The ETF Portfolio Strategist - Saturday, Aug. 21

A Rough Week for (Most) Markets

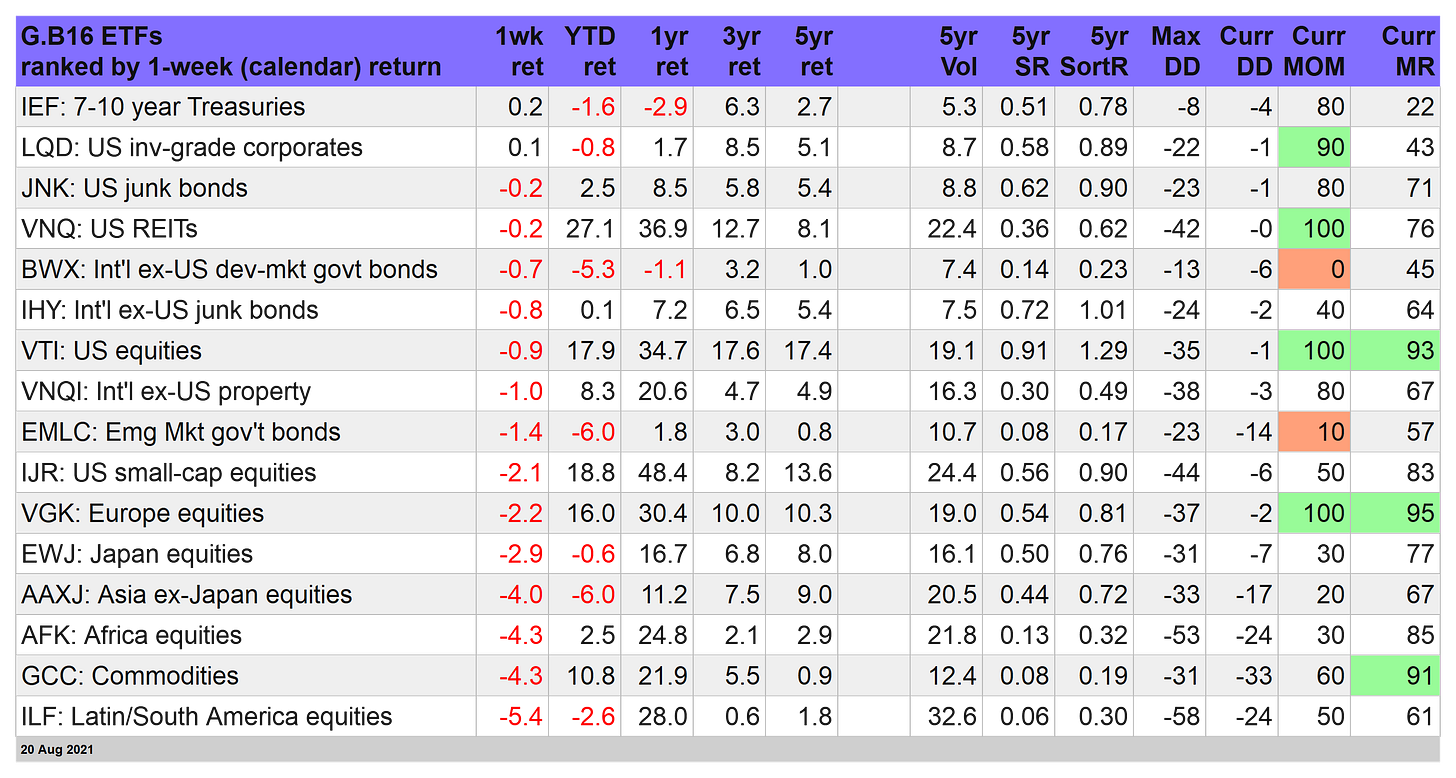

Red ink was nearly everywhere. Save for Treasuries and investment-grade US corporates, our 16-ETF opportunity set was conspicuously biased to the downside for the trading week through Friday, Aug. 20.

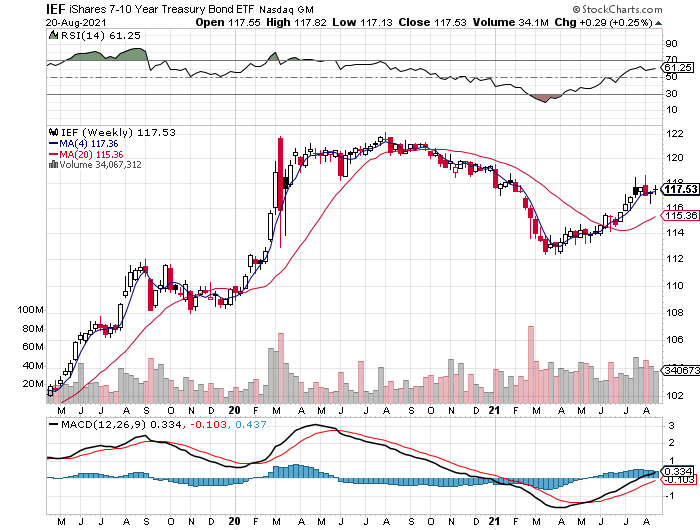

US governments bucked the trend, just slightly. The iShares 7-10 Year Treasury Bond ETF (IEF) edged higher for a second week. The modest gain stands out in a crowd of red, but IEF appears to be consolidating its recent gains these days with a lazy inclination to tread water, more or less.

The fund’s moderately high MOM score — 80, which is just below the top-ranked 100 — is encouraging. Ditto for contrarian minded investors by way of our Mean Reversion (MR) metric, which is current a low 22 (vs. a lowest score of 0), which reflects a five-year return for IEF that’s near the lows of recent history. But for our money, we’re closer to neutral on the prospects for bonds generally.

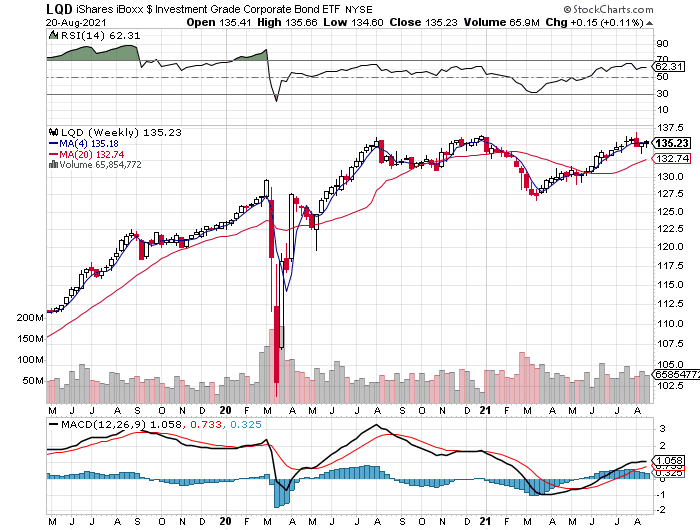

US investment-grade corporates are posting a similar profile: relatively strong upside momentum and a five-year return that’s below the median by way of recent history. Is that enough to power a new run higher? The case for answering “yes” will get a boost if LQD can decisively take out its previous high—roughly $136, or just above Friday’s close of $135.23.

Bonds face a tricky environment in the days ahead as the crowd awaits monetary pronouncements from on high from the Federal Reserve as they mingle at their annual symposium in Jackson Hole, Wyoming next week.

There’s growing chatter that the central bank is poised to soon begin pulling back from its dovish monetary policy, in part because inflation has surged lately. By some accounts, the Fed’s behind the curve and needs to play catch-up. If so, bonds are vulnerable.

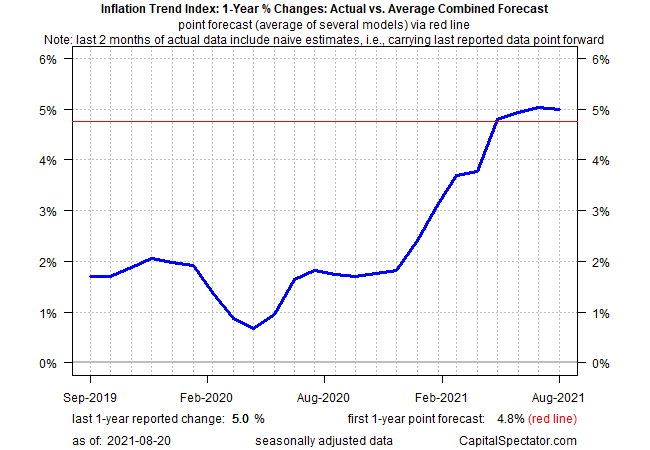

But call us mildly skeptical (still). Although economic growth is still strong, the trend is decelerating. What of inflation? Yes, it’s shot sharply higher, but this jump appears to be peaking (if it hasn’t already done so), based on our proprietary Inflation Trend Index (ITI).

Add in firmer economic headwinds from the ongoing spread of the Delta variant of COVID-19 and the potential for more cooling of the macro trend in the near-term looks plausible, perhaps likely.

On that note, earlier this week we reported that the median nowcast for several estimates for third-quarter GDP points to slower growth vs. Q2. Granted, the deceleration still leaves the expansion in a strong position. But the point is that the broad trend is edging lower — an environment that’s not an ideal time for the Fed to start hiking interest rates, even slightly.

Then again, the Fed has a history of policy errors. Will history repeat?

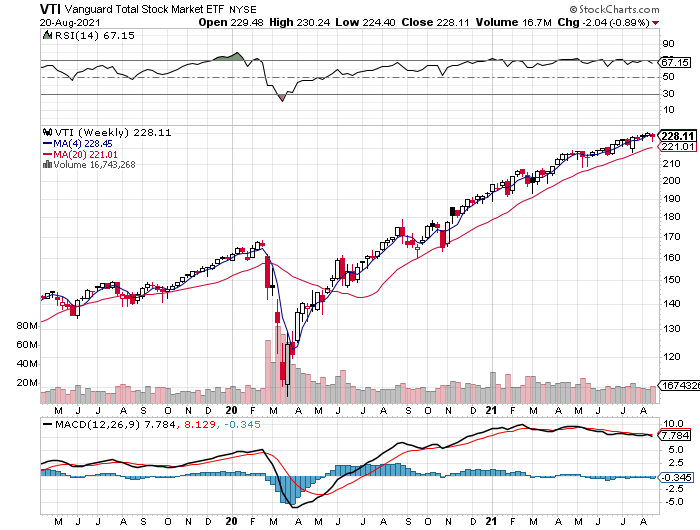

It’s not obvious that a cautious outlook is resonating in the US stock market. Yes, our proxy fund for American shares — Vanguard Total US Stock Market (VTI) — edged down this week, slipping for the first time this month. But the fund’s trending profile remains red-hot bullish and so only an aggressive contrarian will feel comfortable calling a top here.

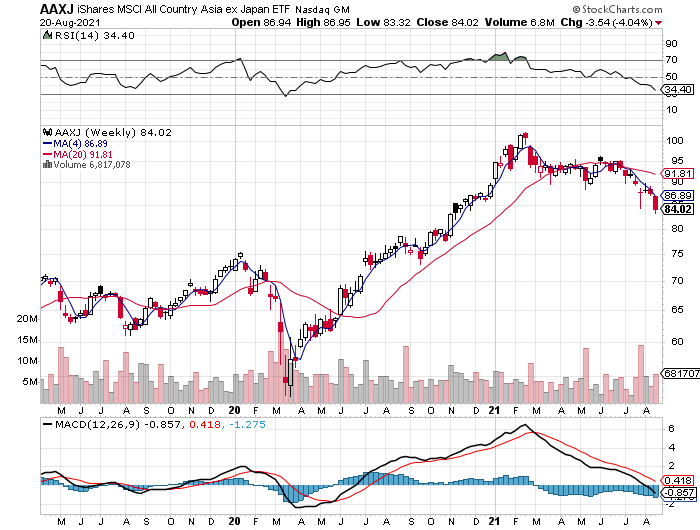

Equities elsewhere in the world took a sharply deeper cut. Asia ex-Japan and Africa were especially hard hit this week. The iShares MSCI All Country Asia ex-Japan ETF (AAXJ) continues to look increasingly bearish, in no small part due to China, which represents nearly 40% of the portfolio.

That’s a problem these days as Beijing continues to announce tighter regulations on its tech industry, which in turn is convincing more investors to dump China stocks generally for fear that the country’s brand of capitalism is in the early stages of transitioning policy management that’s closer to Marx than Adam Smith. For some (many?), that’s an excuse to sell now and ask questions later.

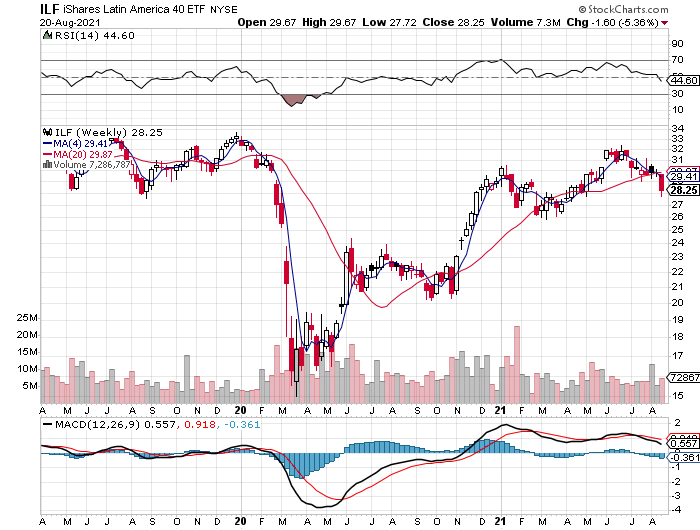

The biggest loss this week for our 16-fund global opportunity set: iShares Latin America 40 ETF (ILF), which tanked 5.4%. Here, too, it’s getting tougher to remain bullish. First question: Will ILF’s previous low in the mid-$20 range hold? If not, the case for cutting and running will look more compelling.

Gravity Takes a Toll on the Strategy Benchmarks

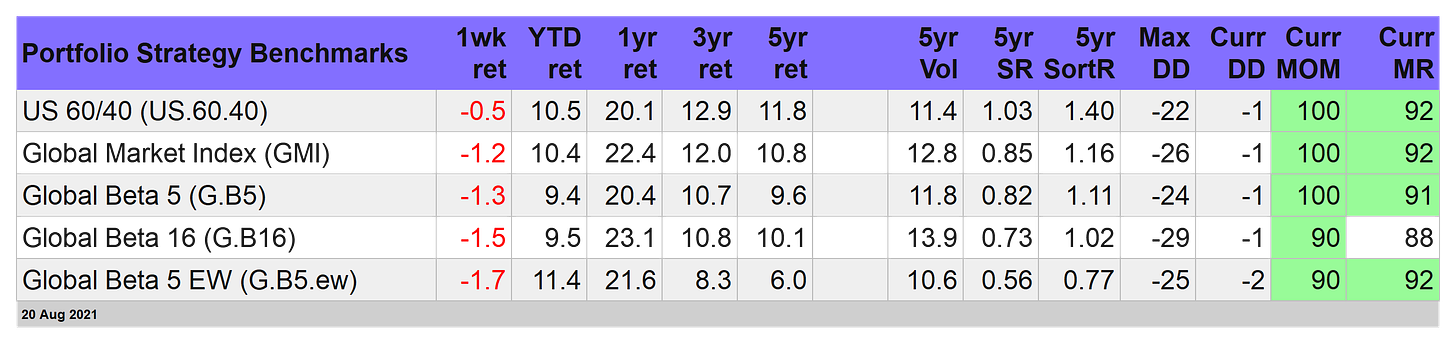

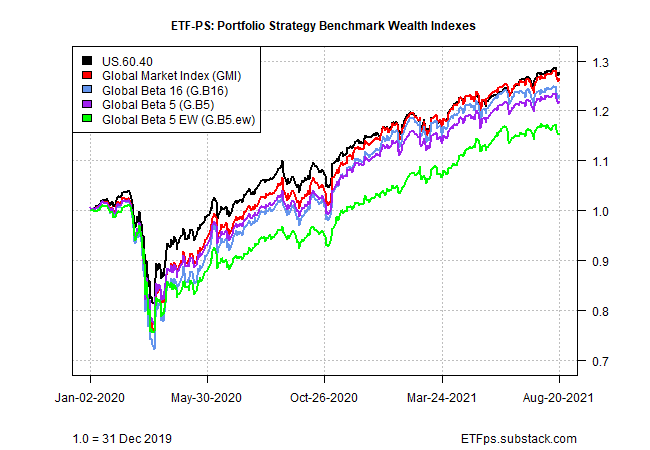

With most markets posting losses this week, the downward pull was too much for our portfolio benchmarks. The range of red ink reminds that foreign assets weighed heavily on global asset allocation for the trading week.

While the 60/40 US stocks/bonds benchmark was nicked a relatively light 0.5%, the rest of the field suffered substantially deeper losses, ranging from a 1.2% decline for the Global Market Index (GMI) to a 1.7% tumble for an equal-weighted mix of global stocks, bonds, real estate, and commodities (G.B5.ew).

MOM scores for all five benchmarks are still strong (as are MR scores), which suggests that there’s room to run higher. But with the uncertainty of a Federal Reserve confab lurking next week, the logic of taking some profits was, apparently, too strong to refute.

For details on all the portfolio strategy benchmarks and metrics in the tables, see this ...

more