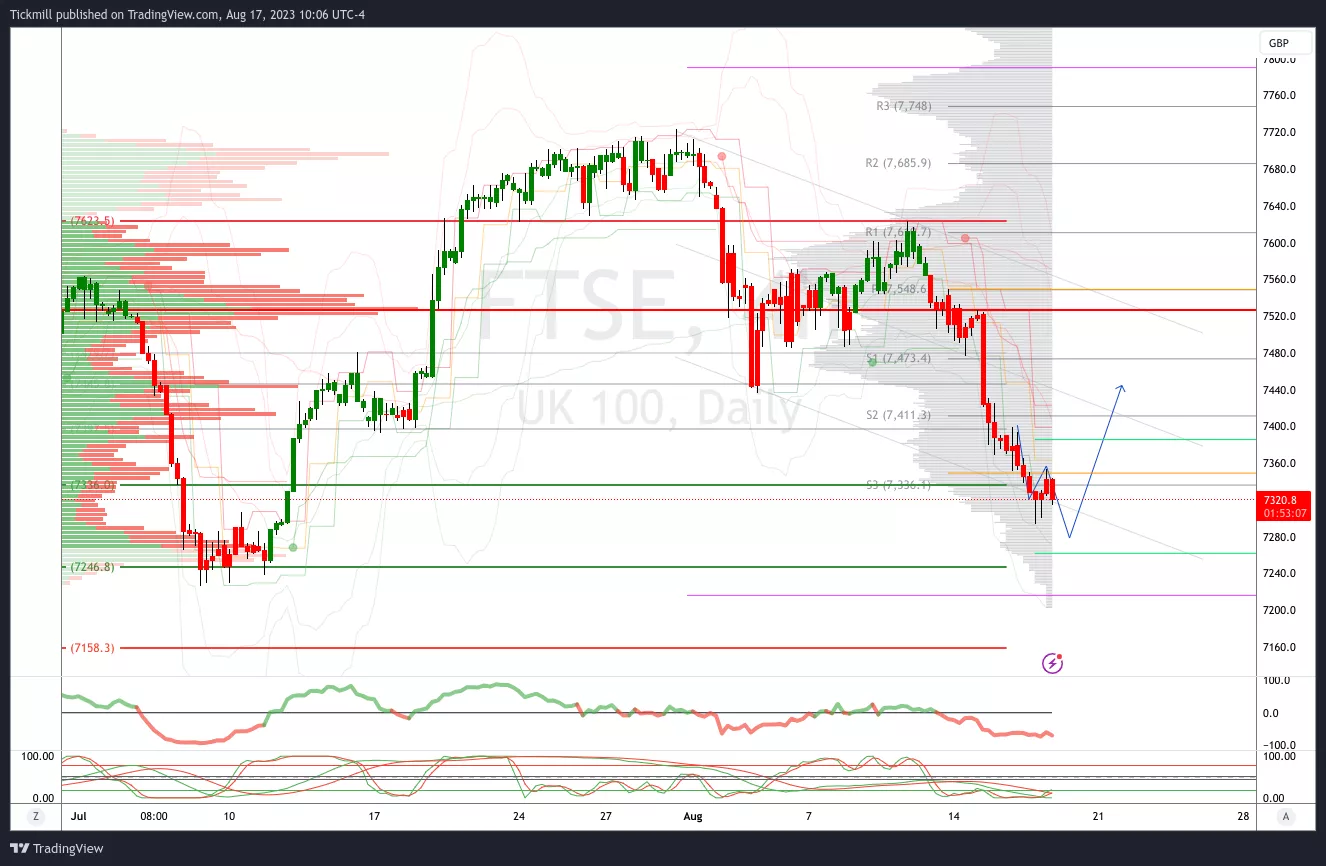

FTSE Intraday Bullish Above Bearish below 7520

- Below 7300 opens 7250

- Primary support is 7240

- Primary objective 7750

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Aug. 17

FTSE Sitting At One Month Lows

Daily Market Outlook - Wednesday, Aug. 16

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more