The End Of QE Will Always Devolve Into This Sort Of Incoherent Mess

That was a circus. These things are typically ungraceful to begin with, but this one was in a class by itself. Mario Draghi, the leader of the rudderless ECB, was in top form today. For pure entertainment value, he couldn’t have done better. People think that’s not the job of a top central banker but it is! Monetary policy long since stripped of any money in it remains solely reduced to expectations management.

Thus, the circus.

Everyone knows Europe is in trouble. Even the most optimistic globally synchronized growth peddlers have taken several steps back. The global economy sits upon a stall already; even President Trump has taken a break from the boom stuff.

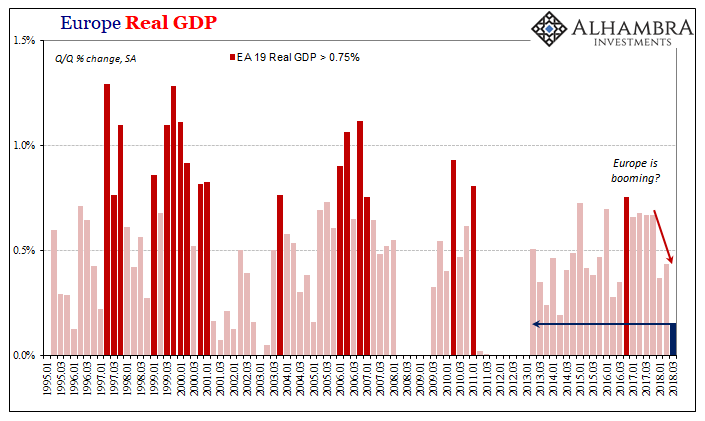

Earlier this week Eurostat revised Q3 2018 GDP across much of the Continent. For the EA 19 unit, growth was just +0.15% Q/Q, or an annual rate of 0.623%. To put that into perspective, quarterly growth in Q4 2017 was more than last quarter’s yearly rate.

Not only did output fall in Germany, it is now believed to have dropped in Italy, too. While some try to blame those on temporary or transitory factors, forward-looking indicators continue in the wrong direction.

Draghi has decided to end QE anyway. To me, that’s disappointing but not for reasons the ECB would appreciate. I’d rather hoped they would continue with it right into the next recession, which might be close at hand. At that point, would there be any doubt about just how useless it has been?

Not to central bankers, of course. Draghi even claimed today, again the circus, that at some points “QE has been the only driver of this recovery.” Even if that statement is true, it can’t have been a recovery. The term itself has been so misused, to reverse engineer some measure of success for the policy.

John Maynard Keynes would be spinning in his grave. Monetary as fiscal policy is supposed to spur the organic processes that then lead to sustained economic growth (pump priming). If it is the only thing moving the economy forward (itself debatable), it has failed on its own terms.

To claim what Draghi did is an act of desperation, poorly thought out simply because he has nothing left.

Which leads officials into their numerous but entertaining contradictions. Here’s the big one from today:

The risks surrounding the euro area growth outlook can still be assessed as broadly balanced.

However, the balance of risk is moving to the downside owing to the persistence of uncertainties related to geopolitical factors, the threat of protectionism, vulnerabilities in emerging markets and financial market volatility.

The risks are broadly balanced by the balance moving to the downside balance? If he keeps saying “balance” perhaps no one will notice the rest? The ECB chief does show very little regard for the media, rightly so, to let these words out of his mouth knowing full well they will never be challenged no matter how directly, obviously preposterous.

QE was supposed to be a game changer, the kind of extraordinary show of monetary force that left no doubt about any expectations. That was how it was sold. Now after almost four years of it, the economic risks are pointing downward because of “uncertainties?” If QE was at time the only thing driving the recovery and the recovery itself was just this fragile, that doesn’t leave anything good to say about QE.

Economists, to be expected, joined the circus applauding as loudly as they could Draghi’s performance as well as his disjointed message. Here’s one from ING:

Contradicting fears of market turbulence or surging bond yields, the ECB managed to end QE, and no one seems to care.

Yeah, that doesn’t mean what you think it means Mr. Economist. Like central bankers, Economists have no idea about bonds. Had the policy reached the conclusion expected, the bond market would be aflame and the world would rightly rejoice at its severe pain. If the economy was even plausibly close to being healed, bonds would sell, sell, and sell to get there first.

They can’t understand them, though, which is one reason why they thought it would be a good idea to have any central bank purchase them in the first place. Draghi today tried to say that QE worked because it brought down interest rates; after they had fallen precipitously.

There isn’t the slightest indication the bond buying had any palliative effect on anything, least of all Europe’s economy which was supposed to be the point of all this. Prolonged periods of low interest rates, as history has proved, are the consequences of tight money in the real economy (liquidity preferences).

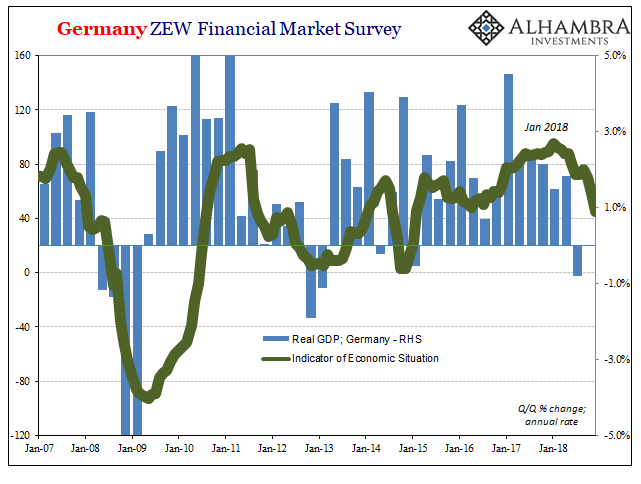

What really happened was especially simple though very different from the tale Draghi is trying to spin. The global economy got slightly better in 2017 for which officials everywhere convinced themselves it was meaningful and durable. Take a look at the bond market shown above, nothing had changed. If central bankers understood bonds, or money for that matter, they wouldn’t have let each other fall for such a miniscule variance.

But they don’t and they did. Now, Mario Draghi more than anyone, the man who couldn’t beam enough last year about Europe’s boom, has backed his institution into a corner. At this point, what else can he do? For him, it really is binary – boom or bust.

QE will always devolve into just this sort of incoherent mess because it doesn’t work and more than that really doesn’t matter. If it did, Europe’s economy would truly be booming, interest rates would be normalizing, and no official would have to bastardize the word “balance” of all words. We would be seeking our entertainment elsewhere and be happy to do so.

If the stakes weren’t so unbelievably high, I would have to applaud even admire Draghi’s bold performance.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more