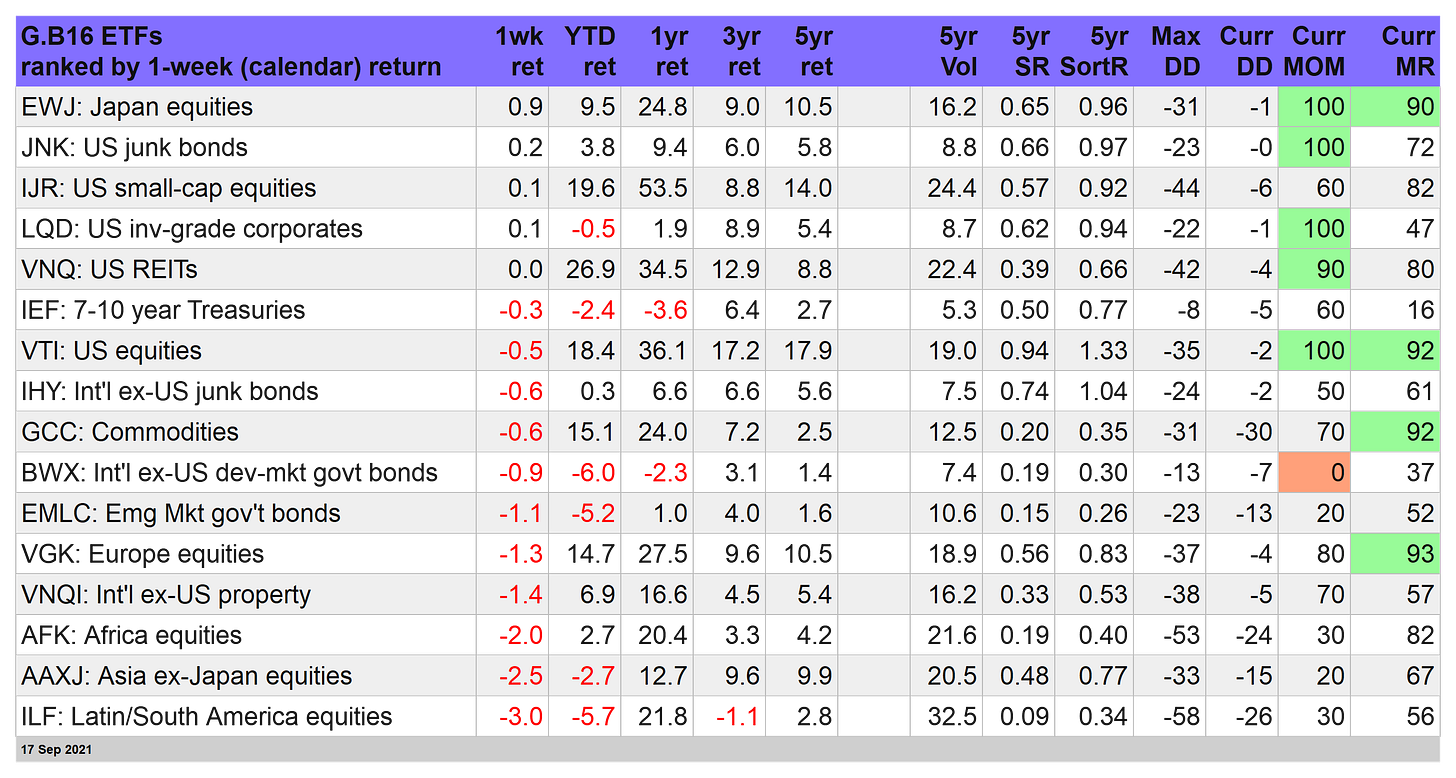

The ETF Portfolio Strategist - Saturday, Sept. 18

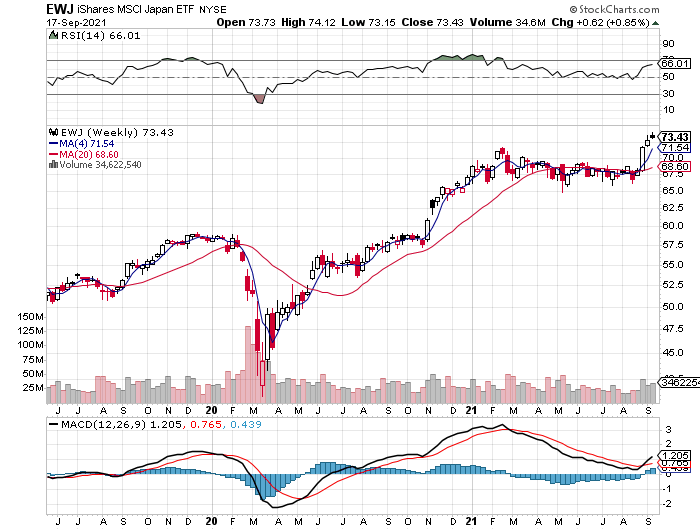

Losses continue to weigh on the global markets this week. But not entirely. Another recurring feature this week: Japan stocks continued to lead the small set of winners for our global opportunity set through Friday’s close.

For a second straight week, iShares MSCI Japan ETF (EWJ) was top dog, posting a 0.9% gain. The fund has been up for a fourth straight week and ended Friday's session just below a record high (the fund was launched in 1996).

Some analysts see this as a catch-up rally. “Shares rose because some investors wanted to boost weightings of Japanese stocks in their portfolio. And there’s demand from those who failed to buy Japanese stocks in a rally earlier this month,” says Jun Morita at Chibagin Asset Management.

Whatever the reason, holding an allocation in the country’s equities is paying off handsomely these days — and at a time when global diversification generally is taking it on the chin.

Indeed, most of our global opportunity set was in the red again this week. US junk bonds (JNK), small-cap US equities (IJR), and investment-grade corporates (LQD) offered a bit of ballast, but otherwise there was no place to hide.

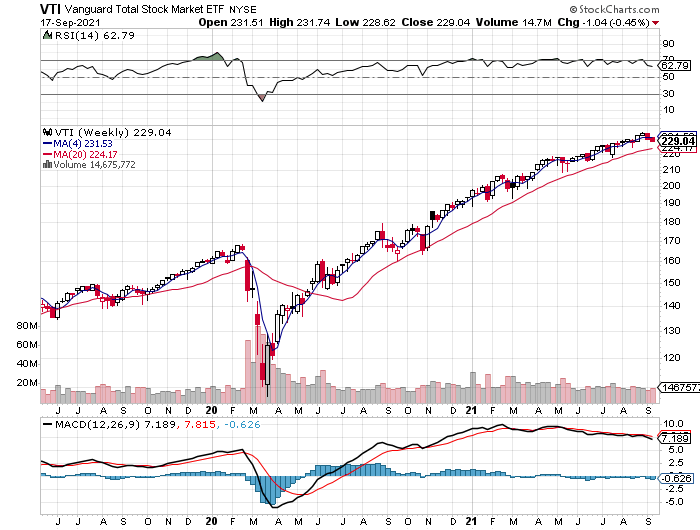

US stocks took another hit this week: Vanguard Total US Stock Market (VTI) fell 0.5%, marking the second consecutive weekly decline. But US shares are still up a sizzling 18.4% so far this year and so excuse us if we’re not exactly worried at this point.

Nonetheless, there are some dark clouds on the horizon. Economic news continues to be mixed — the consumer sentiment reading for September, for example, reminds that Main Street is still cautious in a non-trivial degree.

“The steep August falloff in consumer sentiment ended in early September, but the small gain still meant that consumers expected the least favorable economic prospects in more than a decade,” says Richard Curtin, Surveys of Consumers chief economist at the University of Michigan.

The main risk factor (still) is blowback linked to the Delta variant of the coronavirus. Some health analysts expect that this variant will peak soon, but until that forecast is confirmed with hard data, the future still looks shaky. Add in the fact that the US stock market isn’t exactly value priced and it’s easy to rationalize the case for taking some profits and trimming portfolio allocations, which are probably well above targets anyway after a strong run for American shares in 2021.

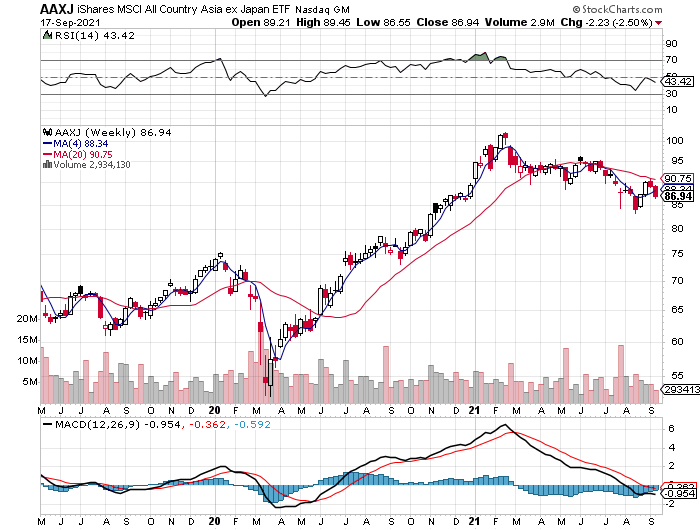

US stocks were squeezed this week, but the pain was great in Vanguard FTSE Europe (VGK), which tumbled 1.3%. Meanwhile, Asia ex-Japan (AAXJ) fell a hefty 2.5% this week. Thanks largely to China, AAXJ remains on the defensive and even lower prices are probably on the near-term horizon.

The latest point of worry for China is the news that Evergrande, one of the country’s biggest property developers, appears to be a bubble that’s set to burst. “Evergrande’s collapse would be the biggest test that China’s financial system has faced in years,” warns Mark Williams, chief Asia economist at Capital Economics.

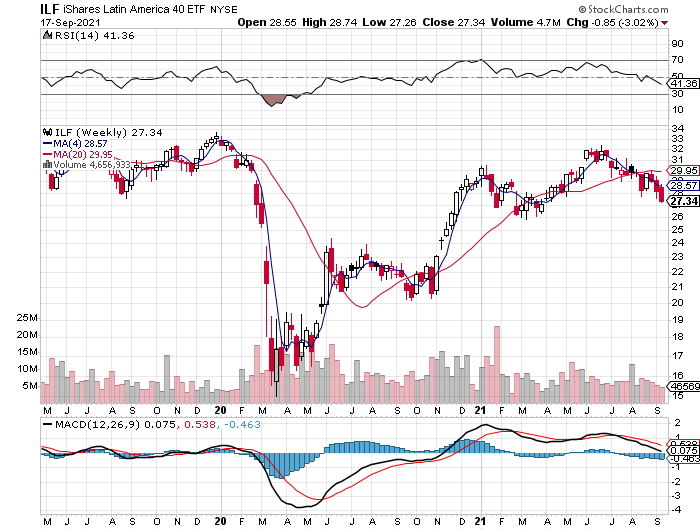

The biggest loser for our global opportunity set this week: stocks in Latin America via iShares Latin America 40 ETF (ILF), which fell a steep 3.0%. There’s not a lot to like here. ILF’s correction looks increasingly persistent. A key test awaits in the days ahead on whether the $26 range (the previous low) can hold.

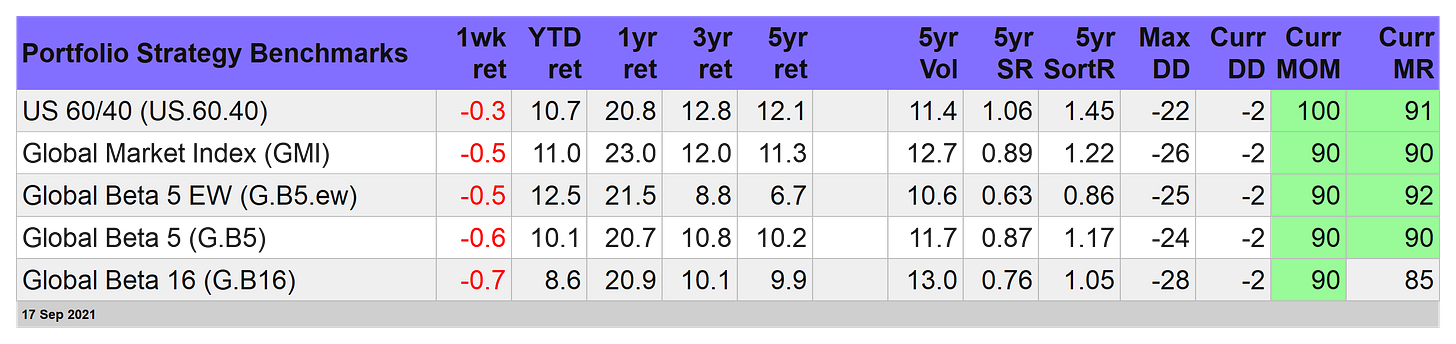

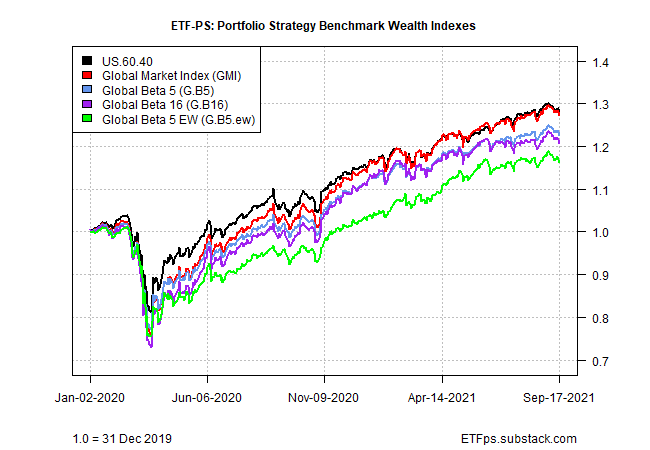

All our strategy benchmarks took another hit this week. The US 60/40 stock/bond mix (US.60.40) suffered the lightest setback, easing 0.3%. That still leaves it up 10%-plus for the year so far. But with stocks feeling the heat for a second week, and US bonds treading water at best, this benchmark is have a rough go of it — an unfamiliar look for this yardstick.

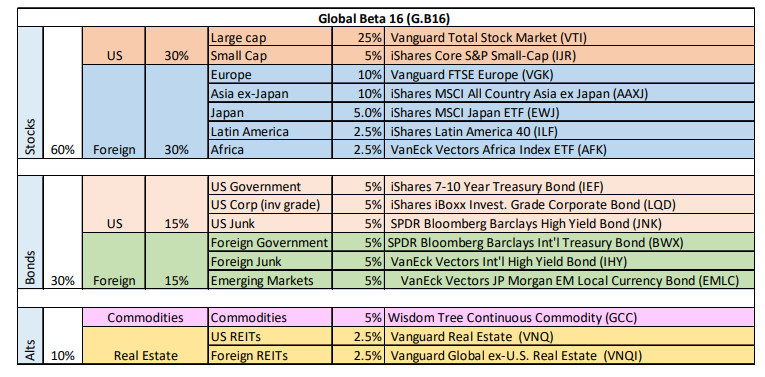

The deepest setback for the strategy benchmarks: Global Beta 16 (G.B16), which holds the opportunity set (see table above) in weights detailed below. But broader diversification isn’t paying off lately.

By contrast, the equal-weighted Global Beta 5 EW portfolio (G.B15.ew) — which covers the globe with just five funds — is comfortably in the lead this year with a 12.5% total return.

Disclosures: None.